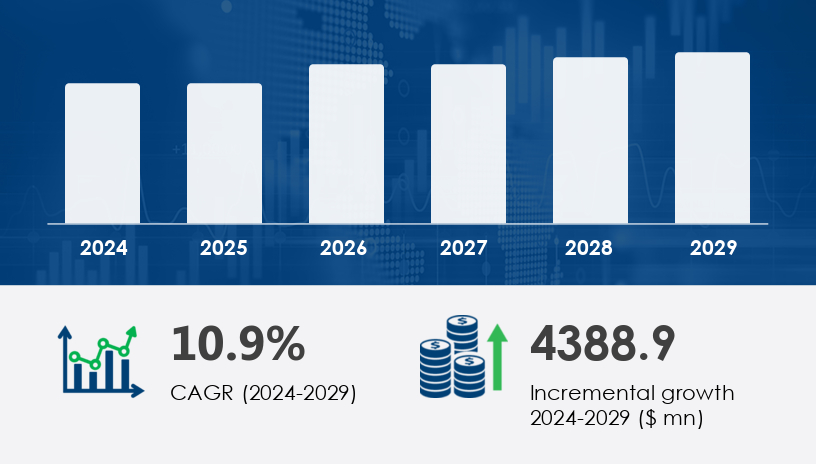

The India online home decor market is poised to expand by USD 4.39 billion from 2025 to 2029, growing at a robust CAGR of 10.9%. This surge reflects a powerful shift in consumer behavior, driven by digital convenience, eco-consciousness, and festive spending. As the digital wave continues to sweep through Indian retail, consumers are rapidly embracing e-commerce retail to beautify their living spaces—driven by convenience, social media influence, and a rising preference for sustainable living. In this comprehensive guide, we explore strategic insights into the market’s core segments by application, product type, and pricing — essential for brands, investors, and retailers planning for the 2025 outlook.

For more details about the industry, get the PDF sample report for free

India’s online home decor sector is experiencing dynamic transformation, fueled by increased smartphone penetration, growing disposable incomes, and the rise of influencer-led social media trends. Platforms like Instagram and Pinterest are shaping consumer tastes, while festivals continue to drive seasonal demand spikes.

| Parameter | Details |

|---|---|

| Market Size (2025–2029) | USD 4.39 billion increase |

| CAGR (2024–2029) | 10.9% |

| Key Applications | Indoor, Outdoor |

| Product Categories | Home furniture, Home furnishings, Others |

| Price Segments | Mass, Premium |

| Primary Challenge | Logistics overhead & delivery inefficiencies |

The indoor segment is projected to dominate growth, reflecting the cultural importance of interior aesthetics in Indian households.

Growth Drivers:

Multiple-bedroom households increase per-unit furniture demand.

Festivals like Diwali and weddings spark periodic spending spikes.

Craft-based local production supports customization and affordability.

Challenges:

Logistics management complexity, particularly for bulky items.

High competition in furniture and textile categories.

Analyst Insight: “Indoor decor will remain the growth engine through 2029, driven by evolving lifestyle preferences and digital ease,” says a Retail Strategy Analyst.

Case Study:

An independent Jaipur-based furniture seller integrated with Amazon's marketplace during the 2023 festive season. Offering RTA (ready-to-assemble) bedroom sets, they saw a 300% increase in orders during Diwali, largely from Tier-2 cities.

Key Facts:

Bedroom furniture shows high fragmentation, led by local firms.

Festivals are the strongest seasonal demand driver.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today!

Home furnishings, including bed linens, rugs, and curtains, have become a top choice for customers seeking quick upgrades with sustainable appeal.

Growth Drivers:

Increased demand for eco-friendly and organic textiles.

Social media influencers promoting minimalist, sustainable living.

Textile brands adopting green production and packaging.

Challenges:

Sustainability comes at a premium, alienating mass-market buyers.

Counterfeit eco-labels threaten consumer trust.

Case Study:

A D2C home textile brand introduced organic cotton linens packaged in cloth bags, eliminating plastic use. Within a year, 40% of sales came through Instagram promotions featuring eco-living influencers.

Key Facts:

Eco-friendly furniture and furnishings are key growth trends.

Regulatory push against non-recyclables is increasing brand accountability.

India’s home decor online market spans both mass and premium segments. While mass-priced items cater to a wide consumer base, the premium segment is fast-growing, driven by personalization and aspirational aesthetics.

Growth Drivers:

Larger middle-class adopting online shopping habits.

High-margin products, especially in premium bedroom and wall decor.

Strategic tie-ups with gift shops and niche labels.

Challenges:

Premium buyers demand personalized, high-touch service — harder to scale online.

Price-sensitive customers challenge profitability in mass segments.

Market View: “Mass retail ensures reach, but real profit lies in curating premium experiences for niche audiences,” says an E-commerce Consultant.

Case Study:

A Bengaluru-based platform collaborated with boutique designers to offer limited-edition decor pieces. While mass SKUs had higher volume, premium collections delivered 60% better margins.

Key Facts:

Premium items tap into high-margin, style-conscious urban consumers.

Mass-market items still dominate in terms of volume and reach.

Eco-friendly decor boom: Brands investing in sustainability gain a competitive edge.

Social media marketing: Visual platforms drive engagement and discovery.

Expansion in Tier-2/3 cities: Rising incomes and aspirations in non-metros.

Festival-based sales: Seasonal campaigns yield significant ROI.

Logistics inefficiencies: Bulky decor items lead to high delivery costs.

High competition: Both local artisans and global players fight for share.

Sustainability credibility: Greenwashing can damage brand trust.

Infrastructure gaps: Inadequate addresses and slow delivery hurt conversion.

By 2029, India’s online home decor market will add USD 4.39 billion in value, reflecting a CAGR of 10.9%. While demand will remain strong across categories, digital personalization, eco-conscious choices, and hybrid shopping models will define winning strategies. As home becomes the new lifestyle statement, are brands ready to pivot to conscious consumption and curated experiences?

The India online home decor market has been witnessing a surge in demand due to changing consumer preferences and increasing digital penetration. Products such as eco-friendly furniture, foldable furniture, bedroom furniture, and carpets and rugs are becoming increasingly popular among consumers looking for convenience and sustainability. Categories like bed and linen, upholstery, wall art, and decorative pillows are also seeing high traction, especially among urban households. The demand for curtains, home textiles, and luxury furnishings reflects a growing inclination toward both aesthetics and functionality. Moreover, there is rising interest in sustainable decor and flat-pack furniture, including ready-to-assemble and children’s furniture. Outdoor spaces are being reimagined with outdoor furniture and floor coverings, while trends like interior design and AI analytics are reshaping consumer experiences in the online marketplace.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Optimize logistics for RTA furniture using regional warehousing.

Leverage festivals with limited-time SKUs and decor bundles.

Use AR/VR tools to visualize room setups and improve buyer confidence.

Market sustainability stories: Highlight organic, water-recycling practices.

Collaborate with lifestyle influencers to create relatable, trustable campaigns.

Offer customization (e.g., size, color) to suit diverse consumer needs.

Create exclusivity with limited collections and designer collaborations.

Build D2C channels with personalized support and white-glove delivery.

Target urban millennials through high-touch digital content and rewards.

Standardize SKUs for scale, ensuring stock consistency and delivery ease.

Drive mobile-first engagement with lightweight app experiences.

Bundle accessories to boost average order value while staying price-sensitive.

Innovations such as augmented reality, virtual reality, and data analytics are driving personalized and immersive customer journeys in India’s online home decor market. These technologies enable consumers to visualize products like smart lighting, premium furniture, vintage decor, and reusable materials in their living spaces before making purchases. The rise of organic linens, handcrafted decor, and modular furniture is supported by the popularity of space-saving designs and technologically integrated offerings like smart mirrors, decorative lighting, and wall decals. Furthermore, bamboo furniture, recycled materials, and artisan crafts reflect a shift toward conscious consumption. Aesthetic preferences like minimalist decor and intelligent features such as smart curtains are enhanced by seamless experiences through digital payments, customer engagement, and personalized decor. The growth of e-commerce platforms, mobile commerce, and online shopping continues to redefine accessibility and consumer reach in this evolving sector.

India’s online home decor market between 2025 and 2029 will be defined by convenience, conscious living, and celebration-driven consumption. With a forecasted addition of USD 4.39 billion, the sector represents a lucrative frontier for brands ready to embrace digital, sustainable, and personalized strategies.

Download our free Strategic Report for full 2025 insights. Stay ahead in this vibrant and rapidly evolving market.

Safe and Secure SSL Encrypted