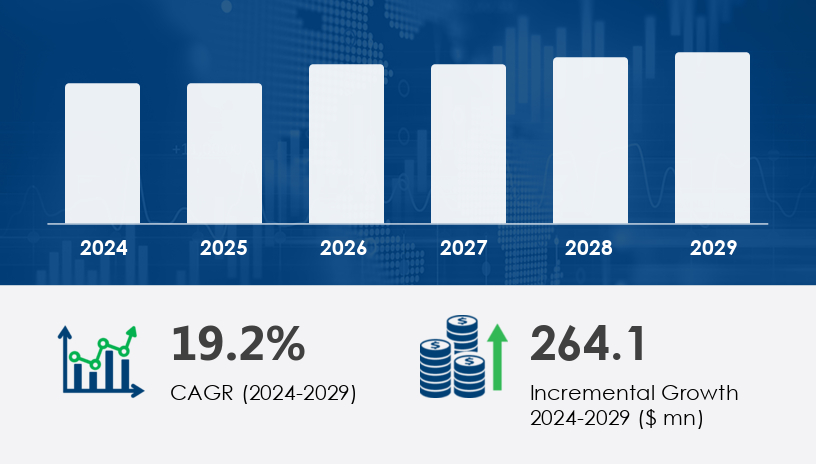

The Light-Emitting Diode (LED) market is poised for rapid expansion, projected to grow by USD 264.1 million between 2024 and 2029 at a compound annual growth rate (CAGR) of 19.2%. This strong momentum is fueled by the widespread transition from conventional lighting technologies to energy-efficient LED solutions across commercial, residential, and industrial sectors.

For more details about the industry, get the PDF sample report for free

A primary driver accelerating growth in the Light-Emitting Diode (LED) market is the rising global demand for energy-efficient lighting solutions. Lighting accounts for approximately 20% of worldwide electricity consumption, prompting governments to implement regulations that restrict or ban traditional incandescent bulbs. In response, consumers and enterprises are turning to LEDs, which consume up to 75% less energy and last 25 times longer than incandescent alternatives. This shift is further supported by global efforts to reduce carbon footprints and achieve long-term energy savings, making LED lighting a compelling, sustainable alternative for both public and private sectors.

A leading trend shaping the Light-Emitting Diode (LED) market is the growing adoption of intelligent lighting systems. These digitally integrated systems use IoT and AI technologies to offer dynamic, energy-optimized lighting environments. Key features include occupancy sensing, daylight harvesting, and wireless controls, allowing users to customize light levels and reduce energy costs automatically. This is particularly advantageous in commercial buildings, where adaptable lighting systems can enhance efficiency and user experience. As innovation continues, intelligent LED lighting is becoming indispensable in infrastructure projects, further broadening LED applications in signage, horticultural grow lights, backlighting, and floodlighting.

The Light-Emitting Diode (LED) Market has become a pivotal segment in global lighting innovation, driven by the rising adoption of energy-efficient LEDs and advanced smart lighting systems. Core products include LED bulbs, LED tubes, LED fixtures, and LED lamps, all of which are transforming both residential lighting and commercial lighting environments. Applications span across general lighting, automotive lighting, and backlighting, with specialized formats such as RGB LEDs, flexible LEDs, and high-power LEDs addressing various design and performance needs. In industrial and urban contexts, street lighting, floodlights, and LED panels are gaining ground due to their durability and cost savings. Meanwhile, niche sectors benefit from LED strips, LED luminaires, LED downlights, and LED modules, all contributing to diverse lighting solutions. Material innovations involving gallium nitride and silicon carbide are enhancing LED efficiency and lifespan. The expansion of indoor lighting, outdoor lighting, and industrial lighting continues to fuel global demand for scalable and sustainable lighting systems.

Product:

Luminaires

Lamps

Application:

General lighting

Automotive lighting

Backlight

Others

Distribution Channel:

Offline

Online

Type:

SMD LEDs

High-power LEDs

Through-hole LEDs

RGB LEDs

Others

Among all segments, luminaires lead in growth and market share during the forecast period. Valued at USD 76.90 million in 2019, the segment continues to expand due to high demand across residential, office, retail, and industrial settings. LED luminaires, including downlights, roadway fixtures, and outdoor lighting, offer superior energy savings and minimal maintenance, outperforming traditional lighting technologies like incandescent and fluorescent fixtures. Analysts highlight that luminaires are preferred for their longer lifespan and elimination of external ballast requirements, aligning with sustainability goals and cost-efficiency strategies.

Covered regions:

APAC (China, India, Japan, South Korea)

Europe (France, Germany, Italy, UK)

North America (US, Canada)

South America (Brazil)

Middle East and Africa (UAE)

APAC is projected to account for 54% of the global LED market growth from 2025 to 2029, making it the top-performing region. This dominance is attributed to the surge in demand for energy-efficient lighting across residential and commercial sectors. The region is experiencing a boom in industries such as retail, hospitality, and healthcare, and multinational companies are increasingly establishing regional offices. Additionally, governments in APAC are investing heavily in smart infrastructure and construction projects, further driving LED adoption. Analysts note that APAC’s expanding IT infrastructure and focus on urban sustainability make it an ideal market for LED displays, signage, panels, tubes, and street lights.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Despite its advantages, a persistent challenge in the Light-Emitting Diode (LED) market is the high average cost per fixture. Although the average selling prices (ASPs) for LED products have declined, upfront installation remains expensive. Costs include not only the LED fixtures themselves but also associated wiring and labor, especially in older buildings that may require electrical system upgrades for compatibility. This cost barrier limits broader market penetration, particularly in price-sensitive markets, despite long-term savings from energy efficiency and reduced maintenance. As a result, companies must balance innovation with affordability to drive mass adoption.

Research indicates a strong upward trend in the adoption of integrated technologies such as IoT lighting, connected lighting, and smart controls, which enable wireless connectivity and real-time system management. Innovations like tunable LEDs, human-centric lighting, and Li-Fi technology are reshaping how users interact with lighting environments, focusing on wellness, adaptability, and high-speed data transmission. The market is also witnessing a surge in LED retrofitting, allowing older systems to be upgraded without full replacement. In digital and signage segments, products like LED displays, LED signage, and LED optics are widely used for advertising and information systems. Other high-growth areas include horticulture lighting and grow lights, where LEDs support efficient plant development. Performance factors such as color rendering and LED drivers are critical in optimizing light quality and stability. Additionally, product development is responding to increased demand for LED efficiency and durability in both consumer and professional applications.

In-depth analysis of the LED market shows a strong convergence of energy savings, digital integration, and enhanced user experience. As smart cities and sustainable infrastructure expand, LED technologies are expected to remain at the forefront of innovation. Continued investment in advanced materials, intelligent controls, and multifunctional lighting will drive competitive differentiation and long-term growth across global markets.

Companies in the Light-Emitting Diode (LED) market are actively deploying strategies such as new product launches, geographic expansion, and mergers and acquisitions to strengthen market presence. Analysts emphasize that staying aligned with consumer demand for energy-efficient and smart solutions will be critical for companies aiming to thrive in this fast-evolving industry.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Product

6.1.2 Luminaires

6.1.3 Lamps

6.2 Application

6.2.1 General lighting

6.2.2 Automotive lighting

6.2.3 Backlight

6.2.4 Others

6.3 Distribution Channel

6.3.1 Offline

6.3.2 Online

6.4 Type

6.4.1 SMD LEDs

6.4.2 High-power LEDs

6.4.3 Through-hole LEDs

6.4.4 RGB LEDs

6.4.5 Others

6.5 Geography

6.5.1 North America

6.5.2 APAC

6.5.3 Europe

6.5.4 South America

6.5.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted