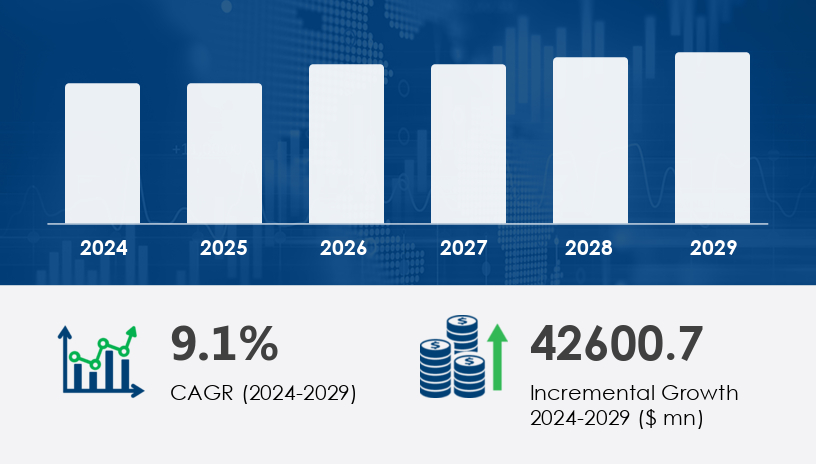

The Southeast Asia IT spending market is poised to surge by USD 42.6 billion between 2025 and 2029, marking a robust CAGR of 9.1%. This remarkable growth trajectory is underpinned by digital transformation initiatives, growing enterprise mobility, and increased adoption of artificial intelligence, blockchain, and IoT solutions. As businesses across verticals seek competitive advantages, the region's IT ecosystem is fast evolving into a cornerstone for operational innovation and data-driven decision-making.For more details about the industry, get the PDF sample report for free

The Southeast Asia IT landscape is undergoing a paradigm shift, driven by surging demand for mobility solutions aimed at bolstering enterprise productivity and flexibility. Businesses—especially SMEs—are increasingly leveraging IT services to modernize operations and elevate customer engagement. Concurrently, the financial sector is prioritizing technology investments to ensure regulatory compliance and effective data synthesis.

A strong demand for cybersecurity services has also emerged, spurred by the proliferation of data and escalating cyber threats. Outsourcing, IoT integration, and cloud adoption are reinforcing the market’s momentum. Companies across B2B, B2C, and B2G domains are recalibrating their technology infrastructure to align with the evolving digital environment. Meanwhile, IT associations are enhancing company selection methodologies and facilitating dependable, data-driven strategies for IT investments.

The most transformative trend reshaping the Southeast Asia IT spending market is the accelerated adoption of big data and analytics services. Businesses are increasingly seeking predictive analytics tools to interpret unstructured data and extract actionable insights, especially in sectors like telecommunications, finance, and tourism.

Moreover, the integration of artificial intelligence and blockchain is expanding across industries, reinforcing digital capabilities and streamlining operations. SMEs are ramping up their spending on mobility and IoT technologies, recognizing their potential to deliver measurable operational efficiencies. As a result, IT spending on hardware, services, and software is projected to witness a significant uptrend over the forecast period.

Despite strong growth prospects, the market faces critical challenges, particularly in acquiring and retaining skilled IT talent. High attrition rates and globalization-induced disruptions have weakened regional talent pipelines. This shortage is particularly acute in outsourcing hubs such as Malaysia, where businesses are grappling with talent retention issues that threaten the continuity of IT transformation initiatives.

Enterprises are under pressure to invest in training programs and employee development to maintain their competitive edge. The challenge of talent retention, coupled with increasing complexity in IT ecosystems, underscores the urgent need for strategic workforce planning and partnerships with academic institutions and IT associations.

The Southeast Asia IT spending market spans multiple countries with varied levels of technological maturity and investment:

Singapore

Malaysia

Thailand

Indonesia

Rest of Southeast Asia

These markets are experiencing varied degrees of IT adoption, but all are united by the overarching trend of digital transformation and the integration of next-gen technologies.

Get more details by ordering the complete report

Business or Organizations: This is the dominant segment, encompassing SMEs and large enterprises across industries such as healthcare, retail, and finance. Businesses are embracing IT to automate workflows, enhance security, and deliver omnichannel customer experiences.

Consumers: While less dominant, this segment reflects growing digital consumer behavior and rising expectations around connectivity and personalized services.

Hardware

Services

Software

These categories reflect the core components of IT infrastructure, with services and software increasingly taking precedence due to their scalability and adaptability.

BFSI

IT and Telecom

Healthcare

Retail and E-commerce

Others

The financial sector stands out as a leading contributor, leveraging IT services for compliance, data security, and operational intelligence. Tourism and hospitality are also making significant IT investments to enhance service delivery and customer personalization.

Large Enterprises

SMEs

While large enterprises have historically led IT investment, SMEs are catching up quickly, particularly in their adoption of cloud-based solutions, mobility services, and analytics platforms.

The Southeast Asia IT spending market is witnessing rapid evolution, driven by digital transformation strategies that emphasize knowledge graph integration and semantic search for optimized data handling. Companies are investing in SEO-centric infrastructures that support elements like meta tags, canonical URL, and schema markup to improve search intent alignment and content relevance. Emphasis is placed on building content clusters to enhance topic authority and entity extraction, enabling stronger semantic network structures. As part of digital marketing strategies, organizations are enhancing domain authority through natural link acquisition, managing keyword density, and crafting content with precise entity relationships to improve content depth and user intent targeting. This focus helps brands better rank for both long-tail keyword and short-tail keyword searches, thus boosting organic traffic and increasing chances of appearing in featured snippets and SERP features

For more details about the industry, get the PDF sample report for free

A robust ecosystem of global and regional IT firms is fueling the Southeast Asia IT spending market. Companies are actively engaging in mergers, acquisitions, geographic expansion, and strategic alliances to gain market share and serve diverse business needs. Key players include:

Accenture PLC

Acer Inc.

Alphabet Inc.

Apple Inc.

ASUSTeK Computer Inc.

Broadcom Inc.

Capgemini Services SAS

Cisco Systems Inc.

Cognizant Technology Solutions Corp.

Dell Technologies Inc.

HCL Technologies Ltd.

Hewlett Packard Enterprise Co.

Infosys Ltd.

International Business Machines Corp.

Lenovo Group Ltd.

Microsoft Corp.

Oracle Corp.

Samsung Electronics Co. Ltd.

SAP SE

Tata Consultancy Services Ltd.

These companies are categorized based on qualitative and quantitative assessments that evaluate their business focus and market influence—ranging from dominant to tentative players.

In-depth analysis of IT spending trends in Southeast Asia reveals strategic prioritization of digital assets that improve conversion rate, click-through rate, and bounce rate, ensuring seamless user experience across platforms. Key tactics include internal linking and external linking to enhance link juice distribution, supported by optimized anchor text and alt text implementations. Organizations are increasingly utilizing structured data to power rich snippets, aligning efforts with high search volume keywords while minimizing keyword difficulty barriers. Performance enhancements such as page speed and mobile optimization directly influence dwell time and quality score, reinforcing content authority. Moreover, digital teams are focusing on local citation strategies and voice search readiness to cater to evolving user behavior. Rising importance of social signals and topical relevance further influences how brands establish digital trust and visibility in the region’s competitive online ecosystem.

Get more details by ordering the complete report

Safe and Secure SSL Encrypted