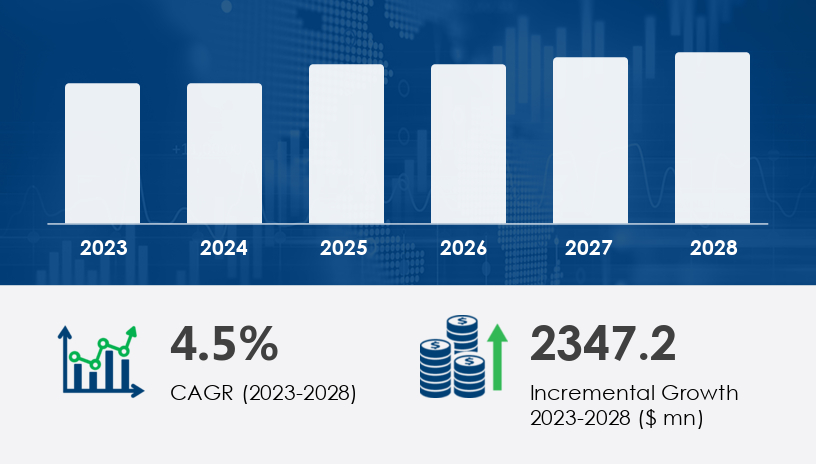

The global Methyl Methacrylate (MMA) monomer market is poised for significant expansion, projected to increase by USD 2.35 billion at a robust compound annual growth rate (CAGR) of 4.5% from 2023 to 2028. This expansion underscores the increasing demand from emerging economies, particularly in Asia-Pacific, and the critical role MMA plays across industries such as construction, automotive, and healthcare. As the market grows, strategic decision-making and adaptability to dynamic global trends are essential for companies aiming to capture a share of this burgeoning sector.

For more details about the industry, get the PDF sample report for free

The Methyl Methacrylate (MMA) Monomer Market is witnessing robust growth driven by the increasing demand for PMMA production and the widespread use of acrylic resin in various industries. MMA is a key component in the manufacturing of surface coatings, automotive glazing, and lightweight materials, offering properties like optical clarity, weather resistance, and UV resistance. The market is also benefiting from innovations in bio-based MMA and plant-derived MMA, which are gaining traction due to their eco-friendly appeal. MMA is used in diverse applications, including adhesives and sealants for construction materials, acrylic sheets for decorative trims, light covers, and instrument panels for automotive parts. The expanding use of MMA-based products like electronic displays, paint formulations, and waterproofing compounds is further propelling the market. Advances in the acetone cyanohydrin and isobutylene processes for MMA production are contributing to a steady supply of this essential monomer.

Methyl Methacrylate, with the chemical formula C5H8O2, is a versatile and essential chemical compound used as a monomer in the production of polymethyl methacrylate (PMMA). PMMA is a popular acrylic polymer widely utilized in various applications, from transparent glass-like structures to durable paints, coatings, adhesives, and sealants. MMA’s unique characteristics—such as its quick drying time, high transparency, excellent adhesion properties, and UV resistance—make it highly sought after in industries such as construction, automotive, electronics, and healthcare.

Construction: MMA is integral to PMMA resins used in coatings and adhesives for building materials. Its weather resistance makes it ideal for infrastructure projects and construction applications.

Automotive: MMA contributes to the production of lightweight vehicles, enhancing fuel efficiency and reducing environmental impact.

Healthcare: MMA is used to produce biocompatible polymers for medical devices and implants, showcasing its versatility in the healthcare sector.

Electronics: As a chemical intermediate, MMA supports the production of emulsion polymers and acrylic resins, crucial for electronic devices.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

The MMA monomer market is divided across different production methods and geographical regions.

ACH Method: This method involves producing MMA monomer via acetoacetyl-cyanohydrin (ACH) synthesis. It's popular for its high yield, simple reaction process, and widespread adoption in the MMA monomer industry. ACH’s ease of use and scalability make it a dominant process for large-scale production.

Isobutylene Method: Although the isobutylene method also plays a significant role in MMA production, it is more regionally focused and tends to be less common than the ACH method.

The global market is segmented into the following regions:

Asia-Pacific is forecasted to contribute significantly to the market’s growth, with China and India leading the charge. The expansion of manufacturing facilities in these countries, driven by lower production costs, abundant labor, and a rapidly growing consumer base, is a key factor contributing to this trend.

APAC's Dominance: Countries like China, India, and Indonesia are seeing large-scale investments in the construction and automotive sectors, further driving the demand for MMA monomer.

North America and Europe: While these regions are traditionally strong markets, their growth is challenged by stricter environmental regulations, high labor costs, and evolving sustainability standards.

The rise of manufacturing in developing economies, especially in Asia-Pacific and Latin America, is a pivotal driver of MMA market growth. These regions are increasingly investing in infrastructure, automotive, and electronics, creating significant demand for MMA-based products.

Strategic Takeaways: To capitalize on this trend, businesses must adapt their operations to these regions, aligning with local regulations and production capabilities.

The MMA monomer market is witnessing a significant shift in manufacturing facilities from established Western markets to emerging economies in Asia. This shift is primarily due to lower production costs, proximity to raw material sources, and an increasing regional demand.

Expert Insight: "Asia’s rapidly growing industrial base, coupled with its vast consumer market, is becoming the global epicenter for MMA production, and companies are increasingly moving their manufacturing facilities to this region." — Rajiv Gupta, Industry Analyst

The growing preference for sustainable materials, such as bio-based MMA and renewable resource-based polymers, is further propelling the demand for MMA monomers. In the healthcare sector, its use in creating biocompatible polymers for medical devices highlights the increasing focus on sustainability.

MMA production is highly sensitive to the fluctuations in raw material prices, especially acetone and methanol. The global volatility of crude oil prices, particularly due to political instability in key regions, significantly affects the cost of production for MMA monomers.

Stringent environmental regulations in regions like Europe and North America, particularly concerning the disposal and use of MMA monomer, can create barriers to entry and increase operational costs. Companies must stay ahead of these regulatory changes to ensure compliance and avoid penalties.

Fluctuating raw material costs

Strict regulatory environments

Increasing competition from alternative sustainable materials

Get more details by ordering the complete report

Companies should invest in greener, more sustainable production methods to remain competitive, reduce costs, and adhere to growing regulatory demands for environmentally friendly manufacturing practices.

To maximize growth potential, businesses should increase their presence in rapidly developing regions, especially in Asia-Pacific, where the demand for MMA is expected to grow substantially.

Given the volatility in raw material prices, robust supply chain strategies—such as securing multiple suppliers and considering alternative sourcing—are essential to mitigate risk.

Research into the MMA monomer market reveals that the demand for high durability, impact resistance, and scratch resistance is driving its use in products such as acrylic sheets, automotive parts, and architectural components. The versatility of MMA in polymer modifiers and specialty chemicals is enhancing its role in various end-use applications, including dental materials, medical devices, and floor polish. With increasing concerns over environmental sustainability, the market is also focusing on low-VOC, recycled PMMA, and the depolymerization process for MMA recycling. Moreover, MMA-based products are increasingly used in smart signage, transparent plastics, and powder coatings, expanding their application range. The growth of the construction sector, coupled with the demand for chemical resistance and structural adhesives in waterproofing compounds and concrete binders, is also fueling the market. As technology advances, MMA continues to play a pivotal role in various industries, from automotive glazing panels to optical clarity products, solidifying its position as a key monomer in modern manufacturing.

The MMA monomer market is set for sustained growth over the next several years, with significant contributions from Asia-Pacific, driven by manufacturing shifts and the demand for sustainable products. However, market players must navigate challenges such as raw material price volatility and regulatory hurdles. By adopting strategic supply chain management, investing in sustainable production techniques, and capitalizing on emerging market opportunities, companies can position themselves for success in this expanding sector.

Safe and Secure SSL Encrypted