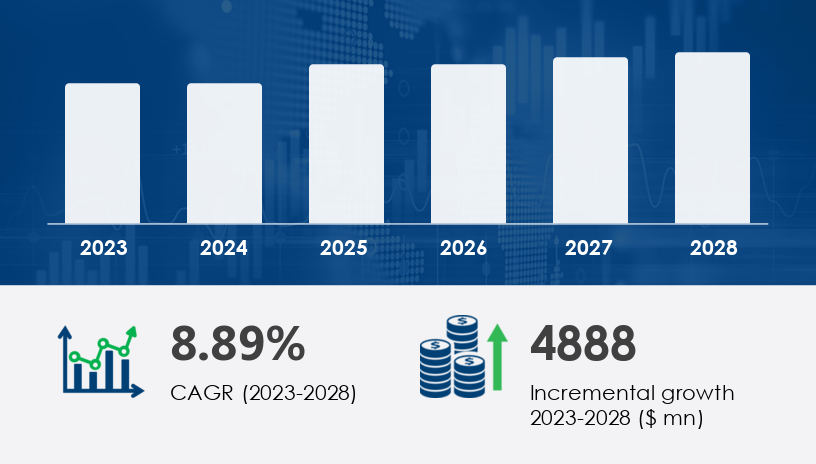

The medical device packaging market in Europe safeguards sterility, ensures integrity, and upholds regulatory standards across a vast range of critical devices—from wound dressings and syringes to surgical instruments and biologics. The Europe medical device packaging market is entering a new phase of expansion, projected to increase by USD 4.89 billion from 2023 to 2028, growing at a CAGR of 8.89%. This surge is more than a market trend—it’s a response to evolving healthcare needs, stricter regulations, and sustainability imperatives.

For more details about the industry, get the PDF sample report for free

The Medical Device Packaging Market is growing steadily due to rising demand for safety, sterility, and sustainability in healthcare. Packaging types like sterile pouches, flexible pouches, blister packs, and clamshell packaging are widely used for storing and transporting devices securely. Specialized formats such as medical trays, folding cartons, and thermoformed trays offer structured containment for delicate equipment. Materials like Tyvek material, medical-grade plastics, polyethylene films, and foil laminates provide durability and resistance, while barrier coatings, moisture barriers, and UV protection ensure device protection throughout the supply chain. Additionally, packaging for specific applications such as implant packaging, syringe packaging, catheter packaging, and orthopedic packaging has seen significant development. Emerging trends also highlight the demand for child-resistant packaging, heat-seal films, and custom packaging tailored for diverse clinical environments.

The competitive landscape features a mix of global giants and specialized innovators. Each player brings unique capabilities in material science, design, and regulatory navigation.

Amcor Plc – Pioneering thermoformed trays and SureForm forming films

Berry Global Inc. – A leader in sustainable flexible packaging for medical use

DuPont de Nemours Inc. – Known for high-performance materials with barrier properties

Oliver Healthcare Packaging Co. – Specializes in sterile barrier systems

Nelipak Corp. – Offers custom-designed medical thermoform trays

Other notable players include Sonoco Products Co., Constantia Flexibles, Gerresheimer AG, and RENOLIT SE, many of which are doubling down on sustainability and smart packaging technologies like RFID and near-field communication (NFC).

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Sterile packaging dominates the market due to its critical role in maintaining hygiene and preventing infection. Single-use medical devices—catheters, syringes, insulin pens, scalpels—are especially reliant on this packaging format.

Common formats: Pouches, clamshells, trays

Sterilization methods: Autoclave, gamma irradiation, ethylene oxide

Market focus: Infection prevention and extended shelf life

Used primarily for secondary packaging and transportation. Though it plays a supporting role, it’s still essential for maintaining physical protection and presentation.

Pouches – Most commonly used; flexible, sealable, and easy to sterilize

Trays – Rigid formats for surgical kits and instrument sets

Clamshells – Ideal for implantables and high-value devices

Others – Includes paper-based wraps, barrier films, and blister packs

As Europe shifts toward disposable medical devices, the demand for flexible packaging such as pouches and films is soaring. These formats offer:

Lightweight transport

Simplified sterilization

Enhanced sustainability with compostable options

Use cases include:

Dialysis disconnect caps

Surgical instruments

Wound dressings

Environmental pressure is reshaping the industry. The rise of biodegradable plastics, recycled materials, and low-impact barrier films signals a shift from functionality alone to eco-conscious design.

Bioplastics and recyclable laminates are becoming mainstream

Packaging strategies must now meet both regulatory and environmental benchmarks

Europe’s medical device packaging demand is directly tied to its aging population and a rise in chronic conditions:

Countries like Germany, Sweden, and the UK have over 20% of their population aged 60+

Rising rates of diabetes, obesity, hypertension, and cardiovascular issues require long-term medical devices and consumables

Packaging is critical to maintain sterility and efficacy of these devices during extended use or repeated distribution.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Europe’s medical powerhouse, Germany leads in device production and packaging innovation. Strict regulatory compliance and advanced logistics infrastructure bolster the market here.

Post-Brexit, the UK is aligning its packaging standards closer to EU norms while fostering growth in contract packaging and sustainable formats.

France emphasizes eco-friendly healthcare practices. The demand for biodegradable pouches and sustainable clamshells is high, especially in public hospitals and clinics.

The European Medical Device Regulation (MDR) mandates strict quality controls for both primary and secondary packaging. Manufacturers must:

Validate microbial barrier properties

Perform rigorous shelf life and sterility testing

Ensure compliance with sustainability laws and FDA guidelines

As biologics gain traction, cold chain packaging has become vital. These sensitive materials require temperature-stable packaging to preserve effectiveness throughout storage and transport.

Specialized barrier films

Real-time monitoring sensors

Advanced insulating materials

Get more details by ordering the complete report

Companies are reshaping their market strategies through:

Mergers & acquisitions to access niche technologies

Partnerships with logistics and automation firms

Geographical expansion to meet regional compliance

A diverse range of players from category-focused innovators to diversified healthcare conglomerates ensures that no one-size-fits-all approach dominates.

In-depth analysis of the Medical Device Packaging Market reveals strong emphasis on innovation and safety compliance. Technologies like tamper-evident seals, antimicrobial coatings, and smart packaging are increasingly adopted to enhance product integrity and patient safety. Tools such as RFID tags, QR codes, and labeling systems enable better traceability and inventory management. The market also focuses on anti-counterfeit features to reduce fraud and ensure brand protection. Environmentally friendly options such as recyclable packaging, sustainable materials, and biocompatible materials are gaining traction due to regulatory and consumer pressures. Packaging for diagnostic kits, surgical packaging, and sterile packaging often involves peelable lids, vacuum packaging, and gas flushing to maintain sterility. Additional needs like sterilization pouches, medical bags, sealed containers, and cleanroom packaging are addressed with high-quality, compliant solutions tailored to support complex healthcare logistics.

Safe and Secure SSL Encrypted