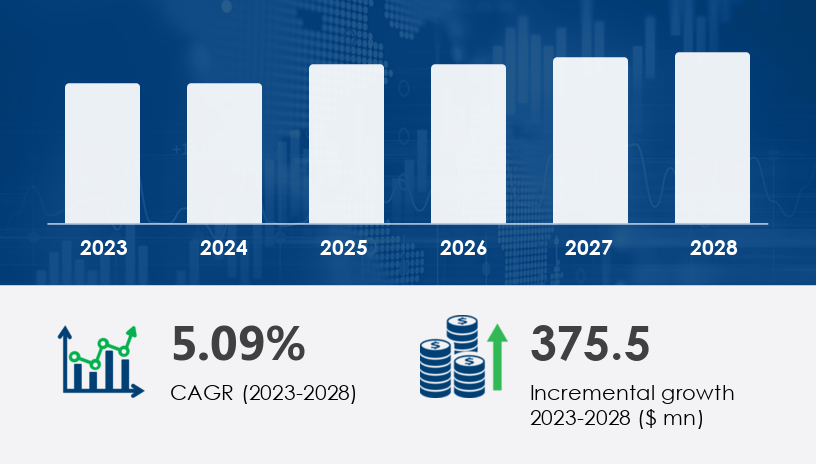

The global isobutanol market is poised to expand by USD 375.5 million between 2024 and 2028, achieving a steady CAGR of 5.09%, driven by its rising use as a green alternative in fuel, coatings, and adhesives.In this 2025 Outlook and Comprehensive Guide, we dive deep into the strategic growth drivers, regional market dynamics, competitive landscapes, and technological roadblocks shaping the future of the isobutanol market. From its expanding role in biofuel development to its critical usage in the automotive and textile sectors, isobutanol is emerging as a linchpin chemical in the shift towards sustainability.

For more details about the industry, get the PDF sample report for free

"Isobutanol represents the ideal blend of performance and environmental responsibility. As industries shift toward greener alternatives, isobutanol’s dual utility as a solvent and chemical intermediate places it at the forefront of innovation."

— says Senior Technavio Expert

The demand for eco-friendly alternatives to petroleum-based chemicals is not a passing trend. It’s a structural shift, and isobutanol — a four-carbon alcohol derived from both bio-based and synthetic sources — is riding that wave

Isobutanol (C₄H₁₀O) is a versatile alcohol with widespread applications as a solvent and intermediate. Its high energy density and chemical stability make it suitable for producing acrylates, adhesives, resins, and even biofuels. Produced via fermentation or petrochemical synthesis, it plays a central role in renewable fuel technology and VOC-compliant coatings.

The solvent segment was valued at USD 488.60 million in 2018 and continues to dominate due to isobutanol’s use in high-performance coatings across automotive, aerospace, architectural, and industrial sectors.

Used in the production of butyl acrylates and esters, key ingredients in adhesives and sealants.

Isobutanol functions as a solvent for dyes and finishing agents, especially in eco-conscious textile manufacturing hubs like India and China.

Includes de-icing fluids and plastics — critical for aerospace and packaging industries.

Gaining traction for its reduced carbon footprint. It aligns with the circular economy and regulatory mandates on VOC emissions.

Still dominant due to established supply chains and cost advantages, especially in heavy industrial applications.

Driven by the US automotive and aerospace sectors, along with stringent VOC regulations from the EPA.

The epicenter of industrial growth. Countries like China and India are key due to rising urbanization, automotive production, and chemical manufacturing.

Focus on sustainability and EU-level chemical compliance standards fuels adoption of bio-based isobutanol.

Growing demand in coatings for infrastructure and packaging applications.

Emerging demand in textiles and food packaging, with Brazil leading the way in biofuel innovation.

Get more details by ordering the complete report

The Isobutanol Market is experiencing significant growth due to its diverse applications across various industries, including automotive, pharmaceuticals, and chemicals. Isobutanol is primarily used as a chemical intermediate in the production of isobutyl acetate, a key solvent used in automotive coatings, ink formulations, and paint thinners. The increasing demand for biofuel additives and fuel oxygenates has led to a rise in the production of bio-isobutanol as a renewable fuel alternative to traditional petroleum-based fuels. In addition to its role as an ethanol alternative and gasoline blend component, Isobutanol is gaining prominence in aviation fuel and marine fuel markets due to its ability to enhance fuel efficiency and reduce emissions. As a plasticizer compound and polymer solvent, Isobutanol is also used in the production of synthetic rubber, butyl rubber, and plastic additives, further expanding its industrial applications.

Automotive paints and coatings are increasingly relying on isobutanol for better adhesion, gloss, and chemical resistance. The move toward electric vehicles (EVs) is further enhancing demand for eco-compliant coatings, where isobutanol excels.

Governments and industries are targeting zero-VOC or low-emission production, pushing manufacturers toward isobutanol as a greener solvent. Regulations in California and the EU are particularly influential.

Rapid growth in India, Brazil, and Southeast Asia is creating massive demand for chemical intermediates and solvents. Outsourcing strategies by global OEMs have also boosted regional consumption.

For more details about the industry, get the PDF sample report for free

Bio-based isobutanol will see increased investments as sustainability becomes a procurement requirement.

The solvent segment will remain the backbone of the market, thanks to widespread use in paints and inks.

Asia Pacific is not just a production hub; it's a massive end-user market in its own right.

VOC compliance and environmental regulations will play a central role in product development and sourcing.

Scaling bio-based isobutanol production remains costly and technically demanding. Feedstock variability and fermentation inefficiencies are core challenges.

Stringent VOC and REACH regulations can increase compliance costs and restrict product portfolios, especially in adhesives and sealants.

Despite its green credentials, isobutanol still poses risks if mishandled. Safe storage, use protocols, and waste disposal are crucial.

Get more details by ordering the complete report

Dow Inc., one of the key market players, has expanded its Verbund production sites to include dedicated facilities for isobutanol-based coating intermediates. These strategic moves aim to meet the surging demand in APAC and North America while ensuring VOC-compliant production. Their investment in bio-based isobutanol capacity illustrates the market’s long-term pivot toward renewable chemistry.

By 2028, expect bio-based isobutanol to account for a significantly larger share of the total market, especially in developed economies where regulatory compliance is strict. Furthermore, isobutanol could play a pivotal role in aviation biofuels, especially for de-icing applications and carbon-offset programs in aerospace.

Companies exploring fuel-blend applications and high-performance adhesives should prioritize strategic sourcing of isobutanol to future-proof their portfolios.

In-depth analysis of the Isobutanol Market reveals a growing demand for solvent cleaners, adhesive removers, and textile chemicals, driven by its effectiveness as an industrial solvent. The market is witnessing an increase in the use of Isobutanol as a pharmaceutical solvent and cosmetic solvent, where it is utilized in the formulation of fragrance carriers and herbicide carriers for agricultural applications. Additionally, Isobutanol plays a critical role in ester synthesis, acting as a precursor to various esters such as isobutyl acetate and resin solvents. With the rise of environmentally conscious consumers, bio-isobutanol is increasingly being promoted as an eco-friendly alternative in cleaning agents, lubricant additives, and hydraulic fluids. The increasing trend toward renewable fuels and sustainable chemicals is expected to further boost the demand for Isobutanol in sectors like adhesive solvents, sealant removers, and industrial solvents, positioning Isobutanol as a key component in the transition to greener industrial practices.

For more details about the industry, get the PDF sample report for free

Manufacturers: Invest in hybrid production facilities capable of switching between synthetic and bio-based feedstocks.

Investors: Focus on companies with vertically integrated supply chains for bio-isobutanol.

Regulatory Affairs: Stay updated on VOC and REACH updates across key regions.

Procurement Managers: Evaluate suppliers not just on price but on sustainability credentials and regulatory alignment.

As industries race toward carbon neutrality, isobutanol offers a rare blend of performance, flexibility, and sustainability. Whether it's used in paints, textiles, or biofuels, its applications are integral to next-gen industrial chemistry. The outlook for the isobutanol market is promising — but strategic foresight and technological innovation will be key to unlocking its full potential.

Safe and Secure SSL Encrypted