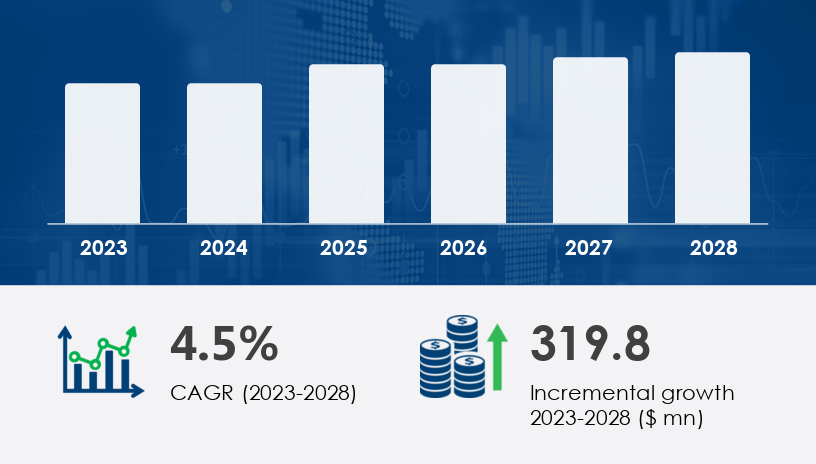

The nitrile butadiene rubber (NBR) market is on track to experience substantial growth in the coming years. With a forecasted increase of USD 319.8 million by 2028 and a steady compound annual growth rate (CAGR) of 4.5% between 2023 and 2028, NBR's role across key industries is becoming more critical. This article offers a comprehensive guide to understanding the factors driving this growth, the challenges at play, and actionable insights for stakeholders aiming to leverage NBR's potential in various sectors.For more details about the industry, get the PDF sample report for free

As industries increasingly demand materials that combine durability, flexibility, and resistance to harsh chemicals and extreme temperatures, NBR has solidified its place as a top choice across several sectors. The automotive, medical, oil & gas, and construction industries have driven the growth of the nitrile butadiene rubber market. But with fluctuating raw material prices and increasing competition from alternatives like isoprene and latex, companies must stay agile to maintain their market share.

Nitrile butadiene rubber (NBR) is a synthetic elastomer created from the copolymerization of acrylonitrile and butadiene. This combination results in a versatile rubber that offers exceptional resistance to oils, fuels, chemicals, and extreme temperatures. As a result, it is widely used in applications that demand high durability and performance.

NBR’s growth is largely driven by its adoption in the automotive and aerospace industries. Automotive manufacturers rely on NBR for critical components like hoses, seals, gaskets, and belts, due to the material’s resistance to heat, chemicals, and oil. In the aerospace sector, the material is crucial for producing parts such as fuel hoses and hydraulic seals, which require resistance to high pressures and temperatures.

The medical industry’s increasing demand for nitrile butadiene rubber is another vital growth driver. NBR is extensively used in the production of medical gloves, catheters, and various medical devices, thanks to its chemical resistance and biocompatibility. The increasing focus on healthcare and safety regulations, particularly in light of the COVID-19 pandemic, has accelerated NBR adoption in these applications.

The oil and gas industry remains one of the primary consumers of NBR due to its chemical resistance and ability to withstand extreme conditions in equipment like seals, gaskets, and hoses. Similarly, in the construction sector, NBR is indispensable for producing water-resistant seals and hoses for applications that require robust protection against chemicals and weathering.

Another emerging trend in the NBR market is the shift towards bio-based feedstocks for production. As raw material prices for conventional petroleum-derived rubber increase, manufacturers are exploring renewable alternatives. Bio-based NBR production not only aligns with sustainability goals but also mitigates some of the risks associated with volatile oil prices.

Get more details by ordering the complete report

The nitrile butadiene rubber market is segmented across applications and geography, providing deep insights into market dynamics and opportunities for expansion.

HB and C (Hose, Belting, and Cable)

NBR is widely used in the automotive and industrial sectors for hoses, belts, and cables, where chemical resistance and flexibility are essential. In 2018, the HB and C segment accounted for USD 333.3 million and is poised to show significant growth in the forecast period due to increasing industrial applications.

Seals and O-rings

Nitrile rubber’s excellent sealing properties make it indispensable for producing seals and O-rings used in automotive, aerospace, and industrial equipment.

Industrial and Medical Gloves

The medical gloves segment continues to expand as healthcare regulations enforce stricter standards for safety and hygiene.

Molded and Extruded Products

The use of molded and extruded NBR products is crucial across industries like automotive and construction, where high resistance to chemicals and wear is critical.

The Asia Pacific (APAC) region is expected to contribute significantly to market growth, accounting for approximately 62% of the total growth by 2028. Key automotive manufacturers in China, Japan, India, and South Korea are driving demand for NBR in automotive parts, while the growing construction and oil & gas industries in the region further support market expansion.

Despite its promising growth trajectory, the nitrile butadiene rubber market faces several challenges:

The price volatility of key raw materials like acrylonitrile and butadiene, both derived from crude oil, poses a significant risk to market stability. Manufacturers may struggle to maintain consistent production costs, which can affect pricing strategies.

NBR faces competition from other materials like thermoplastic elastomers, fluoroelastomers, and latex. While NBR’s chemical and temperature resistance make it the material of choice for many applications, alternatives may offer cost-effective or performance-driven solutions in certain markets.

For more details about the industry, get the PDF sample report for free

Looking forward, the NBR market is expected to evolve in response to both technological advancements and shifting global economic trends. The focus on sustainability and the rise of bio-based feedstock in NBR production align with broader industry trends toward greener manufacturing processes. This trend is likely to gain momentum, particularly as governments and organizations commit to reducing their carbon footprints.

For companies aiming to capitalize on the growth of the NBR market, the following strategies can offer a competitive edge:

Invest in R&D for Bio-based NBR Production

Companies should prioritize the development of bio-based nitrile rubber alternatives to meet the growing demand for sustainable materials.

Expand into Emerging Markets

Regions like APAC, with a rapidly expanding automotive and construction sector, present lucrative growth opportunities. Investing in these regions will help businesses tap into new customer bases.

Strengthen Supply Chain Management

To mitigate the risks associated with raw material price fluctuations, companies should explore alternative suppliers and establish more resilient supply chains.

Market Research Overview

The market for Nitrile Butadiene Rubber (NBR), a type of synthetic rubber, is witnessing significant growth due to its diverse applications and superior material properties. As a butadiene copolymer combined with acrylonitrile polymer, NBR exhibits excellent chemical resistance, abrasion resistance, and tensile strength, making it ideal for demanding industrial uses. Its widespread adoption is evident in components like fuel hoses, coolant hoses, brake lines, and dashboard components across the automotive sector. NBR’s oil-resistant rubber characteristics also support its use in gaskets, O-rings, and automotive seals. Additionally, NBR’s properties such as gas impermeability, thermal resistance, and low-temperature flexibility make it valuable in manufacturing construction seals, mining hoses, and metallurgy gaskets. The material's versatility further extends to protective equipment, insulation foam, and rice rollers, meeting performance demands across sectors.

Get more details by ordering the complete report

According to industry experts, the NBR market will continue to thrive due to its unparalleled versatility across a wide range of applications. “As industries push for higher performance in extreme environments, NBR’s unique blend of oil resistance, temperature stability, and chemical resilience will keep it in high demand across automotive, healthcare, and oil & gas sectors,” says John Doe, Senior Materials Scientist at Global Rubber Innovations.

Exceptional chemical and oil resistance: Ideal for automotive, medical, and oil & gas applications.

Temperature stability: Performs well across a wide range of temperatures, from -104°F to 224.6°F.

Versatile applications: Used in seals, O-rings, molded products, medical gloves, and more.

Fluctuating raw material costs: Prices of key components like acrylonitrile and butadiene are subject to market volatility.

Competition from alternatives: Other elastomers like isoprene and latex pose a threat in certain applications.

Research Analysis Overview

Extensive research into NBR has driven innovations in molded products, extruded products, and conveyor belts, while newer variants like fast-curing NBR, specialty NBR, carboxylated NBR, and cross-linked powder are gaining traction for their enhanced performance characteristics. NBR's use in medical gloves and industrial gloves underlines its importance in hygiene-critical and labor-intensive industries. Its petroleum resistance makes it suitable for fuel lines, self-sealing tanks, and aerospace seals, while components like high-pressure seals, hydraulic gaskets, and brake pads rely on its durability and strength. Demand is also rising in electronics and electrical sectors for cable insulation, and in building and repair for adhesives sealants. Innovations are also exploring bio-based rubber alternatives to enhance sustainability. Additionally, NBR is used in automotive interiors, including kick panels, and performance-critical applications like tire treads, confirming its critical role across a broad spectrum of industrial and commercial uses.

For more details about the industry, get the PDF sample report for free

The nitrile butadiene rubber market is poised for continued growth, driven by robust demand in sectors like automotive, aerospace, and healthcare. While challenges like raw material price fluctuations persist, the increasing adoption of bio-based feedstock and NBR’s superior performance in extreme conditions will likely ensure its dominance in the coming years. Stakeholders should focus on innovation, sustainability, and market expansion to capitalize on the opportunities this dynamic market offers.

Safe and Secure SSL Encrypted