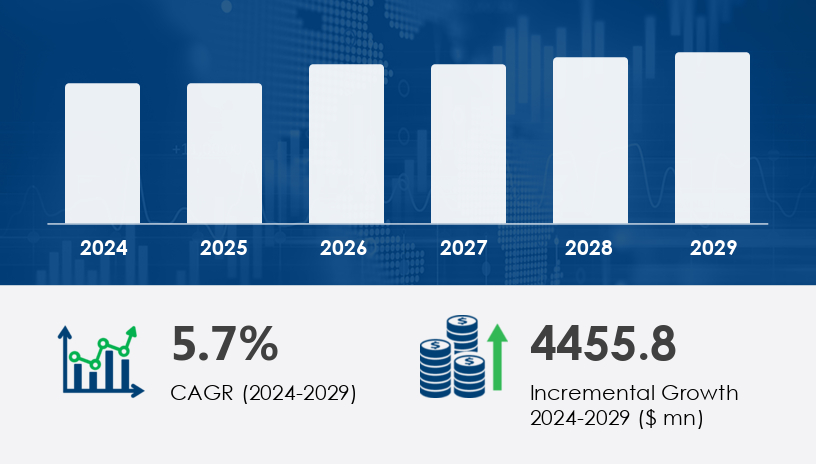

The offshore oil and gas pipeline market is projected to grow by USD 4.46 billion between 2024 and 2029, expanding at a CAGR of 5.7%. As demand for energy continues to rise globally, offshore pipelines are becoming the preferred choice for transporting crude oil, natural gas, and petroleum products. This growth is driven by the economic advantages of pipelines over other transportation modes, particularly in terms of cost-effectiveness, energy efficiency, and reduced environmental impact. However, challenges such as fluctuating oil prices, environmental risks, and technological advancements are shaping the market's trajectory.

For more details about the industry, get the PDF sample report for free

Offshore oil and gas pipelines are a critical part of the global energy infrastructure, enabling the transportation of oil and gas from extraction sites to onshore facilities or directly to consumers. Unlike other transportation methods, offshore pipelines are ideal for long-distance transport, particularly in deep-water or remote locations where other solutions might be inefficient or too costly.

Economic Efficiency: Offshore pipelines offer significant cost savings compared to marine vessels. Their operational costs are lower, and they have a smaller carbon footprint, making them an environmentally friendly choice.

Technological Advancements: Innovations such as intelligent pigging, remote inspection technologies, and AI-based monitoring systems have revolutionized pipeline integrity and reliability. These technologies ensure pipelines are secure, reducing the risk of leaks or failures.

Global Energy Demand: The increasing demand for oil and gas, particularly from regions like North America and Europe, is driving investments in offshore pipeline infrastructure. The sector is becoming even more critical as oil and gas exploration ventures into deeper and more remote offshore fields.

Despite these benefits, offshore pipelines face a few challenges, such as exposure to harsh marine environments and the economic impact of fluctuating global oil prices, which may affect investments in new projects.

For more details about the industry, get the PDF sample report for free

Several global and regional players dominate the offshore oil and gas pipeline market. These companies are investing in advanced technologies to ensure pipeline safety, improve operational efficiency, and expand their market reach.

Allseas Group SA – Specializes in deepwater and shallow-water pipelay services with cutting-edge equipment such as Solitaire and Pioneering Spirit.

McDermott International Ltd. – A major player providing construction and engineering services for offshore pipelines, focusing on innovative and sustainable designs.

Saipem S.p.A. – Known for its expertise in offshore pipeline installation and engineering solutions, Saipem is a key player in large-scale offshore projects.

TechnipFMC plc – This company provides integrated technology and services, ensuring high-quality pipeline design and installation.

Subsea 7 SA – Offers subsea engineering and construction services, with a strong focus on pipeline integrity and offshore project management.

Other key companies in this space include Larsen and Toubro Ltd., ArcelorMittal SA, Fugro NV, and Nippon Steel Corp. These companies are vying to increase their market share through strategic partnerships, technological investments, and geographical expansion.

The offshore oil and gas pipeline market is categorized based on several factors, including sector, product type, and geographic region. Understanding these segments provides deeper insights into market dynamics and opportunities.

Upstream: This segment involves the exploration and extraction of hydrocarbons, which is the primary driver of offshore pipeline construction. New technological advancements like 3D seismic imaging are enhancing accuracy and efficiency in locating oil and gas reserves.

Midstream: Midstream focuses on the transportation of extracted resources via offshore pipelines, and it represents the largest segment in terms of operational focus.

Downstream: This includes refining and distribution, often involving the transportation of refined products to end-users or other processing facilities.

Oil: Crude oil is the most commonly transported product through offshore pipelines, and it remains the cornerstone of the offshore pipeline infrastructure.

Gas: Natural gas pipelines are a vital part of the energy transport system, particularly in regions with significant gas reserves like the Middle East and Russia.

Refined Products: Offshore pipelines also play a crucial role in the transportation of refined petroleum products, such as liquefied natural gas (LNG).

Below 24 Inches: Smaller diameter pipelines are often used in less harsh environments or for short-distance transport.

Greater than 24 Inches: Larger pipelines are used for long-distance transport, particularly in deep-water or remote offshore locations.

By Type

The market's geographic segmentation is critical in understanding regional dynamics and growth drivers. Key regions include:

North America: The United States and Canada are driving growth in this region, fueled by significant offshore reserves in the Gulf of Mexico.

Europe: The North Sea is a key area for offshore oil and gas pipeline projects, with countries like the UK, Norway, and Russia leading the way.

Middle East and Africa: The UAE, Saudi Arabia, and other Gulf countries are investing heavily in offshore infrastructure to transport oil and gas.

Asia-Pacific: China, Japan, and India are expanding their offshore pipeline networks as they continue to increase their energy consumption.

For more details about the industry, get the PDF sample report for free

The offshore oil and gas pipeline market continues to expand as global demand for gas pipelines and oil pipelines accelerates, driven by the need for reliable energy transportation solutions. Technologies such as SSAW pipes, LSAW pipes, and ERW pipes are essential components in pipeline construction, utilizing spiral welding and longitudinal welding for structural strength. Electric resistance techniques are commonly applied to enhance pipeline integrity, especially for offshore pipeline transportation of crude oil and natural gas. The development of robust pipeline infrastructure complements onshore pipelines, with steel pipes configured in helix formation or fabricated using the JCOE process and UOE process. Innovations such as oblique rolling and variable pipeline diameter designs help to improve hydrocarbon transport efficiency. Additionally, the strategic deployment of export terminals supports oil transmission and gas transmission from wellhead transport locations to refinery pipelines across complex offshore pipeline networks.

Several key trends are shaping the future of the offshore oil and gas pipeline market. The market's success hinges on the ability of operators to adapt to technological advances and changing environmental demands.

Technological advancements in pipeline inspection are revolutionizing how operators maintain offshore infrastructure. The adoption of intelligent pigging technologies allows for continuous monitoring of pipeline integrity, detecting issues such as corrosion or structural weaknesses before they lead to catastrophic failures. Remote inspection technologies, such as underwater drones and sensors, are further enhancing safety and reducing the need for manual inspections in hazardous environments.

As environmental regulations become stricter, the industry is moving toward greener solutions. The carbon footprint of offshore pipelines is a growing concern, and companies are increasingly adopting sustainability practices. This includes using materials that reduce environmental impact, employing carbon capture technologies, and optimizing operations to minimize energy consumption.

Digital technologies, including AI, machine learning, and IoT, are enabling better decision-making and predictive maintenance. These technologies help pipeline operators predict potential problems before they arise, ensuring continuous, safe operations. The use of digital twins—virtual models of pipelines—helps monitor and simulate pipeline performance, enhancing reliability and efficiency.

Despite these advancements, the offshore pipeline industry remains vulnerable to the volatility of global oil prices. Price fluctuations in crude oil and natural gas can impact the profitability of pipeline projects. Companies need to strategically manage risks and adopt cost-effective solutions to weather market uncertainty.

Europe is poised to be a dominant player in the offshore pipeline market, contributing 50% of the global growth during the forecast period. The North Sea remains one of the most important regions for offshore pipeline development, particularly as countries like the UK and Norway continue to invest heavily in infrastructure.

Russia is also a major player, with significant oil and gas reserves in its offshore fields, driving pipeline demand.

Advanced technologies in pipeline integrity and advanced materials are key focuses in Europe, ensuring the reliability of pipelines in harsh marine conditions.

In North America, offshore pipeline construction continues to rise, particularly in the Gulf of Mexico. The U.S. is a major hub for offshore exploration and pipeline development, with large-scale investments in subsea technologies and sustainability initiatives. The region is focusing on improving the efficiency and safety of its offshore oil and gas pipelines.

The Middle East and Africa remain central to the offshore pipeline market, with countries like the UAE, Saudi Arabia, and Nigeria investing in expanding offshore infrastructure. These regions are investing in technological upgrades and new installations to meet the growing global demand for oil and gas.

In the full report, you will gain a comprehensive understanding of the offshore oil and gas pipeline market:

Detailed Forecasts: Market projections for 2025-2029 by sector, product, and region.

Technological Insights: The role of digital twins, IoT, and AI in optimizing pipeline operations.

Regional Dynamics: The market trends and challenges in key regions like Europe, North America, and the Middle East.

Key Players: Insights into the strategies of top companies like Allseas, McDermott, and Saipem.

For more details about the industry, get the PDF sample report for free

The research analysis highlights a sharp focus on pipeline safety and the integration of smart pipes built from advanced materials that enhance both structural durability and corrosion prevention. Digitalization is transforming the market with big data enabling predictive maintenance, contributing to improved pipeline efficiency across subsea operations. These intelligent systems also support fuel management, pressure monitoring, and real-time pipeline automation, ensuring continuous performance optimization. Offshore drilling operations now rely on detailed demand forecasting models to streamline energy infrastructure planning. Sophisticated pipeline monitoring tools uphold pipeline integrity, helping detect and mitigate risks proactively. Alongside these innovations, the sector is embracing enhanced maintenance protocols to extend the lifespan of hydrocarbon pipelines. By incorporating automation and rigorous safety standards, offshore pipeline maintenance practices are becoming more precise and cost-effective, solidifying the market’s role in modern energy infrastructure.

The offshore oil and gas pipeline market is poised for growth driven by advances in technology, rising global energy demand, and the need for reliable, cost-effective transportation methods. However, challenges such as fluctuating oil prices and environmental risks require careful management. Companies investing in advanced technologies, sustainability, and digital monitoring systems will be well-positioned to thrive in this rapidly evolving market.

Safe and Secure SSL Encrypted