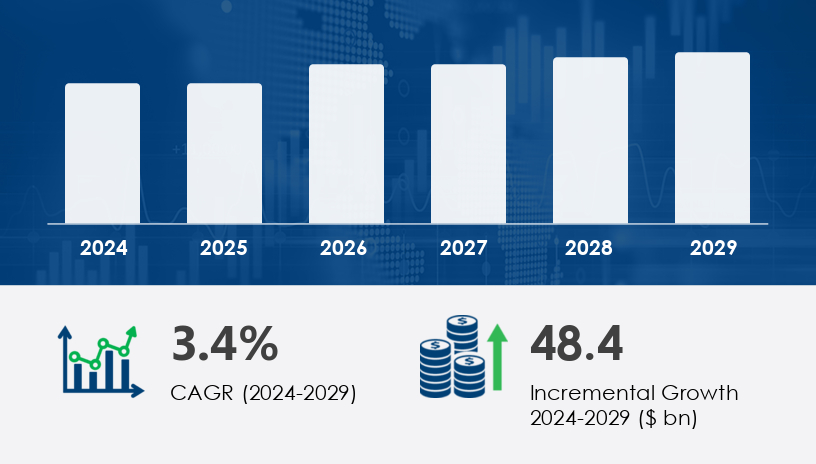

The Europe logistics market is on a steady growth path, projected to increase by USD 48.4 billion between 2024 and 2029, expanding at a CAGR of 3.4%. With digital transformation accelerating across industries, the logistics sector is witnessing a paradigm shift, especially in how companies manage, monitor, and optimize the movement of goods. For more details about the industry, get the PDF sample report for free

At the heart of this expansion is Europe’s booming e-commerce industry, a primary force driving demand for agile and resilient logistics systems. Road transport continues to dominate, playing a critical role in ensuring timely deliveries for online purchases. However, technology integration is becoming equally pivotal. Artificial Intelligence (AI), the Internet of Things (IoT), and Blockchain are transforming logistics operations by improving transparency, route optimization, and operational efficiency.

Additionally, green logistics solutions are reshaping industry priorities. Companies are now focused on reducing their carbon footprint by adopting sustainable practices, including the use of sensor technologies, eco-friendly vehicles, and warehouse energy optimization. These shifts are aligned with broader climate goals and public policy across the continent.

A growing trend is the transition toward customer-centric logistics. Predictive analytics, enabled by AI and real-time data from IoT devices, helps anticipate demand, reduce delivery times, and enhance customer satisfaction. Multi-modal systems—integrating roadways, railways, airways, and waterways—are being leveraged to optimize delivery times and reduce costs.

Warehouse automation, use of augmented reality (AR), and real-time logistics monitoring systems are helping businesses maintain control over inbound, outbound, and reverse logistics processes. This is particularly evident in sectors like defense manufacturing, petroleum, and food products, where time-sensitive and secure transport is vital.

The Third-Party Logistics (3PL) segment is expected to see significant growth through 2029. 3PL providers offer varying models—asset-based, management-based, and integrated services—allowing businesses to outsource operations, reduce costs, and scale logistics capabilities.

Asset-based 3PL firms manage fleets and warehouses, while management-based providers focus on strategy and coordination. Integrated providers combine both, delivering end-to-end solutions. These models are increasingly favored by companies aiming to enhance supply chain efficiency.

Others,

Key industries leveraging logistics services include:

Manufacturing

Automotive

Consumer Goods

Retail Industry

Others

Each of these sectors relies on tailored logistics strategies to meet their unique supply chain demands, from just-in-time deliveries in automotive to complex reverse logistics in consumer goods.

Logistics services are further categorized into:

Transportation

Warehousing and Distribution

Freight Forwarding

Inventory Management

Value-added Logistics

Integration & Consulting

Of these, transportation and warehousing form the backbone of logistics operations, while inventory management and consulting services are gaining prominence for their role in strategic planning and cost optimization.

Roadways – continue to lead, especially for short-haul and last-mile delivery

Waterways – gaining popularity due to cost-effectiveness and sustainability for heavy goods

Airways – essential for time-sensitive, high-value shipments

Railways – suitable for bulk transportation across long distances

The shift toward multi-modal systems highlights the importance of flexibility and sustainability in modern logistics.

Get more details by ordering the complete report

The logistics market is experiencing growth across major European economies, including:

Germany

UK

France

These countries are at the forefront of logistics innovation, driven by strong infrastructure, advanced digital ecosystems, and high consumer expectations. Germany continues to serve as Europe’s logistics hub, while the UK and France are leveraging their strategic locations and trade agreements to optimize cross-border operations.

Despite the growth prospects, the sector faces critical challenges:

High operational costs: These are exacerbated by rising fuel prices, labor shortages, and the cost of maintaining advanced logistics infrastructure.

Competitive pricing pressure: Logistics providers are under constant pressure to offer low-cost solutions, which can hinder investments in innovation and sustainability.

Companies must balance cost-efficiency with service excellence, often through strategic outsourcing and digital transformation.

For more details about the industry, get the PDF sample report for free

The Europe Logistics Market is witnessing rapid evolution driven by advancements in last-mile delivery, e-commerce logistics, and the growing emphasis on green logistics. Companies are investing in logistics automation and enhancing supply chain visibility to meet increasing customer expectations. Rising demand for parcel delivery has encouraged the development of multi-modal systems and advanced logistics monitoring capabilities. Innovative trends like blockchain logistics, IoT logistics, and AR logistics are transforming operational efficiency. Additionally, reverse logistics and military logistics are playing vital roles in specialized sectors. The ongoing digital transformation of the industry is driving supply chain optimization, while tech-driven logistics is enabling more customer-centric logistics experiences across roadway logistics, waterway logistics, and air freight logistics networks.

Several prominent companies are shaping the competitive landscape with strategic partnerships, mergers, and service innovations:

AP Moller Maersk AS – Offering specialized services including Maersk Project Logistics and Cold Chain Logistics

BDP International Inc.

Bertelsmann SE and Co. KGaA

Bollore SE

C H Robinson Worldwide Inc.

CEVA Logistics SA

Deutsche Bahn AG

Deutsche Post AG

DSV AS

Expeditors International of Washington Inc.

FedEx Corp.

Hellmann Worldwide Logistics SE and Co KG

International Distributions Services plc

Kintetsu World Express Inc.

Kuehne Nagel Management AG

Nippon Yusen Kabushiki Kaisha

Rhenus SE and Co. KG

SDK FREJA A S

SF Express Co. Ltd.

XPO Inc.

These firms are adopting hybrid models that combine physical logistics infrastructure with AI-driven analytics, enabling smarter and faster decision-making across the value chain.

Get more details by ordering the complete report

Detailed analysis of the Europe Logistics Market reveals a surge in demand for comprehensive services such as courier services, customs brokerage, and real-time tracking. Emphasis on sustainability is leading to innovations in sustainable pallets, with a growing shift from wooden pallets to plastic pallets, metal pallets, and industrial pallets, supported by efficient pallet pooling systems. Technologies like RFID technology, robust inventory management, and warehouse automation are enhancing logistics workflows. Emerging models such as on-demand delivery, urban logistics, and cross-border e-commerce are reshaping traditional practices. The hub-and-spoke model, crowd shipping, and delivery lockers are becoming integral to B2C logistics, supported by improved logistics infrastructure, cold chain logistics, freight forwarding, and contract logistics services. Altogether, these developments underscore the emergence of smart logistics in a competitive and digitally integrated European supply chain ecosystem.

With 2024 as the base year, companies are aligning strategies with an emphasis on:

Digital logistics innovation

Multi-modal transport integration

Green logistics adoption

Customer-centric service delivery

Through strategic alliances, M&A activity, and geographical expansion, leading logistics providers are aiming to capture a larger share of this USD 48.4 billion opportunity, transforming logistics into a competitive differentiator in Europe’s B2B landscape.

Safe and Secure SSL Encrypted