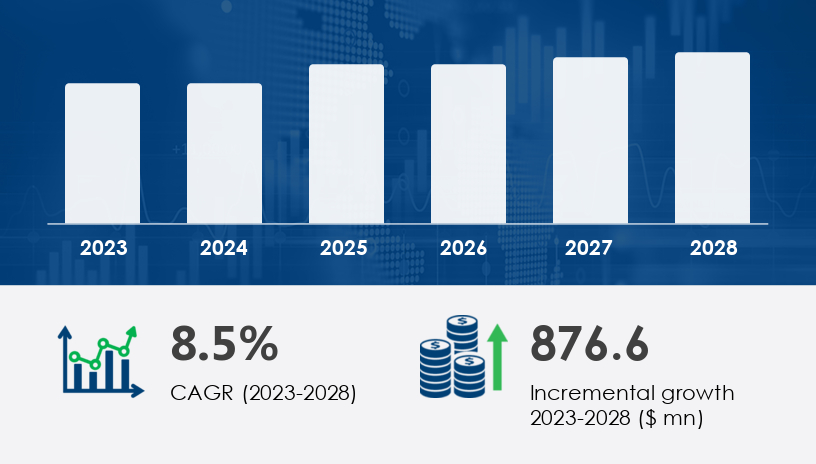

The high temperature cables market is forecast to grow by USD 876.6 million between 2023 and 2028, achieving an 8.5% CAGR. This growth is primarily driven by the rising energy demands across sectors such as wind energy farms, solar power, utility grids, machinery, and mining. High temperature cables offer distinct advantages—low losses, high conductivity, and flexibility in both new installations and retrofit applications. These cables are critical for supporting long-distance transmission, with stranding techniques and insulation materials like silicone, fluoropolymers, ceramic-based compounds, and cryogens extending performance in extreme conditions. Superconducting variants, cooled by liquid nitrogen, further boost conductivity and load capacity, especially in renewable energy grids.

A key growth factor is the enhancement of railway infrastructure, notably in the United States. High temperature cables meet stringent rail industry standards—halogen-free, flame-retardant, self-extinguishing—and are vital in power and control systems for rolling stock. The Biden-Harris Administration’s USD 8.2 billion investment in high-speed rail, including a corridor from Las Vegas to Southern California, underscores this trend. In parallel, increasing wind power generation capacity is driving demand. Offshore turbines, with higher utilization rates than onshore ones, depend on these cables for their reliability and efficiency. From power cost savings to superior insulation, the utility of high temperature cables extends across commercial construction, medical, aerospace and defense, and electronic manufacturing industries.For more details about the industry, get the PDF sample report for free

The market is segmented by end-users into:

Energy: Including oil and gas refineries, wind and solar farms, and utility power networks.

Transport: Focused on rolling stock, rail corridors, and electric transport systems.

Industrial: Encompassing manufacturing, mining, and large-scale construction.

Others: Covering commercial, aerospace, medical, and electronics sectors.

The energy segment leads due to its wide application range and urgency in modernizing legacy infrastructure. This segment benefits from the superior conductivity and longevity offered by high temperature cables, which reduce power loss and adapt to cryogenic systems in power grids.

China: Largest oil consumer (16.6M barrels/day in 2023), fueling demand from refineries and energy utilities.

India: Rising energy demand and investment in renewables and transport.

Japan: Advances in electronics and HVDC transmission expand cable usage.

Germany: Key focus on renewables integration and smart grid retrofits.

United States: USD 8.2B federal investment in high-speed rail boosts transport cable applications.

Middle East and Africa: Growth tied to utility power and industrial expansion.

South America: Renewable integration and mining drive demand for robust transmission solutions.

Get more details by ordering the complete report

The enhancement of railway infrastructure stands out as a leading market driver. As governments upgrade national corridors and rolling stock, the demand for high performance, safety-compliant cabling rises. The United States’ renewed investment in passenger rail is a prime example, requiring extensive use of halogen-free, fire-resistant cables.

Power transmission efficiencies also push market adoption. High temperature cables are crucial in reducing electricity costs, thanks to low resistance and adaptability to cryogenic cooling. These properties make them suitable for both conventional fossil fuel and new renewable energy systems. Additionally, their role in expanding grid capacity supports national clean energy goals.

A major trend reshaping the market is the growing wind power generation capacity. Offshore wind farms in particular benefit from consistent wind conditions, which improve turbine efficiency and justify the use of high-specification cabling. These cables ensure energy loss is minimized over long-distance transmission.

Advancements in insulation technologies, including ceramic-based materials and superconductors cooled by liquid nitrogen, are expanding the operational range of high temperature cables. Their increasing use in electronics, HVDC setups, medical, and defense sectors reflects this technical evolution. Vendors are leveraging both organic strategies (product innovations) and inorganic strategies (acquisitions) to expand their footprint in these sectors.

The most pressing challenge is fluctuation in raw material prices. Conductors (copper, aluminum) and insulators (silicone, fluoropolymers, glass fiber) face volatile pricing driven by global demand and geopolitical disruptions. These increases directly impact cable production costs and may hinder demand in price-sensitive sectors like commercial construction, aviation, and railway upgrades.

For example, recent hikes in copper and aluminum prices have led to elevated cable costs, which could reduce uptake in energy infrastructure projects or renewables where budget constraints are tight. Market participants must adopt pricing strategies and seek supply chain diversification to manage this risk.

The high temperature cables market is witnessing significant growth due to rising demands across infrastructure projects, power transmission, and renewable energy sectors. These cables are critical for high-voltage applications, particularly in HVDC installations, power grids, and wind turbine systems, where heat resistance and durability are essential. Materials like ceramic-based compounds, glass fiber, fluoropolymers, and silicone insulation enhance thermal management and enable reliable performance in harsh environments. Applications span across construction cables, mining cables, and heavy industrial equipment, where load capacity and cable conductivity are critical. Compliance with safety regulations and the growing adoption of solar power and electric vehicles further propel market demand. Additionally, fire-resistant cables, refrigeration cables, and cryogenic cables are being deployed in energy-intensive areas, aligning with global goals of efficient energy consumption and grid modernization in utility power systems.

For more details about the industry, get the PDF sample report for free

The U.S. high temperature cables market features strong competition with global and domestic players leveraging technological innovation and strategic expansion. Key companies highlighted in the research include:

Allied Wire & Cable Inc.

Anixter Inc.

Belden Inc.

Eland Cables

Habia Cable AB

HELUKABEL Romania Srl

KME Germany GmbH

LEONI AG

NKT AS

Omega Engineering Inc.

Prysmian Spa

RSCC Wire & Cable LLC

Southwire Co. LLC

Sumitomo Electric Industries Ltd.

These companies serve various applications in sectors such as energy, transport, construction, medical, and aerospace. Their strategies include product innovation in insulation materials, market expansion into APAC and the U.S., and partnerships to secure major rail and utility contracts.

High temperature cables are integral to advanced sectors such as telecom networks, signal transmission, satellite communications, and electronic warfare, where stable performance and signal intelligence are paramount. Emerging technologies are also utilizing superconductor cables, RF filters, and fiber optic solutions to ensure efficiency in manufacturing cables and electronics cables. In sectors like aviation cables and battery wiring, heat-resistant cables are crucial for sustaining operations under extreme conditions. Specialized protective layers and insulating firebricks contribute to enhanced safety, especially in industrial operations. Materials such as ceramic fibers, calcium silicate, and mineral wool are employed for superior insulation. As the demand for electric vehicles and renewable energy systems grows, the need for resilient, high-performance cables becomes critical. These innovations ensure consistent delivery in electronic warfare and signal intelligence applications, reinforcing the strategic role of high temperature cables in global energy consumption and thermal management systems

Get more details by ordering the complete report

Safe and Secure SSL Encrypted