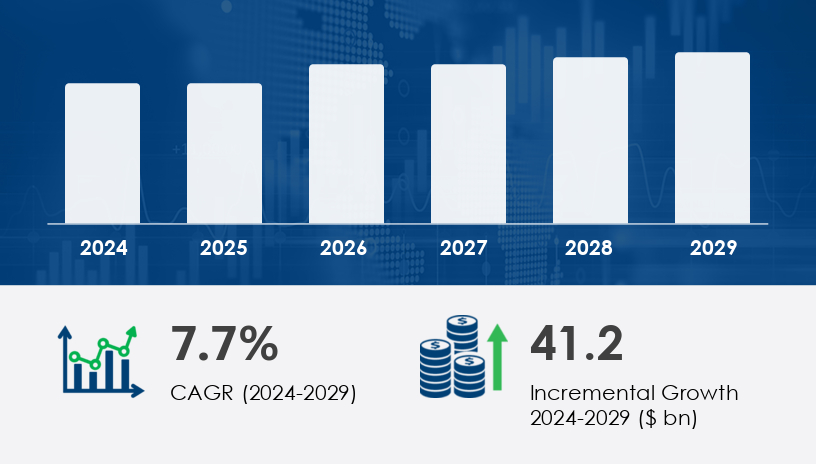

The global Microinsurance Market is projected to grow by USD 41.2 billion from 2024 to 2029, expanding at a CAGR of 7.7%. This surge is driven by rising demand for affordable and accessible insurance products, particularly in underserved and low-income segments across emerging economies. The market benefits from innovations in digital financial services, artificial intelligence (AI), mobile platforms, and data analytics, which enhance product accessibility and underwriting accuracy. However, regulatory barriers and data privacy concerns present significant challenges to market expansion. Despite these, the overall outlook remains optimistic due to rising financial inclusion initiatives and public-private partnerships worldwide.For more details about the industry, get the PDF sample report for free

A primary driver behind the growth of the Microinsurance Market is the rising demand for affordable and personalized insurance solutions in developing countries. These solutions are specifically tailored to meet the needs of populations traditionally excluded from mainstream financial services. Market dynamics such as increased financial literacy, demographic transitions, and the growing middle class are expanding the customer base. Technological advancements like weather index insurance, mobile money, and machine learning-based underwriting are making insurance products more accessible and accurately priced. For example, life insurance premiums in India crossed USD 1.26 billion in FY24, underlining the heightened uptake of microinsurance products.

The most prominent trend shaping the Microinsurance Market is the digital transformation of insurance services. Digitalization is enabling insurers to reach previously inaccessible demographics through mobile payments, digital identity verification, and real-time claims processing. The integration of artificial intelligence (AI), data analytics, and predictive modeling has revolutionized customer engagement and product customization. Community-based organizations are leveraging digital tools to extend savings-linked insurance products and enhance insurance literacy. Furthermore, insurtech firms are disrupting traditional models with direct-to-consumer digital platforms, significantly lowering operating costs and increasing outreach.

The Microinsurance Market is expanding rapidly as insurers and governments prioritize financial inclusion for underserved populations. Designed for low-income individuals and communities, microinsurance products cover a wide range of needs, including health insurance, life insurance, property insurance, and accident insurance. As climate risks intensify, index insurance, natural disaster insurance, and weather-based insurance are gaining traction, especially in regions vulnerable to environmental volatility. In agriculture, crop insurance, livestock insurance, and agricultural insurance offer risk mitigation tools to protect smallholder farmers from losses due to unpredictable weather patterns or pests. These innovations foster economic security by enabling policyholders to recover from shocks quickly.

By Product Type:

Property Insurance

Health Insurance

Life Insurance

Index Insurance

Others

By Type:

Commercially Viable Microinsurance

Aid or Government-Supported Microinsurance

By End-User:

Low-Income Individuals

Smallholder Farmers

Micro-Entrepreneurs

Others

By Geography:

North America (US, Canada, Mexico)

Europe (Germany)

APAC (India, China, Japan, Australia, South Korea)

South America (Brazil)

Middle East & Africa

Rest of World (ROW)

Within the product type category, Property Insurance emerges as the leading segment in the Microinsurance Market. The segment was valued at USD 22.80 billion in 2019 and has demonstrated consistent growth through the forecast period. Property microinsurance covers a range of risks including natural disasters, theft, and structural damage, which are especially critical for low-income populations vulnerable to climate-related risks. As highlighted by Technavio analysts, the growth of this segment is being reinforced by innovations like weather index insurance, digital payments, and catastrophe risk modeling. These tools have improved accessibility and affordability, particularly in rural and semi-urban markets.

Get more details by downloading the sample PDF report

Covered Regions:

North America

Europe

APAC

Latin America

MEA

Rest of World (ROW)

Asia-Pacific (APAC) is projected to contribute 49% of the total market growth during 2025–2029, making it the fastest-growing and most dominant region in the global Microinsurance Market. Key drivers include an expanding middle class, low insurance penetration, and supportive regulatory reforms. For instance, deregulation in APAC countries has facilitated partnerships between banks and insurers, broadening access to insurance for underserved populations. Furthermore, technological penetration through mobile banking and digital identity has made insurance distribution more efficient. According to Technavio analysts, initiatives by governments and community-based organizations are playing a pivotal role in promoting financial inclusion and climate resilience through microinsurance schemes.

Despite its strong growth potential, the Microinsurance Market faces a significant hurdle in the form of data privacy and cybersecurity risks. The rise of digital platforms, although a major enabler, has also introduced vulnerabilities concerning customer data protection and information misuse. The industry’s increasing reliance on big data, AI-driven risk assessment, and online transactions necessitates robust cybersecurity frameworks and data governance standards. Insurers must not only comply with regulatory requirements but also build trust with customers by ensuring transparency and digital safety. Failing to address these issues could undermine consumer confidence and stall adoption in sensitive markets.

Diverse coverage options are a defining feature of the market. Products like medical insurance, disability insurance, vehicle insurance, and liability insurance are being tailored into affordable coverage packages through microinsurance schemes. Innovations such as parametric insurance and index-based coverage offer quicker, automated payouts, enhancing resilience against large-scale risks like droughts or earthquakes. Specific plans such as term life coverage, funeral insurance, personal accident plans, and illness protection address common health and life-related risks in a simplified format. Coupled with micro pension plans, micro savings insurance, and microfinance insurance, these solutions contribute to long-term financial protection and personal asset growth.

Digital transformation is revolutionizing the Microinsurance Market, with digital insurance, usage-based insurance, and mobile-first microinsurance solutions enabling greater insurance penetration in rural and remote regions. Insurtech platforms support the efficient distribution of health microinsurance, life microinsurance, and property microinsurance products, often bundled with financial services from microfinance institutions. Through the use of micro health plans, micro life policies, and asset protection strategies, the market is evolving to meet the unique needs of base-of-the-pyramid populations. As awareness grows and regulatory frameworks mature, microinsurance is poised to become a key driver of inclusive growth in developing economies.

Leading players in the Microinsurance Market are leveraging strategic alliances, mergers & acquisitions, and geographic expansion to strengthen their positions. Technological innovation remains a core strategy, with companies investing in AI-powered underwriting, biometric authentication, and mobile-first platforms. Insurers are also developing flexible premium plans and customized products to cater to the diverse needs of low-income populations. For instance, Accion International offers insurance solutions specifically designed to support financial recovery and resilience for low-income individuals.

Prominent players include:

Accion International

Allianz SE

HDFC Bank Ltd.

ICICI Bank Ltd.

Swiss Re Ltd.

BRAC

ASA International Group plc

AIA Group Ltd.

Life Insurance Corp. of India

Edelweiss Financial Services Ltd.

These companies are classified across various tiers—dominant, leading, and industry-focused—based on their strategic influence and market performance. The competitive landscape is expected to intensify as firms adopt impact investing, savings-linked products, and social enterprise partnerships to deepen market penetration.

The Microinsurance Market is undergoing rapid transformation as it addresses the needs of underserved populations through digital innovation, policy evolution, and community engagement. With a forecasted market increase of USD 41.2 billion by 2029 and a 7.7% CAGR, the industry is moving toward a more inclusive and resilient financial future. As long-tail keywords like weather index insurance, affordable insurance for low-income groups, mobile-based microinsurance platforms, catastrophe risk management, and AI-driven insurance underwriting continue to define market direction, companies that prioritize accessibility, security, and personalization will be best positioned to thrive.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 Type

6.1.1 Microinsurance (Commercially Viable)

6.1.2 Microinsurance through Aid or Government Support

6.2 Product Type

6.2.1 Property Insurance

6.2.2 Health Insurance

6.2.3 Life Insurance

6.2.4 Index Insurance

6.2.5 Others

6.3 End-user

6.3.1 Low-Income Individuals

6.3.2 Smallholder Farmers

6.3.3 Micro-entrepreneurs

6.3.4 Others

6.4 Geography

6.4.1 North America

6.4.2 Europe

6.4.3 APAC

6.4.4 South America

6.4.5 Rest of World (ROW)

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted