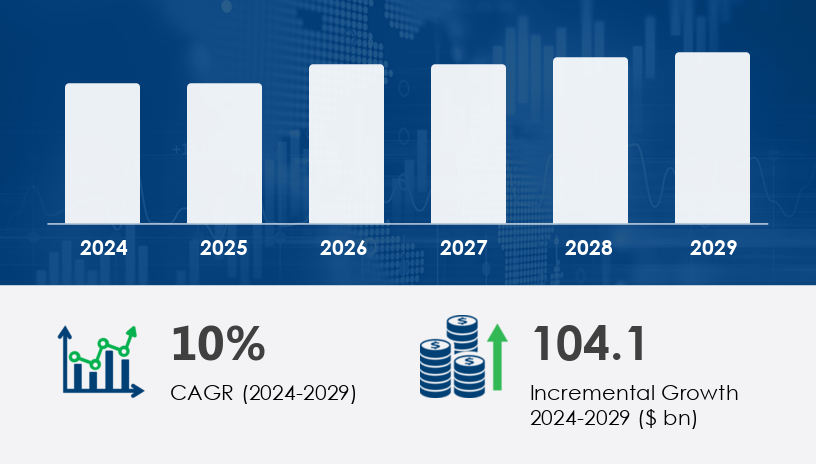

The fitness and recreational sports centers market is poised for robust expansion, with a projected increase of USD 104.1 billion between 2024 and 2029, registering a CAGR of 10%. This trajectory reflects a significant shift in how consumers and corporations approach health, wellness, and preventive care. As healthcare costs in the United States continue to escalate—surpassing USD 4.5 trillion in 2023—Americans are increasingly viewing fitness centers not merely as workout spaces but as affordable and proactive healthcare alternatives.At the heart of this trend is a surge in integrated workout formats for group classes, blending strength training, cardiovascular routines, and interactive instruction. These services are tailored across a diverse range of demographics, offering gymnasiums, pilates studios, yoga centers, tennis courts, swimming pools, and spa amenities under one roof. Men have become a key growth segment, drawn by professional strength training sessions that aid in the management of chronic conditions like diabetes, arthritis, and heart disease. The market is also expanding its offerings to include services in universities, senior centers, hotels, and multi-family residences—catering to both functional fitness and lifestyle enhancement.However, while the market outlook remains optimistic, fragmentation is a persistent challenge. A highly diverse set of players—ranging from boutique studios to large national chains—has created a competitive yet opportunity-rich landscape. For new entrants, success hinges on offering differentiated services, forming strategic alliances, and executing regionally nuanced marketing strategies..For more details about the industry, get the PDF sample report for free

The market's most prominent end-user segment is men, which experienced notable growth in 2024 and is projected to continue expanding through 2029. This surge is driven by the growing popularity of strength training, personalized coaching, and the increasing awareness of physical fitness as a pathway to disease prevention and mental well-being.

The industry targets all age demographics: individuals aged 35 and younger, those aged 35–54, and those 55 and older. Each group engages differently with recreational centers, from youth-driven dynamic workouts to wellness programs for aging populations.

The service landscape is diverse, encompassing:

Gym and fitness centers

Sports clubs

Yoga and Pilates studios

Others, which may include specialized training centers, aquatic programs, and wellness retreats.

These offerings are tailored to meet wide-ranging customer preferences and are increasingly being bundled with healthcare-related services to appeal to health-conscious consumers.

North America is expected to account for 42% of global market growth during the forecast period. This dominance is underscored by advanced infrastructure, a high level of health awareness, and a strong economy. The U.S. and Canada serve as primary hubs, with a proliferation of fitness chains, boutique studios, and recreational facilities offering group classes, personal training, and specialized fitness programs. The increase in chronic illnesses such as obesity and diabetes has further accelerated demand across these regions.

Other regions showing notable market activity include:

Mexico

Australia

China

India

Japan

France

Germany

UK

UAE

Brazil

These countries are experiencing rising middle-class populations, a growing focus on wellness, and increasing female participation in fitness activities—all of which contribute to the expansion of recreational sports centers.

Get more details by ordering the complete report

The primary market driver is the surge in healthcare costs. As traditional medical expenses continue to rise, consumers are seeking cost-effective alternatives to maintain health. Fitness centers offer a proactive approach, enabling people to manage or prevent chronic conditions through regular exercise, thereby reducing dependency on medical interventions. The growing middle class and rising disposable incomes are also fueling demand for premium wellness services.

A pivotal trend shaping the market is the rise of integrated group workout formats. Fitness centers are evolving into holistic health hubs that combine cycling, running, weight training, and bodyweight routines into a single, community-oriented experience. This trend appeals to individuals seeking social engagement, accountability, and structured fitness guidance. Facilities are now engaging professional trainers to lead these sessions, often supplemented with expert advice on nutrition and lifestyle modifications.

Despite its promise, the market remains highly fragmented, presenting challenges for global players aiming to scale. Local studios and regional providers often possess deep community ties and flexible service models, complicating expansion for larger chains. This fragmentation also leads to inconsistent service quality and pricing models, making it difficult to establish standardized branding across markets.

As of May 2024, fitness companies are pursuing strategic moves to strengthen their market presence through mergers, partnerships, and regional expansion. These efforts are aimed at enhancing customer experience and tapping into underserved demographics. For instance, 24 Hour Fitness USA LLC continues to position itself as a leader in community-focused fitness solutions, offering CrossFit programs, certified training, and state-of-the-art facilities.

For more details about the industry, get the PDF sample report for free

Several companies dominate or lead specific subsegments of the market:

24 Hour Fitness USA LLC

CrossFit LLC

Crunch LLC

Curves NA Inc.

David Lloyd Leisure Ltd.

Diverse Retails Pvt. Ltd.

Equinox Holdings Inc.

Konami Group Corp.

Life Time Inc.

Lift Brands Inc.

Planet Fitness Inc.

Roark Capital Management LLC

RSG Group GmbH

Self Esteem Brands LLC

The Gym Group plc

The Little Gym International Inc.

Ultimate Fitness Group LLC

Virgin Active Ltd.

Youfit

These players employ varied strategies—ranging from acquisitions to innovation in digital fitness offerings—to stay competitive.

For investors, franchisors, and fitness technology providers, the next five years represent a high-growth window in a rapidly evolving landscape. Winning strategies will depend on the ability to meet diverse demographic needs, form local partnerships, and adapt to hybrid wellness models that blend physical and digital experiences. The rising demand for community-based, preventative health services signals a new era in the fitness and recreational sports centers industry—where agility, specialization, and engagement will define market leadership.

Get more details by ordering the complete report

The Fitness and Recreational Sports Centers Market is evolving rapidly, driven by growing consumer interest in health and wellness. Facilities are increasingly integrating diverse fitness equipment ranging from cardio machines like treadmill workouts and elliptical trainers to strength training tools such as free weights, weight racks, resistance bands, and dumbbell sets. Specialty workout areas include yoga studios, dance studios, and aerobics studios catering to Zumba classes, yoga mats, barre classes, and Pilates reformer sessions. There’s a rising focus on functional fitness, with offerings like CrossFit gyms, HIIT workouts, bodyweight training, battle ropes, TRX suspension, and kettlebell exercises. Many centers now also feature climbing walls, sauna facilities, steam rooms, locker rooms, and meditation spaces, emphasizing holistic wellness experiences alongside physical fitness

Fitness centers are expanding into tech-enhanced and group-focused environments, integrating smart gym technologies, fitness trackers, wearable tech, fitness apps, and virtual workouts to enhance user engagement. Personalized experiences through personal training and structured fitness classes such as kickboxing classes, indoor cycling, and spin bikes are standard offerings. Additional infrastructure includes rowing machines, foam rollers for recovery, and multipurpose spaces like sports courts, squash courts, basketball courts, and indoor pools for recreational versatility. Facilities also support stretching areas and innovative programming in group fitness, responding to growing demand for interactive wellness. With a consumer shift toward digital integration and comprehensive amenities, the market for fitness and recreational sports centers is set to continue growing, blending traditional gym offerings with high-tech and lifestyle-enhancing elements.

Get more details by ordering the complete report

Safe and Secure SSL Encrypted