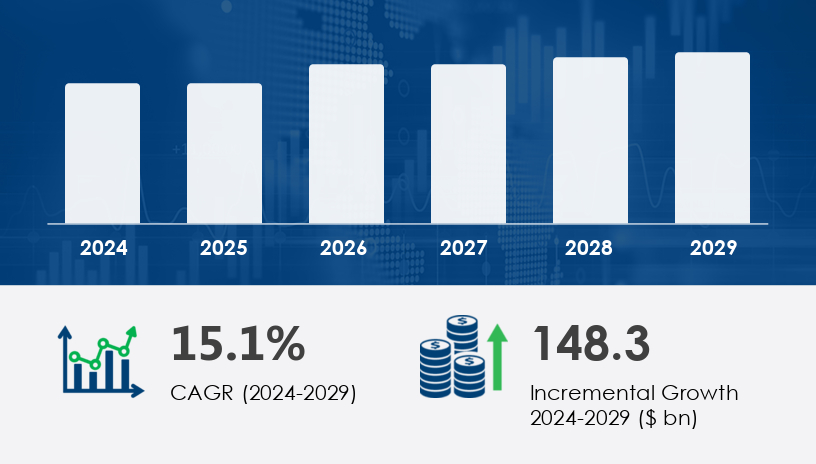

The Hospitality Real Estate Market is projected to grow substantially from 2025 to 2029, continuing its recovery from recent global disruptions. Valued at a strong base in 2024, the market is forecast to expand by USD 148.3 billion by 2029, registering a robust compound annual growth rate (CAGR) of 15.1%. This momentum is driven by investor interest, shifting consumer behaviors, and technological advancements shaping the future of hospitality properties. The U.S. remains a focal point for strategic investments, particularly in full-service restaurants, luxury hotels, and smart real estate infrastructure.

For more details about the industry, get the PDF sample report for free

A pivotal driver fueling the growth of the Hospitality Real Estate Market is the surge in quick-service restaurants and related properties. As global mobility returns and domestic tourism gains traction, quick-service and full-service hospitality venues are rebounding. The increasing adult population aged 25–49, particularly in urban centers, seeks convenience and variety, leading to a growing preference for dining out. In fact, the full-service restaurants segment was valued at USD 49.90 billion in 2019 and has shown a gradual increase in recent years. This trend is reinforced by multi-cuisine offerings, promotional strategies, and flexible menus, making the segment highly attractive to private equity and institutional investors. According to analysts, the rising interest from investment fund entities in properties such as meeting centers, catering facilities, and extended accommodation options underlines the confidence in the sector's long-term returns.

Technology adoption is emerging as a transformative trend within the Hospitality Real Estate Market, influencing both operational efficiency and guest experience. The implementation of smart sensor technology, cloud-based leasing platforms, and LED lighting systems is reshaping property management strategies across hotel chains and resorts. Tech-forward property features now serve as key differentiators, enhancing energy efficiency and sustainability. Additionally, large real estate investment trusts (REITs) and tech companies, including Apple, are deploying advanced analytics and remote management tools to streamline operations. This digital shift reflects a broader trend of integrating real estate technology to improve ROI and enable data-driven decision-making, positioning properties as high-value assets for long-term investment.

The Hospitality Real Estate Market is evolving rapidly as diverse accommodation and leisure preferences drive demand for various asset types, from luxury hotels, boutique hotels, and budget hotels to vacation rentals, serviced apartments, and extended stay properties. Developers and investors are also expanding portfolios to include resort properties such as spa retreats, casino resorts, beach resorts, ski lodges, and golf resorts. A growing interest in experiential travel has catalyzed the rise of theme hotels, heritage hotels, eco lodges, capsule hotels, and glamping sites, appealing to niche traveler segments. Urban expansion continues to support the development of urban hotels, while integrated experiences at conference centers and wellness resorts underscore the sector’s multi-functional growth.

By Application

Full service restaurants

Quick service establishments

Catering services

By Type

Hotels and accommodation

Spas and resorts

Other services

By Sector

Owned and operated

Franchised properties

Real estate investment trusts (REITs)

Management contracts

Among all segments, full-service restaurants represent the leading category in terms of growth and investment attractiveness. The market for this segment, which was valued at USD 49.90 billion in 2019, continues to grow, fueled by evolving consumer dining habits and a focus on work-life balance among the 25–49 age group. Restaurant operators are increasingly offering menu flexibility and multi-cuisine experiences to cater to a diverse urban customer base. According to analysts, the full-service restaurant segment is particularly well-positioned for growth due to its adaptability to promotional campaigns and evolving consumer expectations. Its alignment with investor interest in flexible hospitality assets makes it a critical driver of overall market expansion.

North America (United States, Canada)

Europe (Germany, UK, France, Italy)

APAC (China, India, Japan)

South America (Brazil)

Middle East and Africa

North America leads the Hospitality Real Estate Market, contributing an estimated 34% to global growth during the forecast period. This dominance is fueled by high consumer demand for urban hospitality venues, including hotels, restaurants, and luxury accommodations. The United States and Canada have witnessed significant investments in urban resorts, amusement facilities, and luxury lodges, capitalizing on the returning foot traffic to tourist destinations. According to market analysts, investor interest in REITs and full-service properties has surged due to the recovery of leisure and business travel. Furthermore, demand for hospitality spaces is being shaped by consumer expectations for experiential travel and premium service offerings, reinforcing North America’s leadership in both revenue and innovation.

For more details about the industry, get the PDF sample report for free

Despite the promising outlook, the Hospitality Real Estate Market faces notable challenges, primarily due to uncertain macroeconomic conditions. Rising interest rates, inflation, and recession risks have impacted both consumer spending and investor sentiment. Properties in urban centers and high-end resort markets are particularly vulnerable, with reduced mobility and international travel continuing to limit demand in some segments. The luxury sector has experienced fluctuations in occupancy and room rates, while developers remain cautious with new projects. Moreover, labor costs, healthcare expenses, and limited credit access further constrain profitability. Analysts caution that prolonged economic instability may delay full market recovery, especially in regions dependent on international tourism.

Beyond lodging, hospitality real estate is being shaped by rising demand for fine dining, quick-service restaurants, catering services, and multifunctional event venues such as banquet halls, meeting rooms, and outdoor venues. On-site amenities like recreational facilities, fitness centers, spa facilities, day spas, culinary schools, rooftop bars, and poolside lounges are becoming value drivers that enhance guest experiences and increase asset valuation. New property formats like timeshare properties, co-living spaces, and hostel accommodations are disrupting traditional models, while alternative offerings such as agritourism farms, pop-up restaurants, and wellness centers continue to gain investor attention for their adaptability and profit potential.

From a financial perspective, the market is attracting capital from hospitality REITs, private equity, investment funds, and property trusts seeking diversified exposure through hotel portfolios with high-yield returns. Investors are particularly focused on properties with built-in flexibility and strong thematic appeal, such as capsule hotels in urban hubs or glamping sites in nature-centric locales. The rising importance of ESG considerations has led to heightened interest in eco lodges and wellness-focused developments, while hospitality players increasingly seek to blend lodging with lifestyle experiences. This dynamic convergence of tourism trends and asset innovation is redefining real estate strategies across the hospitality sector.

Key industry players are adapting through strategic partnerships, geographical expansion, and tech-forward developments. Companies such as Apple Hospitality REIT Inc. have diversified their offerings with properties like Embassy Suites, Homewood Suites, and SpringHill Suites, focusing on consistent guest experiences across various price points. Market leaders such as Hilton Worldwide, Marriott International, and Hyatt Hotels Corp. are investing in cloud-based platforms for asset management, enabling better control over operational costs. Other firms, including Best Western and InterContinental Hotels Group, are incorporating energy-efficient systems and smart technologies to align with sustainability goals. These competitive strategies not only improve efficiency but also make hospitality properties more attractive to investors seeking scalable, future-ready assets.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Application

6.1.2 Full service restaurants

6.1.3 Quick service establishments

6.1.4 Catering services

6.2 Type

6.2.1 Hotels and accommodation

6.2.2 Spas and resorts

6.2.3 Other services

6.3 Sector

6.3.1 Owned and operated

6.3.2 Franchised properties

6.3.3 Real estate investment trusts

6.3.4 Management contracts

6.4 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 Europe

6.4.4 South America

6.4.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted