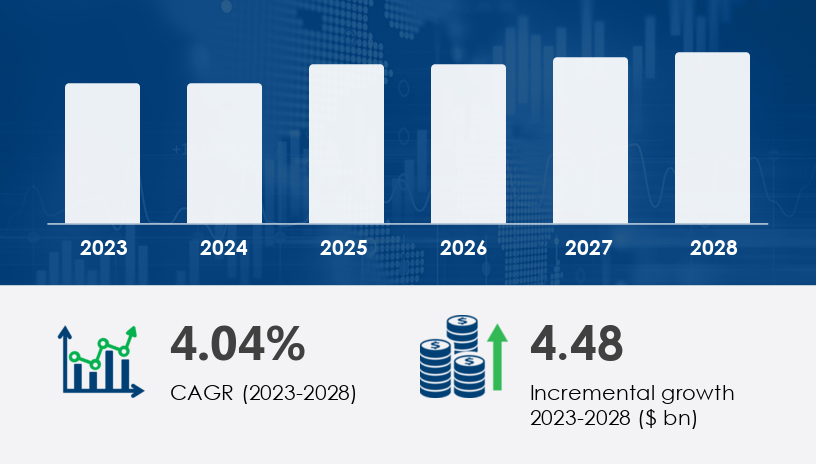

The Military Aircraft Modernization and Upgrade and Retrofit Market is witnessing robust growth driven by the urgent need to enhance operational readiness, extend fleet longevity, and integrate advanced technologies into aging military aircraft. As defense forces worldwide face evolving security challenges, modernization efforts are becoming crucial to sustain air superiority and combat effectiveness.The military aircraft modernization and upgrade and retrofit market is forecast to grow by USD 4.48 billion between 2023 and 2028, progressing at a CAGR of 4.04%. This growth is attributed to increasing investments in avionics, sensors, propulsion systems, and cybersecurity, alongside rising demand for structural upgrades and mission system enhancements.

.For more details about the industry, get the PDF sample report for free

A central driver of the military aircraft modernization and upgrade and retrofit market is the integration of sophisticated navigation, weapon, and defensive systems. Modernization efforts are being accelerated by the demand for GPS-based satellite navigation systems, head-up displays, infrared sensors, laser designators, and fire control radars. These technologies significantly enhance the operational capabilities of both fixed-wing and rotary-wing platforms. For instance, avionics configurations that provide real-time data sharing improve situational awareness and interoperability among allied forces, a critical feature in today’s multidomain warfare scenarios. The increased focus on electronic warfare suites, missile warning systems, and cyber protection measures also ensures aircraft survivability in hostile environments, driving sustained demand in this segment.

A major trend reshaping the market is the integration of advanced armaments and smart technologies, especially in fighter jets and mission-critical aircraft. Defense agencies are prioritizing enhancements such as stealth capabilities, autonomous systems, and directed energy weapons to boost mission effectiveness. For example, the incorporation of MAD-XR (modernized airborne electronic warfare systems) improves anti-submarine warfare capabilities, while structural upgrades extend aircraft service life. Stealth materials and reduced radar cross-sections are also gaining traction to ensure better survivability in contested airspace. These upgrades are not just about adding new capabilities but also about preserving fleet viability amid tightening defense budgets.

The Military Aircraft Modernization and Upgrade and Retrofit Market is witnessing significant evolution driven by the integration of cutting-edge technologies across fixed-wing and rotary-wing platforms. Modernization efforts include advanced avionics upgrades, CNS systems (communication, navigation, surveillance), and stealth capabilities to enhance mission effectiveness. The growing demand for electronic warfare readiness and cybersecurity solutions has prompted defense agencies to revamp multi-role aircraft, combat aircraft, and military transport fleets. Key innovations such as propulsion systems, sensor systems, and advanced materials like lightweight materials and composites are improving fuel efficiency, structural integrity, and platform durability.

The Military Aircraft Modernization and Upgrade and Retrofit Market is segmented by:

By Application

Combat Aircraft

Transport Aircraft

Others

By Type

Fixed-wing Aircraft

Rotary-wing Aircraft

The combat aircraft segment is projected to witness the most significant growth during the forecast period. These aircraft—often deployed in high-intensity missions—undergo substantial wear and tear, making frequent modernization vital. According to data, this segment was valued at USD 9.96 billion in 2018 and has shown consistent growth since. Fixed-wing combat aircraft, especially fighter jets, are a primary focus for upgrades that include stealth enhancements, avionics modernization, and propulsion system optimization. Analysts highlight that MRO (maintenance, repair, and overhaul) providers are instrumental in delivering these upgrades, helping air forces maintain technological superiority in air combat readiness.

Get more details by downloading the sample PDF report

North America (US)

APAC (China, India)

Europe (France, Germany)

Middle East and Africa

South America

North America is the leading contributor, projected to account for 49% of global market growth during the forecast period. The United States dominates this region, driven by high military expenditure and strong commitments to technological advancements. For instance, the U.S. Department of Defense awarded an USD 8.2 billion contract for 90 F-35 aircraft under the LRIP 10 phase. These investments extend beyond procurement to include R&D initiatives in avionics, stealth technologies, and cybersecurity systems. Additionally, countries like Canada and Mexico are involved in development projects, although the U.S. remains the central hub for innovation and investment in this space.

Despite its promising growth, the market faces a significant challenge in the complexity of data integration and management across advanced systems. Modernized military aircraft generate vast and diverse data streams—from avionics to sensors and defensive systems. Managing these data sets to ensure seamless communication, efficient system interoperability, and real-time decision-making is a growing technical hurdle. This challenge is compounded by the necessity for cybersecurity and the high costs associated with maintaining such sophisticated digital infrastructure. As aircraft become more interconnected, any failure in data processing or cyber defense could compromise mission success.

Ongoing enhancements focus on airframe modifications, navigation systems, mission systems, and communication systems that align with network-centric warfare strategies and interoperability standards. Platforms including fighter jets, rotorcraft modernization, and special missions aircraft are being equipped with next-gen defensive systems, surveillance systems, optronic systems, and reconnaissance systems to expand battlefield awareness and situational awareness. Emerging technologies like AI integration, predictive maintenance, and digital cockpits with cockpit displays, autopilot systems, and helmet-mounted sights are now standard in upgrade packages. Additionally, fire control, radar systems, and weapon integration are transforming air combat readiness.

The strategic push towards enhanced multi-mission capabilities, air superiority, and lifecycle extension is also driving investment in electrical power systems and modernization of aerial resupply fleets. These efforts are supported by improved defensive systems, precision weaponry, and communication technologies enabling more robust mission support. Developments in Sustainment and Maintenance areas such as predictive maintenance are helping reduce costs while maintaining operational availability. The broader objective of achieving a fully connected, agile, and tech-advanced air force reinforces the need for continual innovation across the entire modernization and upgrade spectrum

Innovations and Recent Developments

Leading players in the military aircraft modernization and upgrade and retrofit market are implementing a wide range of strategies to maintain and expand their market positions. These include strategic alliances, technological innovations, mergers and acquisitions, and global expansion.

Key companies include:

Airbus SE

BAE Systems Plc

Dassault Aviation SA

Elbit Systems Ltd.

Honeywell International Inc.

Israel Aerospace Industries Ltd.

Lockheed Martin Corp.

Northrop Grumman Corp.

Raytheon Technologies Corp.

Saab AB

The Boeing Co.

Many of these firms are partnering with governments and defense alliances to deliver tailored modernization solutions. For example, Northrop Grumman offers a comprehensive portfolio of aircraft upgrade services, including modification and replacement programs designed to extend aircraft lifespan. Similarly, Lockheed Martin is spearheading avionics configuration and stealth capability development for the F-16 and F-35 platforms.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 Application

6.1.1 Combat Aircraft

6.1.2 Transport Aircraft

6.1.3 Others

6.2 Type

6.2.1 Fixed-wing Aircraft

6.2.2 Rotary-wing Aircraft

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East and Africa

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted