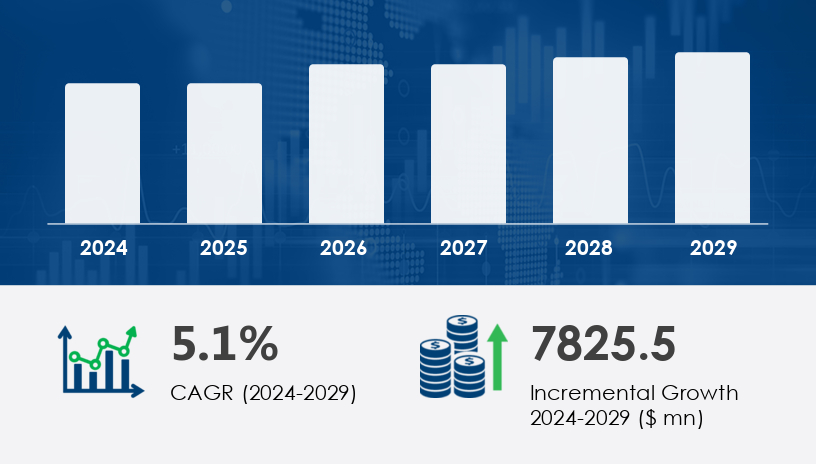

The Over The Counter (OTC) Analgesics Market is set to witness sustained growth between 2025 and 2029, building on the momentum observed over the past few years. Valued significantly in 2024, the market is expected to grow by USD 7.83 billion by 2029, expanding at a compound annual growth rate (CAGR) of 5.1%. This growth trajectory reflects rising consumer demand for accessible and effective pain relief solutions across global demographics. The rise in chronic pain conditions, notably arthritis, back pain, and musculoskeletal disorders, is especially prevalent among the elderly and middle-income demographics, leading to a strong demand for over-the-counter relief products.

For more details about the industry, get the PDF sample report for free

A primary driver propelling the Over The Counter (OTC) Analgesics Market is the rapidly aging global population. By 2050, the number of people aged 60 and above is projected to more than double. In 2022 alone, over 771 million individuals were aged 65 or older, accounting for approximately 10% of the global population. This demographic segment is more susceptible to chronic conditions such as arthritis, musculoskeletal disorders, and age-related aches, significantly increasing demand for non-prescription analgesic solutions. As a result, internal OTC analgesics—especially those treating joint pain and backaches—are seeing heightened usage among elderly consumers seeking affordable, self-managed pain relief.

An emerging trend reshaping the Over The Counter (OTC) Analgesics Market is the surge in new product launches and approvals, reflecting a shift toward innovation and regulatory responsiveness. Companies are increasingly investing in research and development to introduce more effective and tolerable OTC analgesics. A notable example includes GlaxoSmithKline’s 2020 U.S. FDA approval for Voltaren Arthritis Pain Gel, transitioning from prescription to OTC use. This trend underscores the market’s commitment to expanding accessible treatment options for chronic pain, including off-label use of medications like antidepressants and antihistamines, thereby broadening the scope of OTC analgesics beyond traditional applications.

The Over-The-Counter (OTC) Analgesics Market is expanding steadily due to rising demand for accessible pain relievers and non-prescription drugs that support self-medication. Products such as internal analgesics and external analgesics are widely used to treat common ailments like muscle aches, joint pain, and headache relief, without the need for a physician’s prescription. Popular formulations include oral tablets, liquid analgesics, suppositories, topical creams, pain relief gels, and topical patches, giving consumers multiple options for effective pain management. The core active ingredients in many OTC products are acetaminophen, NSAIDs, ibuprofen, aspirin, naproxen sodium, and salicylates, each offering unique benefits for fever reduction, menstrual cramps, arthritis pain, and musculoskeletal pain. Fast-acting relief and extended-release drugs are in demand, especially for those managing chronic pain or recurring conditions.

The Over The Counter (OTC) Analgesics Market is segmented into the following categories:

By Type: Internal, External

By Distribution Channel: Offline, Online

By Form Factor: Tablets and Capsules, Topical, Syrups, Others

Internal analgesics dominate the market, holding the largest share due to their widespread use in managing common conditions such as arthritis and chronic back pain. In 2018, the internal segment was valued at USD 17.63 billion, and it has shown steady growth since. Products like acetaminophen, NSAIDs (including ibuprofen and naproxen), and aspirin remain cornerstones in this segment. According to analysts, the preference for internal analgesics stems from their effectiveness in addressing deep-tissue and systemic pain conditions, along with the consumer trend toward self-medication. Internal OTC analgesics, due to their proven efficacy, accessibility, and affordability, are particularly popular among the geriatric and middle-lower income populations.

Covered Regions:

North America

Europe

Asia-Pacific (APAC)

South America

Rest of World (ROW)

North America holds the largest share of the Over The Counter (OTC) Analgesics Market, contributing 42% of the global market growth during the forecast period. The U.S. leads regional demand, driven by high healthcare expenditure and widespread prevalence of chronic pain conditions such as arthritis, migraines, and muscle injuries. According to the NIH, about 1 in 6 men and 1 in 5 women in the U.S. report migraines or severe headaches, underlining a vast consumer base. Analysts note that this strong demand is also bolstered by established distribution networks, a robust presence of key pharmaceutical companies, and a well-informed consumer population. These factors collectively enhance the accessibility and adoption of OTC pain relief medications across North America.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Despite promising growth, the Over The Counter (OTC) Analgesics Market faces a significant challenge in the form of increasing product recalls. These recalls are often due to safety concerns and regulatory compliance failures related to drug composition, incorrect labeling, or manufacturing errors. Such incidents pose reputational and financial risks to manufacturers and can lead to decreased consumer confidence. The rise in recalls underscores the critical need for companies to prioritize stringent quality control measures and transparent regulatory practices. Failure to do so not only threatens market presence but also endangers public health, making regulatory compliance a pivotal aspect of sustainable growth.

Market research reveals increasing consumer preference for convenience and accessibility, reflected in the growing sales of OTC analgesics through retail pharmacies, drug stores, hospital pharmacies, and especially online pharmacies and e-commerce sales platforms. Consumers are also becoming more educated and proactive in their consumer healthcare decisions, choosing targeted solutions for age-related pain, neuropathic pain, and post-surgical pain without clinical supervision. With an aging population, geriatric care is emerging as a crucial driver of demand, particularly for products designed to manage chronic conditions safely over time. Additionally, sports and lifestyle factors are contributing to a rise in OTC use for sports injuries, overuse injuries, and back pain, prompting further segmentation of products for specific therapeutic areas.

Research analysis suggests the market is trending toward innovation in formulation, delivery mechanisms, and user-centric solutions. The shift toward anti-inflammatory drugs for managing inflammation-related discomfort, and niche products targeting conditions like migraine relief, signals an increasing focus on product differentiation. As more consumers seek holistic and efficient solutions for pain relief, the OTC analgesics market is likely to see continued growth, supported by evolving consumer behavior, regulatory frameworks, and technological advances in drug delivery.

Innovation and strategic partnerships are at the core of competitive success in the Over The Counter (OTC) Analgesics Market. Key players such as GlaxoSmithKline, Pfizer Inc., and Bayer AG are focusing on expanding their product portfolios through R&D investments and regulatory approvals. The Voltaren Arthritis Pain Gel approval is a prominent example of how companies are aligning with consumer needs for non-prescription solutions. In addition to product innovation, companies are leveraging digital marketing, e-commerce platforms, and direct-to-consumer advertising to enhance visibility and drive sales. Analyst insights emphasize the importance of aligning with regulatory bodies and health agencies to navigate the complex approval landscape and ensure product safety and efficacy. Strategic alliances, such as mergers and acquisitions or geographical expansions, also play a vital role in increasing market penetration and competitive advantage.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Type

6.1.1 Internal

6.1.2 External

6.2 Distribution Channel

6.2.1 Offline

6.2.2 Online

6.3 Form Factor

6.3.1 Tablets and capsules

6.3.2 Topical

6.3.3 Syrups

6.3.4 Others

6.4 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 Europe

6.4.4 South America

6.4.5 ROW

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted