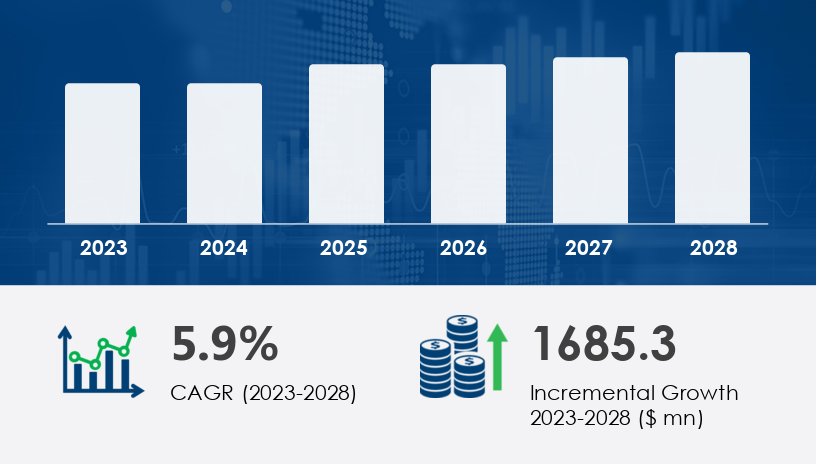

The military laser systems market is poised to grow by USD 1.69 billion at a CAGR of 5.9% from 2024 to 2028, driven by the rising adoption of high-power laser technologies in defense applications. This comprehensive guide offers an expert analysis of the evolving landscape, focusing on key market segments by product type and geography. As defense forces worldwide emphasize operational efficiency and cost-effective alternatives to traditional weaponry, military laser systems are emerging as game-changers in modern warfare.

With the 2025 outlook pointing toward accelerated deployment of solid-state lasers, high-energy laser weapons, and AI-integrated control systems, this article provides strategic insights into the market’s growth drivers, challenges, opportunities, and forecasted trends. Our detailed segment breakdown and region-wise analysis are designed to help stakeholders make informed decisions in this dynamic sector.

For more details about the industry, get the PDF sample report for free

The military laser systems market is experiencing robust growth due to advances in laser weapon technology and increased defense investments. Laser systems provide precision, sustainability, and rapid response capabilities, making them integral to modern military platforms such as unmanned aerial vehicles (UAVs) and electronic warfare suites.

| Quick Facts Table | |

|---|---|

| Market Size (2024-2028 Growth) | USD 1.69 billion increase |

| CAGR | 5.9% |

| Key Product Types | Laser Weapon Systems, Laser Radar Systems, Laser Target Designators |

| Leading Regions | North America (US), APAC (China), Europe (UK), Middle East & Africa, South America |

| Top Companies | Lockheed Martin, BAE Systems, Northrop Grumman, Elbit Systems, Rafael |

Growth Drivers & Challenges:

Laser weapon systems dominate the market, driven by their precision and cost-efficiency compared to traditional weapons. The surge in demand is fueled by innovations in high-power solid-state lasers and integration of radiofrequency and microwave technologies. However, high development costs and prototype failures—such as the cancellation of Boeing’s YAL-1 Airborne Laser project—pose significant challenges.

Expert Insight:

“High-power laser weapons are redefining battlefield engagement by offering sustainable, rapid-response options that reduce collateral damage,” says a Technavio Defense Technology Analyst.

Mini Case Study:

Lockheed Martin’s 30-kW mobile laser weapon system, unveiled in 2015, showcased the practical capabilities of laser weapons by disabling a moving truck target. By 2017, the company further pushed the envelope with a record 58 kW laser beam, marking a milestone in military laser power.

Key Stats:

The laser weapon systems segment was valued at USD 2.88 billion in 2018.

Lockheed Martin’s 58 kW laser demonstrates nearly double the power of previous models.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Growth Drivers & Challenges:

Laser radar systems, including LIDAR, enhance target acquisition, navigation, and battlefield reconnaissance. Their high accuracy and fast response times are critical for UAVs and guided munitions. However, these systems require advanced power management and cooling solutions, increasing operational complexity.

Expert Insight:

“LIDAR technology integrated with AI-powered targeting is transforming battlefield intelligence,” notes a Senior Defense Systems Engineer.

Mini Case Study:

The US military’s integration of LIDAR into UAV platforms for reconnaissance missions has significantly improved situational awareness, enabling rapid target detection and precision strikes.

Key Stats:

Military applications of LIDAR have increased by over 20% in operational use since 2020.

Integration with AI has reduced target acquisition time by 30%.

Growth Drivers & Challenges:

Laser target designators are essential for guiding precision munitions and improving hit accuracy. Their compact size and low maintenance needs have made solid-state laser designators especially popular. However, environmental factors like dust and weather can affect performance, requiring robust system designs.

Expert Insight:

Laser designators remain a vital component in modern combined arms tactics, offering unparalleled accuracy in target marking.

Mini Case Study:

During recent joint military exercises, the deployment of solid-state laser designators enabled coalition forces to achieve precision strikes with 25% fewer collateral incidents compared to conventional targeting methods.

Key Stats:

Solid-state laser designators have seen a 15% increase in adoption across NATO countries since 2021.

Operational efficiency in target marking improved by approximately 18% using laser designators.

Major Opportunities:

Expansion in APAC markets, with China leading 36% of the regional market growth.

Increased adoption of AI-enabled laser beam control systems to enhance targeting accuracy.

Growing use of directed-energy weapons for homeland security and electronic warfare.

Development of laser-based communication systems to address spectrum limitations.

Key Risks & Challenges:

High development and deployment costs for advanced laser technologies.

Project cancellations due to prototype failures and technical setbacks.

Regulatory hurdles related to export controls and international arms agreements.

Infrastructure demands for power and cooling systems in field deployments.

The military laser systems market is projected to maintain a CAGR of 5.9% through 2028, adding USD 1.69 billion in market value. Solid-state lasers and high-energy directed energy weapons will continue to dominate growth, driven by modernization programs and increasing defense budgets worldwide. Are defense companies prepared to pivot their R&D strategies to fully exploit emerging laser technologies?

Expert Prediction:

By 2028, laser systems will be integral to all frontline military platforms, combining precision with reduced logistical footprint.

The Military Laser Systems Market is gaining momentum as defense organizations prioritize laser weapon systems and directed-energy weapons to enhance battlefield capabilities. Innovations in laser-based communication and advancements in solid-state lasers, chemical lasers, and fiber laser modules have significantly increased the effectiveness of high-power lasers deployed across various platforms. Critical components such as laser target designators, laser radar systems, and the atmospheric lens concept contribute to superior laser defense systems with unmatched precision targeting capabilities. Utilization of electromagnetic waves and emerging techniques like ionosphere manipulation are broadening the scope of laser applications. This market is driven by the growing need for air combat lasers, ground-based lasers, and naval laser systems designed to counter evolving threats such as drone countermeasures and missile defense lasers, all while improving operational efficiency amid ongoing military modernization efforts influenced by escalating geopolitical conflicts and terrorism defense initiatives.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Invest in AI Integration: Leverage AI-powered control for faster, more accurate laser targeting and threat neutralization.

Focus on Cost-Efficiency: Develop sustainable, solid-state laser modules to reduce maintenance and operational expenses.

Expand into APAC: Target the growing defense budgets of Asia-Pacific countries, especially China, for new market penetration.

Collaborate on Power Solutions: Partner with energy firms to innovate compact, efficient power and cooling systems essential for laser deployment.

Monitor Regulatory Trends: Stay ahead of international export controls and compliance issues affecting laser weapons proliferation.

Research analysis highlights the significance of managing laser beam power through advanced beam control systems and effective thermal management techniques to maintain consistent laser pulse energy during missions. The incorporation of adaptive optics and innovative materials such as optical coatings, photonic crystals, and quantum cascade lasers enhances system resilience and performance. Critical functionalities including laser guidance, laser tracking, and deployment of coherent beams are essential for defending against emerging threats like hypersonic defense systems. The synergy of electro-optical systems, monitoring laser frequency, and integrating infrared sensors ensure heightened situational awareness. Simultaneously, laser countermeasures play a pivotal role in neutralizing hostile threats, underscoring the comprehensive capabilities necessary for modern warfare and defense strategy in this rapidly evolving market.

The military laser systems market is entering a transformative phase, with high-power laser weapons, laser radar, and target designators driving substantial growth. Our analysis underscores the strategic importance of AI integration, regional expansion—particularly in APAC—and overcoming technical and regulatory challenges. The forecast period through 2028 presents a clear opportunity for defense companies to innovate and lead the next wave of military technology.

Download our free Strategic Report for full 2025 insights and detailed market forecasts.

Safe and Secure SSL Encrypted