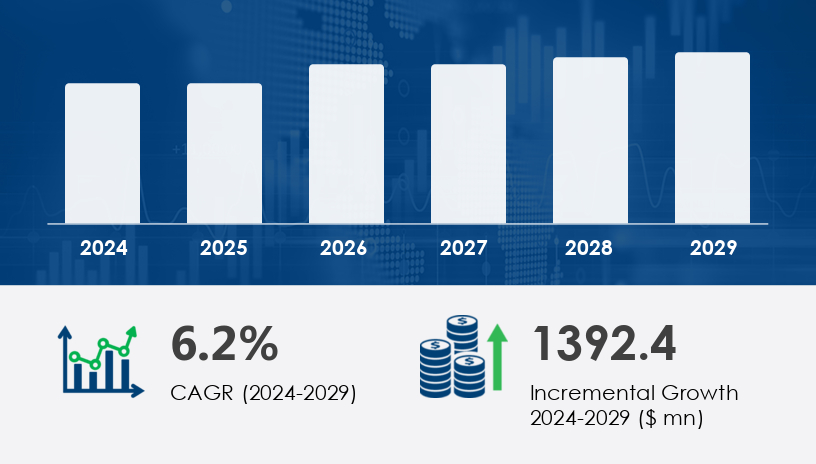

The geothermal energy power equipment market is undergoing a strategic transformation, powered by a fusion of digital innovation, capital partnerships, and regional development initiatives. Forecast to expand by USD 1.39 billion at a CAGR of 6.2% between 2024 and 2029, this market’s momentum stems from the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into geothermal infrastructure, along with strategic policy and financial support mechanisms. As geothermal’s potential rises to rival conventional energy sources, stakeholders are intensifying focus on sustainable growth, resource optimization, and cost efficiency in their operational strategies.For more details about the industry, get the PDF sample report for free

Artificial Intelligence (AI) and IoT have emerged as critical enablers in optimizing geothermal power plant operations. Real-time data collection from integrated sensors, paired with predictive analytics, is helping mitigate downtime, enhance thermal output, and streamline maintenance across plant components such as turbines, generators, heat exchangers, and control systems. These innovations also facilitate environmental compliance through advanced environmental impact assessments and seismic monitoring, essential for resource sustainability.

Thermal energy storage is another innovation gaining traction, allowing plants to balance output during demand fluctuations and contributing to overall grid stability. Yet, one of the most persistent challenges remains the high levelized cost of energy (LCOE), with geothermal ranging from USD 45 to USD 75 per megawatt-hour, noticeably higher than solar (USD 30–49) and wind (USD 30–57). This disparity, rooted in the high upfront capital investment for exploration and drilling, continues to influence investor sentiment and requires counterbalance through government incentives and renewable energy credits.

The electricity generation subsegment remains the primary application for geothermal equipment, owing to heightened demand for clean and stable power sources. District heating and industrial heating are also growing steadily, particularly in countries with established geothermal infrastructure. Enhanced geothermal systems (EGS) and binary power cycles are now unlocking previously inaccessible geothermal reservoirs, enabling further diversification of geothermal use cases.

Get more details by ordering the complete report

The APAC region is projected to contribute 44% to global market growth between 2025 and 2029. Noteworthy developments include:

Taheke Geothermal Power Project in New Zealand, which received government approval in November 2024.

Te Mihi 2 Geothermal Power Plant, where Ormat Technologies secured an EPC contract in January 2024, adding 101 MW capacity.

These projects underscore the region’s commitment to renewable energy expansion, with Indonesia, Japan, New Zealand, and the Philippines leading geothermal adoption. Companies are also deploying advanced drilling and thermal storage technologies, alongside AI-based data acquisition systems, to enhance plant performance and reduce LCOE.

The US is central to innovation in EGS. In Oregon, Mazama Energy, Inc. received a grant from the US Department of Energy’s Geothermal Technologies Office to demonstrate Superhot Rock-EGS at Newberry Volcano. This project combines AI and machine learning for cost reduction and drilling optimization. Canada continues its geothermal assessments and sustainability initiatives to support industrial heating and electricity needs.

Germany and Italy are benefiting from multilateral financing and technology partnerships. The European Investment Bank (EIB) committed €350 million in October 2024 to expand geothermal capacity in Iceland, Italy, and Kenya, enhancing both power generation and sustainability.

Chile is setting a global benchmark with the Cerro Dominador hybrid geothermal-solar power plant, unveiled in December 2025. As the world’s largest of its kind, it demonstrates the strategic potential of integrating multiple renewable technologies to stabilize power output and lower emissions.

Regions under ROW are exploring geothermal via seismic and electromagnetic surveys to identify new geothermal fields, often relying on public-private partnerships and green bonds to drive exploration and plant construction.

The competitive landscape is marked by innovation, strategic alliances, and regional expansion. Key players include:

Ansaldo Energia Spa – Advanced turbomachinery and steam turbine solutions focused on energy efficiency and minimal environmental impact.

Toshiba Corp. – Known for large-scale turbine projects like Wayang Windu (Indonesia).

Ormat Technologies Inc. – A major player in EPC contracts, now collaborating with Siemens Gamesa (June 2024) to integrate wind and geothermal solutions.

Enel Spa / Enel Green Power – Operationalized the 110 MW Krafla Geothermal Power Plant in Iceland (February 2023), growing their geothermal footprint by over 50%.

Baker Hughes Co., Fuji Electric Co. Ltd., ElectraTherm Inc., Schlumberger Ltd., Turboden SpA, and Holtec International – Each active in geothermal-specific product offerings and plant optimization technologies.

These players are aligning with trends such as M&A, geographical expansion, and cost-competitive innovations, including the use of binary cycle systems, control systems, and corrosion-resistant equipment to meet geothermal demands across different geographies.

For more details about the industry, get the PDF sample report for free

AI + IoT Integration: Enabling predictive maintenance and real-time diagnostics to reduce downtime and operating costs.

Enhanced Geothermal Systems (EGS): Unlocking deeper geothermal sources for higher thermal output.

Geothermal-Solar Hybrids: As seen in Chile, combining renewables to increase reliability and grid stability.

Thermal Energy Storage: Facilitating better load balancing and increasing power plant efficiency.

Environmental & Community Engagement: Projects must pass rigorous environmental assessments and gain community trust, especially in indigenous and ecologically sensitive areas.

Despite technological breakthroughs, the high levelized cost of energy (LCOE) and capital intensity of geothermal projects remain critical challenges. Exploratory drilling, well completion, and permitting processes can be both costly and time-consuming. Additionally, resource availability is geographically constrained, necessitating sophisticated reservoir management and exploratory surveys to expand viable geothermal zones.

Still, government incentives, renewable portfolio standards, and access to green financing tools like renewable energy credits and geothermal bonds offer pathways to mitigate financial risks.

For more details about the industry, get the PDF sample report for free

The Geothermal Energy Power Equipment Market is advancing rapidly, driven by the global transition toward renewable energy and low-emissions solutions. Central to this evolution are geothermal turbines, heat exchangers, and geothermal generators that enable clean electricity production from subterranean heat sources. Core geothermal technologies, including flash steam, dry steam, and binary cycle systems, are increasingly deployed across geothermal reservoirs to maximize power generation efficiency. Power plants designed for both electricity generation and district heating or industrial heating benefit from innovations in drilling technology and the utilization of geothermal fluids. Enhanced geothermal systems and deep geothermal wells are extending the reach of geothermal capacity, while steam turbines and energy storage technologies play pivotal roles in stabilizing power output. The integration of AI monitoring, IoT components, and predictive maintenance is further enhancing operational performance, particularly in decentralized applications like geothermal microgrids.

February 2023: Enel Green Power launches 110 MW Krafla plant in Iceland.

June 2024: Siemens Gamesa and Ormat form a strategic alliance for integrated wind-geothermal solutions.

October 2024: EIB funds €350 million to geothermal expansions in Iceland, Italy, and Kenya.

December 2025: Chile’s Cerro Dominador unveils world’s largest geothermal-solar hybrid plant.

These milestones highlight the market’s transition from traditional geothermal exploitation toward integrated, AI-enabled, and hybridized energy systems that are both environmentally and economically sustainable.

As the geothermal energy power equipment market accelerates toward 2029, success will depend on how effectively companies navigate cost structures, deploy digital innovations, and expand into geologically rich regions. With robust demand for decarbonized power, geothermal’s role in the renewable mix is poised to scale in both capacity and technological sophistication.

For more details about the industry, get the PDF sample report for free

The Geothermal Energy Power Equipment Market is advancing rapidly, driven by the global transition toward renewable energy and low-emissions solutions. Central to this evolution are geothermal turbines, heat exchangers, and geothermal generators that enable clean electricity production from subterranean heat sources. Core geothermal technologies, including flash steam, dry steam, and binary cycle systems, are increasingly deployed across geothermal reservoirs to maximize power generation efficiency. Power plants designed for both electricity generation and district heating or industrial heating benefit from innovations in drilling technology and the utilization of geothermal fluids. Enhanced geothermal systems and deep geothermal wells are extending the reach of geothermal capacity, while steam turbines and energy storage technologies play pivotal roles in stabilizing power output. The integration of AI monitoring, IoT components, and predictive maintenance is further enhancing operational performance, particularly in decentralized applications like geothermal microgrids.

Safe and Secure SSL Encrypted