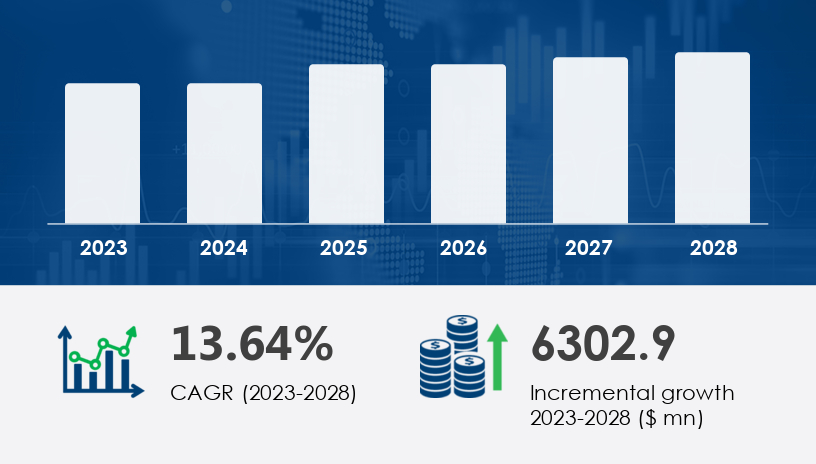

The head and neck cancer diagnostic methods market is entering a period of unprecedented transformation. Once a niche segment characterized by reactive diagnosis and late-stage detection, it is now on the cusp of becoming a cornerstone of precision medicine. Fueled by the rising incidence of head and neck cancers globally and the demand for earlier, more accurate detection tools, the market is projected to grow by USD 6.3 billion between 2023 and 2028, expanding at a CAGR of 13.64%.

This evolution is not only technological but strategic—bringing genomics, immunotherapy, and real-time digital diagnostics to the forefront. As one industry expert stated during a recent oncology summit, “We’re no longer diagnosing cancer to confirm disease—we’re diagnosing to determine the most targeted path forward.”

For more details about the industry, get the PDF sample report for free

Legacy Disruption:

Historically, cancer diagnostics relied heavily on imaging followed by surgical biopsies, often performed after symptoms had progressed.

New Strategy Emerging:

Today, non-invasive blood-based biomarkers and genomic tests are becoming routine for early-stage detection. These tests also support immunotherapy eligibility and personalized treatment strategies.

Analyst Insight:

With the prevalence of oropharyngeal cancers and thyroid nodules rising, the biopsy and blood tests segment remains the largest and fastest-growing, underpinned by the need for precision diagnostics.

Business Case:

A U.S.-based cancer center adopted liquid biopsy panels from a genomics startup, reducing diagnostic time for oropharyngeal carcinoma by 38% while improving therapy targeting accuracy.

Key Stats:

Biopsy and blood test segment was valued at USD 1.64 billion in 2018.

Segment is projected to witness the most significant growth through 2028.

Legacy Disruption:

Traditional imaging methods (CT, MRI) were often limited by stage-dependent detection accuracy.

New Strategy Emerging:

High-definition endoscopy and hybrid imaging platforms (PET/CT) now provide real-time, multilayered tumor visualization, enhancing staging precision and surgical planning.

Analyst Insight:

Imaging, once a confirmatory tool, is becoming diagnostic in its own right through AI overlays and fusion imaging technologies.

Business Case:

A European hospital group implemented AI-assisted PET/CT scans in ENT oncology units, reducing unnecessary biopsies by 24% while increasing early-stage cancer detection rates.

Key Stats:

Imaging is a core component alongside biopsy in diagnosis and staging.

Integrated imaging diagnostics are essential in the management of throat and oral cavity cancers.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Legacy Disruption:

Dental examinations were once peripheral in oncology. Oral health was rarely linked directly to cancer diagnostics.

New Strategy Emerging:

With strong evidence linking oral hygiene to early signs of head and neck cancers, dental diagnostics have become a frontline screening tool.

Analyst Insight:

Dental diagnostics, once overlooked, now serve as non-invasive first alerts, especially in populations with limited access to full cancer care.

Business Case:

A Japanese startup developed a chairside diagnostic saliva test, deployed across 200 dental clinics, identifying pre-cancerous lesions with 92% sensitivity.

Key Stats:

Dental care is now recognized as an essential diagnostic category.

Oral health screenings are key for early oropharyngeal cancer detection.

Next-Gen Diagnostic Technologies

AI-assisted imaging, molecular profiling, and liquid biopsies are enabling earlier detection with greater precision.

“Emerging diagnostics must not only detect the disease but also decode its behavior,” said Dr. Elina Choudhary, an oncology tech advisor.

Immunotherapy-Driven Demand

As immunotherapy gains ground, diagnostics must identify biomarkers that determine therapy compatibility—making companion diagnostics indispensable.

Regulatory Pressures and Recalls

Despite progress, frequent product recalls and FDA oversight highlight the need for rigorous quality and compliance frameworks.

The Head and Neck Cancer Diagnostic Methods Market is expanding due to the increasing prevalence of conditions affecting the vocal cord, thyroid nodule, sinus tumor, and tonsil cancer, among others. With rising cases of esophageal cancer, adenoid cancer, and epiglottis cancer, demand for diagnostic tools like ultrasound scan, fluoroscopy test, and laryngoscopy exam is growing. Other non-invasive procedures such as nasal endoscopy, swallowing test, and saliva test are being widely used for initial screening, especially in identifying symptoms like neck lump, hearing loss, swollen glands, and ear pain. Critical anatomical areas such as the soft palate, hard palate, tongue base, parotid gland, submandibular gland, voice box, and facial nerve are routinely assessed using advanced imaging techniques. These methods assist in diagnosing tumors in the trachea, jaw, and skull base, as well as evaluating the impact on functions like speech through speech pathology.

AI-Driven Diagnosis Integration

By 2028, real-time AI diagnostics will be integrated into imaging systems, allowing pathologists and radiologists to collaboratively diagnose from a single data platform.

Personalized Monitoring Platforms

Wearable biosensors and at-home diagnostic kits could monitor cancer recurrence, transforming post-treatment care.

Tele-diagnostics in Underserved Areas

Remote diagnostic solutions will expand access to underserved populations, reducing late-stage presentation globally.

Company Example:

GE Healthcare is integrating advanced molecular imaging with software analytics, enabling precision staging and treatment prediction within oncology workflows.

Provocative Question:

As diagnostics shift from the lab to the point of care, are we ready to decentralize cancer detection without compromising clinical accuracy?

Get more details by ordering the complete report

Prioritize Early Detection Capabilities

Invest in biopsy and liquid biopsy innovations that can intercept cancers before symptoms emerge.

Build AI-Enhanced Diagnostic Workflows

Accelerate AI-driven imaging tools and software platforms to improve diagnostic accuracy and speed in head and neck cancers.

Expand Tele-diagnostics Infrastructure

Leverage telemedicine for early consultations and post-treatment surveillance, especially in regions with limited access to specialists.

Strengthen Regulatory and Quality Control Systems

Mitigate recall risks with robust compliance programs and real-time device monitoring, especially for imaging and biopsy tools.

Focus on Integrated Diagnostic Ecosystems

Foster interoperability between genomic labs, radiology suites, and oncology EHRs to build unified diagnostic pathways.

Adopt Value-Based Diagnostic Metrics

Align your diagnostics with outcome-based metrics—like time to diagnosis, early detection rates, and therapy optimization—to stay competitive in cancer value chains.

Advanced research in this market focuses on pinpointing causes and responses to treatments using detailed evaluations like tissue sample biopsies and cytology analysis. The role of genetic mutation, viral infection, HPV testing, and EBV detection in head and neck cancers is a significant area of study. Additionally, the analysis of tumor marker levels and hormone levels provides insights into disease progression and helps tailor treatment. Imaging techniques such as bone scan are used to detect cancer spread, while assessments for nerve damage aid in understanding treatment side effects. Evaluating chemotherapy response and monitoring radiation effect are essential for ongoing care and pain management. Research also focuses on less visible indicators like cheek mucosa irregularities and post-treatment complications in critical regions, ensuring comprehensive diagnostics that enhance patient outcomes.

From reactive confirmation to proactive precision, the head and neck cancer diagnostic methods market is not just growing—it’s redefining the very framework of oncology care. As diagnostics become faster, smarter, and more personalized, the divide between detection and treatment continues to blur. Leaders must embrace this convergence or risk being sidelined in the next era of precision medicine.

Are we thinking beyond “detect and treat”—and toward “predict and prevent”?

Safe and Secure SSL Encrypted