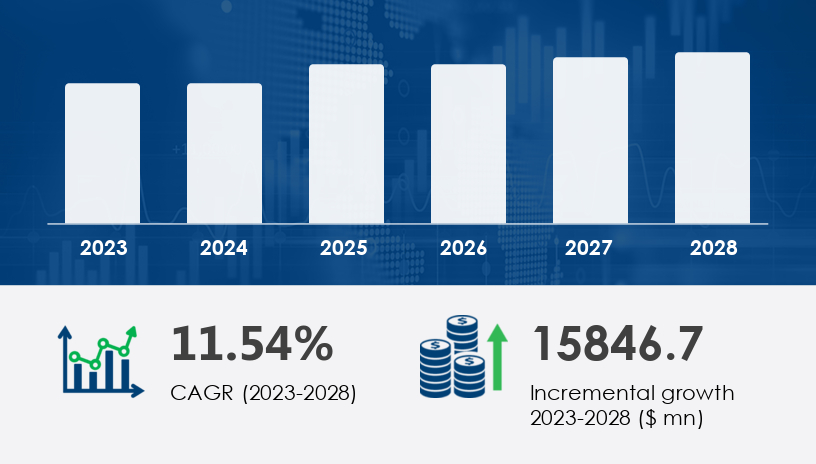

The money transfer agencies market is forecasted to expand by USD 15.85 billion between 2023 and 2028, accelerating at a CAGR of 11.54%. This growth reflects a seismic shift in how individuals and businesses conduct cross-border transactions, as digital innovation, migration trends, and fintech disruption converge to reshape the financial services landscape. In this 2025 Outlook and Comprehensive Guide, we unpack the key dynamics, trends, and strategic opportunities shaping the global money transfer ecosystem.

For more details about the industry, get the PDF sample report for free

"We’re witnessing a convergence of digital technology and financial accessibility — mobile-first remittances are no longer a luxury but a baseline expectation," says a Senior Technavio Expert.

Technological innovation stands at the heart of the money transfer agencies market surge. From real-time transaction tracking to multicurrency accounts, both incumbent banks and fintech disruptors are rapidly digitizing services to meet evolving consumer demands.

Fintech Startups Leading the Pack:

Wise (formerly TransferWise) and Revolut are pioneering peer-to-peer and multicurrency solutions.

Xoom (PayPal) holds a commanding 23% market share due to its ease of use and international reach.

These firms are rewriting the rules of cross-border transactions, offering alternatives that are often faster, cheaper, and more transparent than legacy banking systems.

Money Transfer (Dominant segment)

Currency Exchange

The money transfer segment continues to dominate, driven by rising international mobility, global employment, and educational migration. In 2018, this segment accounted for USD 14.49 billion — a figure that has grown substantially due to the rise of digital wallets, cash pickup agents, and mobile-based remittances.

Get more details by ordering the complete report

Asia-Pacific, led by India, China, and the Philippines, is experiencing a boom in remittance inflows and outflows. Migrants in the Middle East and the US are sending record volumes back home, facilitated by easy-to-use mobile platforms

Digitalization of Financial Services: Mobile apps and API-driven platforms streamline operations.

Increased Migration and Travel: More students and workers moving abroad demand secure, fast fund transfers.

Rising Financial Inclusion: Services tailored for the underbanked, especially in developing economies.

Real-time FX and Remittance Services: More users enjoy currency conversion transparency and tracking.

Illicit Financial Flows: Fraud, tax evasion, and cybercrimes threaten market integrity.

Regulatory Complexity: Compliance with cross-border laws remains a burden.

Exchange Rate Volatility: Fluctuating FX rates can erode customer trust if not transparently communicated.

For more details about the industry, get the PDF sample report for free

Partnerships Are Crucial: Collaboration with local banks, telecom providers, and digital wallets can accelerate market entry.

Security Should Be a Differentiator: Companies investing in blockchain, AML tools, and transaction tracking will gain trust and compliance advantages.

Diversified Services Drive Loyalty: Adding services like bill payments, mobile recharges, and savings plans can deepen user engagement.

The Money Transfer Agencies Market is expanding rapidly with the growing adoption of digital wallet solutions and mobile payment technologies. These platforms support diverse services like remittance service, cross-border payment, and traditional wire transfer options. Consumers increasingly prefer instant transfer methods, including emerging innovations such as blockchain payment and cryptocurrency transfer. Additionally, peer-to-peer payment channels and established systems like the SWIFT network and ACH transfer are playing a key role in the global remittance landscape. Complementing these are tools like payment gateway, money order, and prepaid card, while digital innovations such as virtual card and forex transfer cater to the tech-savvy segment. Agencies also provide e-wallet, bank transfer, and cash pickup services, with added convenience for bill payment and QR code payment options. The rise of contactless payment is pushing further integration with leading payment processor solutions, as consumers become more aware of transaction fee structures and competitive exchange rate offerings.

Get more details by ordering the complete report

Expect a wave of M&A activity, especially as traditional financial institutions seek to acquire nimble fintech players. Furthermore, as blockchain and AI continue to mature, we may witness:

Self-regulating transaction networks

Dynamic, real-time FX optimization

Enhanced fraud detection through machine learning

Despite the optimism, illicit financial flows pose a significant challenge. Governments are increasing regulatory scrutiny, which may increase compliance costs. The future success of money transfer agencies depends on:

Transparent customer onboarding

KYC/AML integration

Cross-border data sovereignty considerations

For more details about the industry, get the PDF sample report for free

Invest in API-First Infrastructure: Enables seamless integration across platforms.

Prioritize Customer-Centric UX: Intuitive interfaces reduce drop-off rates.

Strengthen Compliance Frameworks: Stay ahead of AML and cybersecurity standards.

Expand Payout Options: Offer both traditional and modern formats — from bank deposits to mobile wallets.

Leverage Analytics for FX Optimization: AI-driven insights can enhance customer savings and loyalty.

From a research analysis perspective, money transfer agencies are under increased scrutiny for KYC compliance and AML regulation, ensuring secure operations and building trust. Payment security and fraud detection remain at the core of technological advancements, with features like biometric authentication enhancing platform integrity. The market is also seeing rising demand for multi-currency account services and enhanced transfer tracking through user-friendly payment API integrations. With the growth of the fintech platform landscape, agencies are leveraging tools such as mobile banking, online banking, and feature-rich transfer apps. Added services like payment link, recurring payment, and escrow service are expanding agency capabilities. To further enhance convenience and access, agencies are introducing cardless withdrawal solutions and supporting real-time settlement. Lastly, robust systems for payment encryption and transaction monitoring are critical for securing user data and maintaining regulatory standards across digital channels.

Get more details by ordering the complete report

As digital technology, international education, and global tourism become intertwined, the demand for secure, fast, and affordable money transfers will only increase. With USD 15.84 billion in new market value at stake by 2028, agencies that embrace innovation, compliance, and customer experience will emerge as leaders in the new financial frontier.

Safe and Secure SSL Encrypted