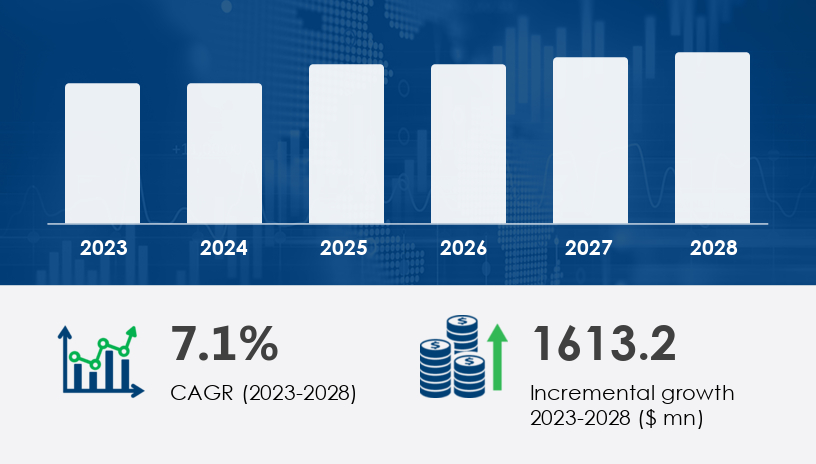

As the global demand for hydrocarbons endures despite accelerating energy transitions, the offshore oil and gas seismic equipment and acquisitions market is poised for dynamic expansion. Between 2023 and 2028, the market is forecast to grow by USD 1.61 billion, registering a CAGR of 7.1%. This growth trajectory reflects a renewed global focus on deepwater and ultra-deepwater resource exploration—driven by both the need to replenish reserves and the commercial feasibility of advanced offshore production, particularly as oil prices stabilize. Technological advances in seismic imaging, increasing adoption of 4D seismic surveys, and integration of AI and IoT tools are reshaping how exploration is conducted in some of the planet’s most geologically complex frontiers.

For more details about the industry, get the PDF sample report for free

The offshore oil and gas seismic equipment and acquisitions market encompasses specialized equipment—such as high-performance seismometers, streamers, nodes, and advanced data acquisition devices—and services essential to conducting marine seismic surveys. These surveys are critical for imaging subsurface structures and guiding oilfield development in harsh offshore environments.

3D seismic surveys remain the dominant technology, having become the industry standard due to their ability to deliver high-resolution subsurface imagery. This segment was valued at USD 1.9 billion in 2018 and has shown consistent growth, supporting more accurate well placement and reservoir delineation. However, the spotlight is shifting to 4D seismic technology—an emerging trend that integrates time-lapse data with 3D seismic surveys to provide dynamic reservoir insights. These advances enable oil and gas operators to not only detect reserves more accurately but also manage them more efficiently across the lifecycle of a field.

One of the market's central drivers is the rebound of capital expenditure in offshore upstream activities. Since the oil price downturn of 2014, investment had stagnated, but rising prices and energy security imperatives have brought offshore fields back into focus. Operators are ramping up exploration efforts in mature basins like the North Sea and frontier areas such as the Black Sea and parts of the Asia-Pacific. Notably, seismic fleets have seen growing deployment, although the sector must grapple with overcapacity and uneven utilization rates—a challenge that tempers short-term margins but also signals available potential for strategic fleet realignment.

By technology, the seismic services market is segmented into 2D, 3D, and 4D surveys. While 2D remains relevant in preliminary exploration phases, 3D and 4D seismic surveys are gaining traction as critical tools for oilfield development and enhanced recovery. The push toward 4D seismic is particularly noteworthy. This technology delivers valuable insights into reservoir behavior over time, improving production planning and reducing non-productive time. Its integration with AI-driven data interpretation platforms further boosts its value, allowing operators to simulate different recovery scenarios, automate geological modeling, and minimize exploration risks.

AI, machine learning, and IoT applications are no longer futuristic concepts—they are reshaping seismic acquisition strategies in real-time. From sensor data optimization to anomaly detection and automated reservoir modeling, these digital tools are enabling smarter and faster decision-making. Operators can now process terabytes of complex seismic data with unprecedented speed, turning subsurface data into a strategic asset rather than an analytical bottleneck.

However, even with such innovations, the market must contend with vessel fleet overcapacity. Despite growing global demand, the number of available seismic crews and survey ships often exceeds project opportunities, especially during market lulls. This imbalance poses a profitability risk for pure-play seismic contractors and has encouraged the industry to explore asset-light models and integrated service partnerships.

Get more details by ordering the complete report

Regionally, Europe continues to command the largest share of the offshore seismic equipment and acquisitions market. The North Sea and Black Sea remain active exploration zones, bolstered by strong energy policy support in the UK and Norway. The European market is notable for its emphasis on sustainable energy practices and stringent environmental monitoring, which in turn increases demand for high-precision, low-impact seismic technologies.

Asia-Pacific (APAC) is projected to contribute 28% of the market’s growth between 2024 and 2028, driven by offshore activities in China, Southeast Asia, and Australia. Deepwater blocks in the South China Sea and offshore India present high-risk, high-reward opportunities, incentivizing investments in advanced seismic equipment. Additionally, growing regional demand for energy security—coupled with government support for exploration projects—makes APAC a high-potential growth territory.

The Middle East and Africa and South America (notably Brazil) also present growth pockets. Brazil’s pre-salt basins continue to be a seismic-intensive hotspot, while offshore West Africa remains active in exploration licensing rounds. In North America, particularly the US Gulf of Mexico, mature infrastructure and high-capacity operators continue to invest in technology upgrades, though regulatory headwinds may affect the pace of seismic acquisitions.

The Offshore Oil and Gas Seismic Equipment and Acquisitions Market is driven by rising demand for advanced seismic equipment in offshore exploration and oil exploration activities. These operations leverage cutting-edge seismic surveys such as 3D seismic and 4D seismic for enhanced subsurface imaging and reservoir characterization. Tools like seismic vessels, ocean bottom nodes, seismic sensors, and seismic source systems—including air guns and multi-sensor streamers—are integral to collecting precise seismic data beneath the seabed geology. Seismic waves generated through these technologies help identify hydrocarbon reserves for both deepwater drilling and ultra-deepwater applications. Geophysical contractors and seismic contractors are key players facilitating seismic acquisition and data interpretation, while innovations such as fiber-optic sensing and autonomous underwater vehicles are reshaping modern marine seismic operations

For more details about the industry, get the PDF sample report for free

Several strategic opportunities are emerging across the seismic acquisition value chain. First, there's a clear demand for integrated digital platforms that unify data acquisition, processing, and visualization in a single ecosystem. Equipment providers and seismic contractors that can offer bundled digital services will differentiate themselves in a crowded field.

Second, joint ventures between seismic firms and national oil companies (NOCs) offer a promising route to market penetration, particularly in politically sensitive or capital-intensive offshore regions. Collaborative models also help distribute the financial burden of fleet utilization, technological upgrades, and regional licensing risks.

Yet challenges remain. Overcapacity in seismic vessel fleets is a critical headwind, compounded by fluctuating oil prices and periodic underinvestment in seismic exploration during down cycles. Environmental considerations—particularly the impact of marine seismic operations on marine ecosystems—are increasingly under regulatory scrutiny. Companies must now demonstrate a strong ESG profile, including commitments to marine biodiversity and carbon-conscious operations.

Looking ahead, the offshore oil and gas seismic equipment and acquisitions market is expected to maintain a robust growth trajectory through 2029, underpinned by a strategic shift toward high-tech, low-footprint exploration. The convergence of AI, 4D seismic, and IoT-enabled data acquisition systems will define the next era of exploration excellence.

Companies that prioritize continuous innovation, digital integration, and sustainability will be best positioned to capitalize on new opportunities in both mature and emerging offshore markets. Moreover, the trend toward time-lapse seismic (4D) will become increasingly mainstream, not just as a competitive differentiator, but as a necessity for efficient reservoir management in an environment of rising cost pressures and stricter environmental mandates.

The market will also witness consolidation, with mergers and strategic partnerships among seismic contractors, E&P firms, and tech developers becoming more common. By combining hardware expertise with software innovation, these alliances will deliver smarter seismic solutions capable of meeting the dual challenge of increasing hydrocarbon yields and minimizing environmental impact.

For more details about the industry, get the PDF sample report for free

Invest in 4D Seismic Capabilities: Service providers should prioritize upgrading their fleets with time-lapse imaging systems and offer 4D survey services to operators focused on maximizing existing field recovery.

Leverage AI for Competitive Advantage: Integrate AI-driven analytics into seismic data processing workflows to reduce interpretation time and improve decision accuracy.

Diversify Regional Presence: Expand into high-growth regions like APAC and South America to offset demand variability in mature markets.

Embrace Sustainability Mandates: Develop ESG-compliant seismic practices to align with regulatory and societal expectations around offshore energy development.

Adopt Flexible Fleet Models: Explore leasing, subcontracting, or asset-sharing models to optimize vessel utilization and mitigate overcapacity-related losses.

Technological advancements are accelerating seismic imaging capabilities with tools like seismometers, sub-bottom profilers, geophone sensors, and hydrophone arrays to ensure better reservoir optimization and long-term reservoir management. As offshore regions become more complex, the market sees growing adoption of full-waveform inversion and seismic data processing to improve the accuracy of seismic monitoring and support gas exploration. These innovations play a vital role in exploration technology and optimizing data acquisition strategies for offshore drilling ventures. The use of integrated geophysical services and advanced analytics is also expanding, helping operators make better decisions regarding resource development and field planning. With rising global energy demands and a push for precise seismic technology, the market is expected to grow significantly in response to evolving industry needs and environmental challenges.

For more details about the industry, get the PDF sample report for free

In a world where offshore exploration remains vital yet increasingly complex, the seismic equipment and acquisitions market stands at a strategic crossroads. The infusion of cutting-edge technologies, deeper data intelligence, and environmentally responsible practices will determine which players thrive in the years ahead. With USD 1.61 billion in projected growth and a 7.1% CAGR through 2028, the market promises not only financial upside but also a chance to redefine how we discover energy beneath the ocean floor.

As the waves of digital transformation reshape every aspect of offshore exploration, the question for seismic firms and oil producers alike is clear: Are we equipped to listen more deeply—and act more decisively—than ever before?

Safe and Secure SSL Encrypted