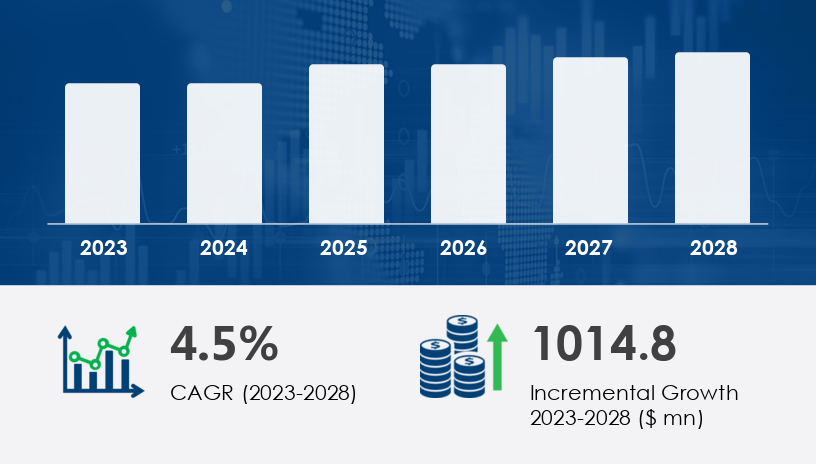

In 2024, the IVF devices and consumables market stands on the edge of its most transformative decade yet. As fertility rates decline and more individuals delay parenthood, IVF is no longer a niche procedure—it’s a mainstream medical solution. With an expected increase of USD 1.01 billion between 2024 and 2028, growing at a CAGR of 4.5%, this market is being shaped by new reproductive technologies, expanding access, and rising global awareness.

“IVF is no longer just a procedure—it’s a system of personalized, tech-augmented care,” notes a fertility technology strategist. The next-gen IVF landscape will center on affordability, automation, and precision—all geared toward improving patient outcomes and clinic performance.

For more details about the industry, get the PDF sample report for free

Legacy Disruption: IVF success was once highly dependent on clinician skill and limited media formulations that lacked customization for embryo viability and patient variability.

New Strategy Emerging: Clinics now demand high-performance, protein-supplemented reagents tailored for individual fertility profiles. From sperm prep to embryo transfer, every step is being optimized through biocompatible media, continuous culture systems, and amino acid enriched buffers.

Analyst Insight: “Culture media innovation is a silent engine of IVF success, and it's evolving with personalized supplements and smart batch monitoring systems.”

Business Case: By 2023, Indira IVF expanded its reagent R&D lab, launching a proprietary Triple-Phase Media Kit that boosted embryo viability rates by 18% in trials across India.

Stats:

Culture media and reagents segment was valued at USD 1.53 billion in 2018, continuing its upward trajectory through 2028.

Segment growth is driven by advanced reproductive technologies such as ICSI and IVM.

Legacy Disruption: IVF instruments such as micromanipulators and cryosystems operated in silos, lacked interoperability, and were capital-intensive with minimal digital capabilities.

New Strategy Emerging: The sector now sees convergence—AI-integrated incubators, robotic ovum aspiration pumps, and real-time embryo monitoring systems have redefined lab productivity and accuracy.

Analyst Insight: “We're moving from manually intensive IVF cycles to automation-assisted, precision-controlled protocols.”

Business Case: In 2024, Thermo Fisher launched the NovaScope IncuVision™, a smart incubator with continuous, non-invasive imaging—used across 150 clinics in Europe to boost success rates by up to 12%.

Stats:

Instruments and devices now feature AI, automation, and data syncing.

Device innovation is critical as IVF cycles grow in complexity and scale.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Legacy Disruption: Often overlooked, disposables were seen as secondary, standardized supplies with low innovation and high replacement costs.

New Strategy Emerging: In 2024, the focus has shifted to custom-designed, biodegradable disposables—embryo-safe plastics, ergonomic transfer catheters, and traceable tubes ensure patient safety and reduce lab waste.

Analyst Insight: “Disposables are becoming intelligent tools with traceability, quality consistency, and environmental compliance built in.”

Business Case: Shivani Scientific Industries began offering eco-certified transfer sets in early 2024, cutting material waste by 30% in Indian IVF labs while maintaining sterility standards.

Stats:

Accessories and disposables are essential across all IVF stages, from retrieval to transfer.

Their innovation supports efficiency and sustainability in high-throughput clinics.

As more women choose to delay childbirth, particularly in urban centers, the demand for IVF has surged globally. Rising maternal age correlates with declining fertility, fueling the need for more robust, AI-supported IVF interventions.

Artificial intelligence is transforming embryo grading, monitoring, and cycle planning. From AI-powered cryosystems to predictive ovum quality analytics, IVF labs are integrating smart systems to reduce variability and enhance precision.

The high cost of IVF remains a barrier—but governments and private insurers are beginning to fund treatments, particularly in Asia and parts of Europe. This will accelerate mainstream IVF access and reduce socioeconomic bias.

The IVF Devices and Consumables Market is expanding rapidly due to increasing infertility rates, rising awareness, and technological advances in assisted reproductive techniques. A key segment includes devices such as IVF catheters, IVF needles, IVF syringes, IVF pipettes, and IVF workstations, which play a critical role in procedures like oocyte retrieval, sperm preparation, and embryo transfer. Supporting processes include oocyte aspiration, sperm collection, and semen analysis, with precise tools such as micromanipulation tools, IVF microscopes, and IVF lasers enhancing procedural accuracy. IVF incubators, IVF chambers, and culture media are vital for maintaining ideal growth environments, while culture dishes and IVF reagents aid in successful embryo culture. As fertility clinics strive for improved success rates, demand continues to rise for embryo transfer catheters and IVF disposables, all underpinned by increased focus on advanced ovulation induction protocols and gamete handling techniques.

AI-Designed IVF Protocols

Predictive analytics will guide clinicians in customizing stimulation, insemination timing, and embryo transfer—maximizing individual success rates.

Biodegradable, Smart Disposables

Sustainability concerns will push labs to adopt green-certified catheters, tubes, and pipettes embedded with usage tracking.

Integrated Fertility Platforms

Expect a rise in full-service fertility software suites integrating genetics, lab operations, and patient engagement in a single AI platform.

Company Example: In 2024, Vitrolife AB launched IVFLink™, a cloud-based fertility management platform designed to unify embryology data, patient profiles, and equipment feedback loops—revolutionizing how clinics track and optimize success metrics.

Will fertility clinics evolve into AI-powered centers of reproductive diagnostics and care—or remain limited by procedural fragmentation?

Invest in Precision Consumables

Elevate IVF success rates by sourcing culture media and reagents tailored for patient-specific embryo culture conditions.

Adopt AI-Driven Cycle Management

Implement AI-driven inventory optimization for IVF labs to streamline resource usage and predict clinical needs.

Prioritize Affordability in Product Design

Focus on scalable, cost-effective devices to support wider access to fertility treatments, especially in emerging markets.

Support Compliance and Ethical Transparency

Align with Human Fertilisation and Embryology Authority (HFEA) standards for IVF compliance and device regulation.

Drive Sustainable Lab Practices

Shift toward eco-certified IVF accessories and disposables to future-proof operations and reduce environmental impact.

Get more details by ordering the complete report

Current research in the IVF Devices and Consumables Market focuses on the safety, efficiency, and innovation of consumables used in cryogenic preservation and embryo assessment. Key areas include cryopreservation systems, cryogenic tanks, freezing vials, cryo straws, and cryoprotectants, which support long-term embryo storage, oocyte storage, and sperm freezing. Precision techniques such as embryo freezing, embryo thawing, embryo biopsy, and embryo grading are becoming increasingly critical for successful outcomes. Enhanced methods like oocyte freezing, sperm washing, sperm separation, and sperm injection are under constant refinement to improve sperm motility and fertilization efficiency. Advances in embryo incubators and laboratory conditions are helping to optimize conditions for gamete and embryo viability. Overall, these innovations are elevating the standard of IVF by enabling more consistent results through improved oocyte handling and robust cryostorage systems.

The IVF devices and consumables market is moving beyond a purely clinical model—into a human-centered, tech-enabled, and globally inclusive system of care. As we head toward 2028, expect innovation not only in devices but in the very delivery and design of fertility care.

Are we thinking big enough about what IVF can become—not just as a medical service, but as a transformative health infrastructure?

Access our Full 2024–2028 Playbook to lead your market transformation.

Safe and Secure SSL Encrypted