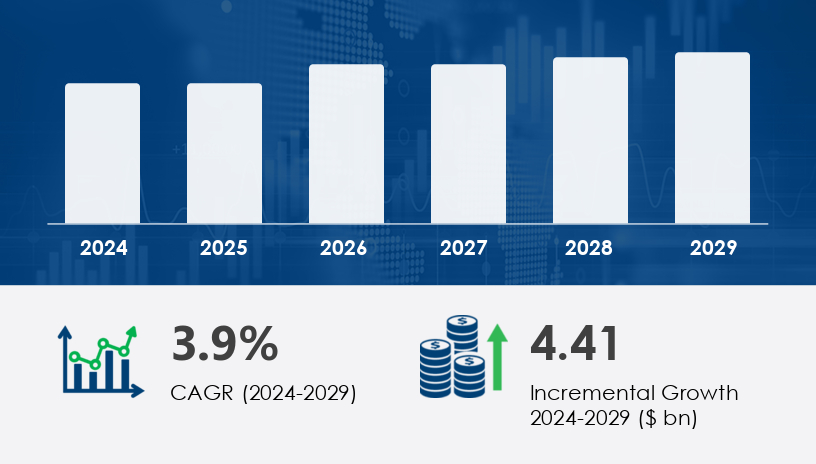

The metal cutting tools market is poised for steady growth from 2025 to 2029, fueled by advancements in manufacturing technologies and an increasing need for high-precision machining solutions across sectors like automotive, aerospace, and construction. The global market is projected to increase by USD 4.41 billion, growing at a compound annual growth rate (CAGR) of 3.9% during the forecast period. As of 2024, the metal cutting tools market maintains robust momentum despite past supply chain disruptions and labor shortages. By 2029, the market is forecast to exceed its current size, driven by automation trends and the growing integration of Industry 4.0 technologies.

For more details about the industry, get the PDF sample report for free

The most significant driver of growth in the metal cutting tools market is the rising demand for metal components across core industries. Sectors such as automotive, aerospace, and defense heavily rely on metal cutting tools to manufacture complex parts like engine blocks, gearboxes, clutch plates, and structural components. Manufacturers increasingly prefer solid round tools, indexable inserts, and milling and turning tools for high accuracy and productivity. Tools like grinders, lathes, boring machines, and CNC systems have become integral due to their ability to maintain tight tolerances. According to the research, original equipment manufacturers (OEMs) are adopting these advanced cutting tools to streamline operations and reduce costs. Analysts note that the continued demand for efficiency and material compatibility with metals like titanium, ceramics, and superalloys is a core factor sustaining this growth trajectory.

A key trend shaping the metal cutting tools market is the emergence of additive manufacturing and smart cutting tools. Industry 4.0 is enabling manufacturers to shift from traditional machining to hybrid processes that integrate smart sensors, real-time data analytics, and predictive maintenance capabilities. This transition is transforming production lines, enhancing productivity, accuracy, and machine uptime. Technologies such as digital tool presets, tool life sensors, and automated calibration are rapidly becoming standard. Moreover, automotive and aerospace firms are increasingly turning to multi-axis machining, adaptive feed control, and surface finish enhancers to meet rising demands for product quality and performance.

The Metal Cutting Tools Market is essential to modern manufacturing, serving a broad range of applications in metal fabrication and precision machining. Core tools such as milling tools, drilling tools, tapping tools, reaming tools, and broaching tools are fundamental in shaping and forming metal components across various industries. Supporting technologies like gear cutting, counter-boring tools, grooving tools, and holemaking equipment help improve accuracy and versatility in cutting processes. Material advancements have led to the widespread adoption of high-speed steel (HSS tools), carbide tools, and cutting inserts, each chosen based on material hardness and machining needs. Integration with CNC machines, machining centers, and lathe tools enables high-precision workflows for producing parts in structural metal and fabricated metals. Tool-specific components such as tool holders, drill bits, reamers, taps dies, and specialized heads for face milling, shoulder milling, and high-feed milling are optimized for speed and efficiency.

Segmentation categories:

By Product: Milling tools, Drilling tools, Others

By Application: Automotive, Construction, Aerospace and Defense, Electronics, Others

By Tool Type: Indexable Inserts, Solid Round Tools

Among product segments, milling tools dominate the metal cutting tools market. Valued at USD 2.30 billion in 2019, the segment has seen consistent growth and is expected to lead throughout 2025–2029. Milling tools are widely used across multiple industries for their cost-effectiveness, versatility, and compatibility with high-speed machining. The segment includes end mills, gear cutters, and slitting tools that meet the demands of die and mold manufacturing, as well as EDM electrode fabrication. Analysts point out that the integration of high-efficiency materials such as titanium, high-tensile steels, ceramics, and superalloys is fueling demand for precision-driven, intelligent milling solutions. The increasing use of smart manufacturing systems and Industry 4.0 integration further boosts the appeal of this segment.

Regions Covered:

North America

Europe

APAC

South America

Middle East and Africa

Asia-Pacific (APAC) leads the global metal cutting tools market, contributing 47% to its overall growth between 2025 and 2029. This dominance is attributed to rapid infrastructure development, urbanization, and manufacturing expansion in countries like China, India, and Japan. With governments investing heavily in construction and industrial projects, the demand for machinery, automotive components, and aerospace parts is rising steadily. The region's manufacturers are increasingly adopting intelligent tools, carbide and PCD-based solutions, and CNC systems to meet the growing need for precision and cost efficiency. Analysts observe that despite challenges like labor shortages and supply delays, APAC maintains a high growth outlook due to its scale, resource availability, and manufacturing agility.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

A significant challenge facing the metal cutting tools market is the increasing competition from substitute technologies, particularly Electrochemical Machining (ECM) and Electrical Discharge Machining (EDM). These non-traditional cutting methods allow for precise removal of material without direct contact, making them ideal for hard or brittle materials where conventional cutting fails. ECM and EDM offer benefits such as reduced tool wear and higher material compatibility, particularly in industries like automotive and aerospace. Moreover, the high initial costs of traditional cutting machines, combined with logistics and energy expenses, can hinder adoption among smaller manufacturers. These alternatives pose a challenge to market share, particularly as technological accessibility increases.

Market research shows increasing demand for diverse metal shaping technologies, including turning tools, grinding tools, boring tools, and sawing machines, driven by the rise of customized and complex metal components. Non-traditional cutting methods such as laser cutters, plasma cutters, and water jet systems are also gaining traction due to their precision and ability to cut through hard materials without heat distortion. The influence of additive manufacturing and 3D printing is also notable, complementing traditional metal processing by enabling near-net-shape production before final cutting and finishing. Additionally, sectors like automotive and aerospace rely on tools like press brakes, roll forming, and metal stamping systems for shaping parts at scale. In facilities that handle a mix of forming and joining, welding equipment continues to be essential alongside cutting solutions. The broader adoption of these tools in industrial machinery manufacturing highlights the market's integration into global production supply chains.

Research analysis reveals a trend toward automation, digital integration, and tool material innovation in the metal cutting tools market. As manufacturers seek cost-effective, high-precision, and durable solutions, the demand for hybrid production strategies combining subtractive and additive methods continues to rise. This convergence of technologies positions the metal cutting tools sector as a vital enabler of next-generation industrial productivity.

Leading companies are actively innovating to retain market share in an increasingly competitive environment. For instance, Amada Co. Ltd. introduced the HPSAW 310 Band Saw Machine, engineered for high-precision metal cutting. Major players such as Sandvik AB, FANUC Corp., Mitsubishi Electric, and TRUMPF SE are focusing on integrating digital capabilities, predictive analytics, and high-speed spindles into their tool systems.

Smart tools equipped with vibration-dampening tech, chip evacuation systems, and thermal compensation are reducing tool wear and optimizing cutting performance. Toolpath optimization software, hybrid machining units, and laser-guided systems are enabling manufacturers to cut complex geometries with fewer errors and less downtime. These innovations align with the broader industry trend toward automated, intelligent manufacturing ecosystems.

Furthermore, companies are pursuing strategic partnerships, mergers, and product launches to diversify portfolios and expand their geographic reach. According to market researchers, such strategies allow firms to maintain operational flexibility and respond swiftly to shifting market demands in the post-pandemic recovery phase.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Product

6.1.1 Milling tools

6.1.2 Drilling tools

6.1.3 Others

6.2 Application

6.2.1 Automotive

6.2.2 Construction

6.2.3 Aerospace and defense

6.2.4 Electronics

6.2.5 Others

6.3 Tool Type

6.3.1 Indexable Inserts

6.3.2 Solid Round Tools

6.4 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 Europe

6.4.4 South America

6.4.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted