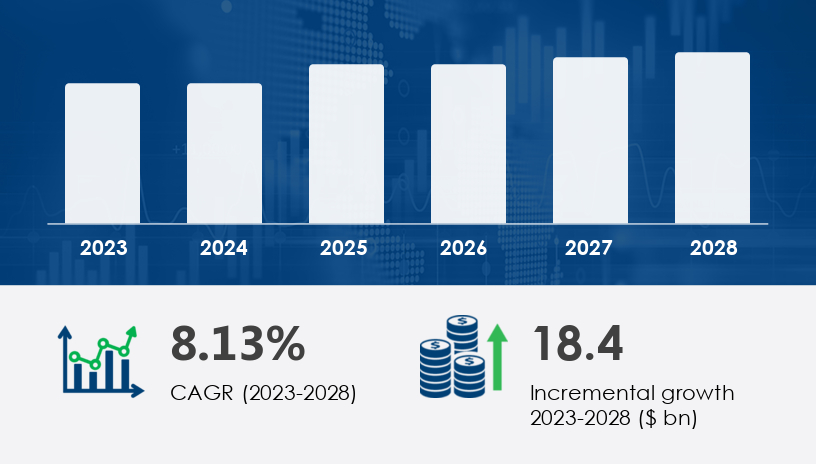

The non-genetically modified (GMO) animal feed market is set for substantial growth, with a projected increase of USD 18.4 billion by 2028, representing a compound annual growth rate (CAGR) of 8.13%. This growth trajectory is being fueled by shifting consumer preferences toward healthier, more sustainable animal feed options. As concerns about the environmental and ethical implications of genetically modified organisms (GMOs) intensify, non-GMO animal feed is emerging as the preferred alternative for livestock producers. In this comprehensive report, we explore the key drivers, trends, and challenges shaping the market, along with regional insights and forecasts for the years ahead.For more details about the industry, get the PDF sample report for free

The global demand for non-GMO animal feed is surging as consumers become increasingly health-conscious, prioritizing animal welfare and environmental sustainability. Non-GMO feed is produced from organically grown ingredients, free from harmful chemicals, toxins, and genetically modified substances. This trend is particularly evident in sectors such as poultry, swine, and aquaculture, where the focus on producing meat and dairy products free from genetically engineered ingredients is gaining momentum.

Market dynamics indicate that the demand for non-GMO feed is not only driven by consumer preferences but also by growing concerns about biodiversity, food safety, and the long-term sustainability of agricultural practices. As more consumers demand transparency in the sourcing and production of their food, non-GMO feed is being recognized as a healthier, more ethical alternative.

The non-GMO animal feed market is projected to grow by USD 18.4 billion by 2028.

The market is expected to experience a CAGR of 8.13% from 2023 to 2028.

Key sectors driving growth include poultry, aquaculture, and ruminant feed.

Several key players dominate the non-GMO animal feed market, offering innovative feed solutions and expanding their production capabilities to meet growing demand. Notable companies include Archer Daniels Midland Co., Advanced Biological Concepts, and Bar ALE Inc. These players are leveraging their expertise in animal nutrition and sustainable farming practices to offer premium feed products that align with consumer demand for non-GMO options.

Archer Daniels Midland Co.: Specializes in high-protein, non-GMO animal feed products, including soybean meal.

Advanced Biological Concepts: Offers cutting-edge nutritional technology to promote animal health and ensure hormone-free meat and milk production.

Bar ALE Inc.: Provides non-GMO feed ingredients, including testing and certification to meet industry standards.

Get more details by ordering the complete report

The non-GMO animal feed market is segmented by product type and distribution channel. Key product segments include poultry, swine, ruminant, and aquaculture feeds, each of which has unique nutritional requirements. The growing popularity of non-GMO poultry feed, driven by increased demand in global poultry farming, is one of the most significant trends in this market.

Poultry Feed: Expected to experience significant growth due to the rise in poultry farming.

Swine Feed: Increasing demand for high-quality, GMO-free feed for pig farming.

Aquaculture Feed: Focus on sustainability and health benefits driving growth in fish farming.

Ruminant Feed: Important for cattle and dairy farms that prioritize non-GMO, nutrient-rich feed.

The market is also divided based on distribution channels, with the offline segment currently dominating. This channel is particularly important for farmers and livestock owners who prefer in-person interactions and bulk purchasing options. The offline segment remains crucial, with conventional agricultural supply stores and farm visits being common methods of distribution.

Offline Distribution: Significant growth driven by traditional agricultural supply stores and in-person interactions.

Online Distribution: Increasing trend as more consumers look for convenient, digital shopping options for animal feed products.

The growth of the non-GMO animal feed market is driven by a variety of factors, including the increasing demand for ethical, sustainable food sources and rising investments in research and development. These trends are not only reshaping the way non-GMO feed is produced but also influencing consumer behavior across regions.

Health-Conscious Consumers: As people become more aware of the health implications of consuming products derived from genetically modified organisms, demand for non-GMO animal feed has skyrocketed.

Environmental Sustainability: Non-GMO feed production is seen as more sustainable, with less environmental impact compared to traditional farming practices that rely on genetically modified crops.

Ethical Considerations: Consumers are increasingly concerned about the ethical implications of using genetically modified ingredients in animal feed, which has spurred the adoption of non-GMO alternatives.

Investment in R&D: Companies are focusing on developing new, innovative non-GMO feed products. For instance, Nature’s Path recently launched a line of non-GMO, plant-based keto cereals, showcasing the growing trend of innovation in non-GMO products.

Rise of Digital Marketplaces: Digital platforms are playing an increasingly significant role in the distribution of non-GMO animal feed, expanding the reach of manufacturers and enhancing the market's visibility.

For more details about the industry, get the PDF sample report for free

The personalized gifts market is experiencing significant growth, driven by the increasing consumer preference for unique and tailored products. Non-GMO feed and organic feed have influenced the customization trend, as consumers are more conscious of sustainability and quality. While poultry feed, swine feed, and ruminant feed are traditionally used in agriculture, consumers now seek personalized items, such as aquaculture feed, which mirrors this natural and customized demand. Key offerings in the market include feed ingredients like natural feed and GMO-free feed, which ensure better health and quality. With the rise of feed formulation that emphasizes feed safety, online platforms are becoming increasingly popular for offline distribution of feed certification products, alongside agricultural stores and feed wholesalers. Buying groups are gaining traction, especially those offering labeling regulations to ensure transparency in product origins. Moreover, the surge in consumer awareness about livestock health is expanding the market for dairy production and meat production products that focus on feed quality and nutritional benefits. The rising demand for animal welfare and organic seeds is steering the personalized gifts market toward a more ethical, quality-conscious direction.

The non-GMO animal feed market is seeing rapid growth across various regions, with North America and Europe leading the charge. In North America, the focus on health-conscious livestock feed is particularly strong, driven by high production levels of feed crops like soy and corn, as well as the region's large beef cattle farming industry.

North America is projected to account for 38% of the global market growth by 2028. The U.S. alone produces a significant portion of global feed crops, providing a competitive edge in non-GMO feed production. Additionally, the demand for non-GMO feed in the region is boosted by a growing preference for meat and dairy products that are raised on ethically sourced, GMO-free feed.

Europe is also witnessing a rise in non-GMO feed demand, particularly in countries such as Germany, the U.K., and France. Consumer preference for products that are free from genetically modified ingredients is driving the adoption of non-GMO animal feed in the region.

The Asia-Pacific region, particularly China and India, is experiencing steady growth in the non-GMO animal feed market. As agricultural practices evolve and more farmers shift to sustainable and ethical feed options, the demand for non-GMO feed in this region is expected to rise.

South America

Middle East & Africa

Get more details by ordering the complete report

A deep dive into the personalized gifts market reveals a shift toward products that not only offer emotional value but also focus on feed sourcing and sustainability. With the growing popularity of non-GMO crops, consumers are increasingly selecting personalized gifts that reflect their values, like feed transparency, ethical production, and adherence to feed standards. Personalized products such as feed testing kits for premium pricing and healthy livestock solutions are gaining momentum. In addition, there is a noticeable rise in non-GMO soy and non-GMO corn products, which reflect the rising consumer interest in feed purity. The trend toward feed authenticity and non-GMO grains is encouraging companies to adopt feed traceability practices. Meanwhile, products like animal digestion supplements and immunity boost formulas are also being customized to meet specific health needs. As consumers continue to prioritize feed quality and animal welfare, personalized gifts in these categories are expected to remain a focal point in the market, with a keen emphasis on natural and organic offerings that cater to the ethical preferences of modern buyers.

The non-GMO animal feed market is set for robust growth over the next few years, driven by increasing consumer demand for sustainable, ethical, and healthy food sources. With significant investments in research and development, expanded production capabilities, and growing awareness about the benefits of non-GMO products, the market is poised for continued expansion. However, challenges such as misleading claims about non-GMO products and the complexities of global supply chains may impact growth in the short term.

As the market evolves, key players will need to stay ahead of emerging trends, ensuring that their products meet consumer demands for transparency, sustainability, and animal welfare. With a strong outlook for 2025 and beyond, non-GMO animal feed is likely to become a cornerstone of the global agricultural landscape.

For more details about the industry, get the PDF sample report for free

Safe and Secure SSL Encrypted