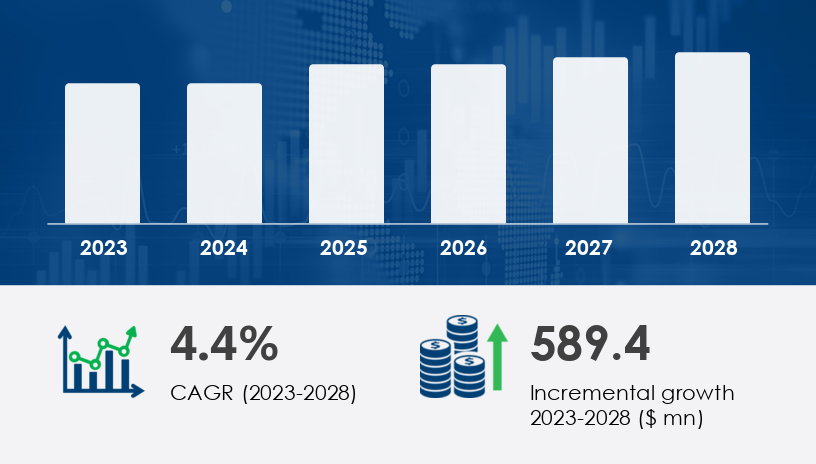

The femoral head prostheses market is set to expand by USD 589.4 million between 2024 and 2028, growing at a CAGR of 4.4%, driven by a surge in hip replacement procedures worldwide.In this 2025 Outlook and Comprehensive Guide to the femoral head prostheses market, we explore the vital factors propelling this orthopedic segment, the challenges threatening adoption, and strategic insights into the competitive landscape. As aging populations and rising orthopedic disorders converge, the demand for femoral head prosthetics is expected to scale to new heights—reshaping patient outcomes and the future of joint replacement.For more details about the industry, get the PDF sample report for free

Femoral head prostheses are integral components of artificial hip implants used to replace damaged or degenerated hip joints—particularly in patients suffering from osteoarthritis, rheumatoid arthritis, or traumatic injuries. They work in conjunction with the acetabular component, plastic liner, and femoral stem to create a functional hip replacement.

“Hip replacement is no longer a last resort. It’s a proactive step toward mobility and independence—especially for aging populations,” says Senior Analyst at Technavio

The global elderly population is increasing rapidly. In the U.S. alone, over 57.8 million individuals were aged 65+ in 2022, creating a surge in demand for hip arthroplasty procedures. This demographic shift is linked with higher incidence rates of osteoporosis, osteoarthritis, and joint degeneration—conditions that commonly necessitate total hip replacement.

Robotic-assisted hip replacements are revolutionizing surgical accuracy, reducing recovery time, and minimizing implant misalignment. Additive manufacturing (3D printing) allows the customization of implants to suit individual anatomy, enhancing implant longevity and biocompatibility.

“We are entering a precision era in orthopedics—robotics and 3D printing allow surgeons to tailor femoral head prostheses like never before,” says Senior Analyst at Technavio.

Hospitals are the dominant end-user segment, valued at USD 1.17 billion in 2018, with a consistent upward trend. Their comprehensive services—from diagnostics to post-operative care—make them the preferred setting for orthopedic surgeries.

Get more details by ordering the complete report

Hospitals – Primary segment due to volume of procedures and infrastructure

Ambulatory Surgical Centers (ASCs) – Gaining traction for same-day discharge procedures

Specialty Clinics – Offer niche orthopedic services

Research & Academic Institutions – Focused on clinical trials and innovation

Ceramic Femoral Head Prostheses – Popular for their wear resistance and low reactivity

Metal Femoral Head Prostheses – Durable and cost-effective

Ceramicised Metal Prostheses – Hybrid benefits of strength and biocompatibility

Hospitals will continue to be the largest procurement centers, driven by their surgical capacity and access to skilled professionals.

Ceramic-on-ceramic and ceramic-on-polyethylene combinations are gaining popularity due to reduced wear and better long-term outcomes.

North America’s dominance is likely to continue due to high procedure volumes and favorable insurance coverage.

For more details about the industry, get the PDF sample report for free

Despite growth, the market faces significant hurdles:

With hip replacement surgeries ranging from USD 15,000 to USD 35,000, affordability remains a barrier. This is particularly problematic in emerging markets and for uninsured or underinsured patients.

Potential complications include:

Device faults or early implant failure

Allergic reactions and metal poisoning

Infections and bone loss post-surgery

Higher revision rates in elderly patients

These risks can necessitate additional surgeries and elevate healthcare costs.

Tailored implants based on a patient’s unique anatomy, activity level, and bone structure are expected to become standard. As 3D scanning and custom fabrication become more accessible, orthopedic outcomes are set to improve significantly.

India and China, with their aging populations and growing middle-class, represent huge untapped markets. However, access to healthcare and insurance penetration will be key determinants of market success.

Get more details by ordering the complete report

The Femoral Head Prostheses Market is witnessing steady growth driven by the rising incidence of hip replacement surgeries due to conditions such as osteoarthritis treatment, rheumatoid arthritis, hip fracture, and avascular necrosis. The market comprises a variety of femoral head materials, including ceramic prostheses, metal prostheses, and polyethylene implants, utilized in total hip, partial hip, and hip resurfacing procedures. Recent innovations in robotic surgery and 3D printing have enabled more minimally invasive approaches and patient-specific implants, enhancing surgical outcomes. Materials like titanium alloys, cobalt-chromium, and stainless steel are selected for their biocompatible materials and long-term bone integration. The industry also supports various implant configurations such as modular prostheses, ceramic-on-ceramic, metal-on-polyethylene, and ceramic-on-metal, including mobile-bearing and fixed-bearing options to restore hip mobility and address hip disorders. Increasing focus on personalized implants, prosthesis design, and surgical precision has strengthened adoption across orthopedic clinics and ambulatory centers.

The femoral head prostheses market is highly competitive and innovation-driven. Key players are engaging in strategic partnerships, regional expansion, and product differentiation.

Zimmer Biomet Holdings Inc.

Johnson & Johnson Services Inc.

Smith and Nephew plc

Medacta International SA

Exactech Inc.

Corin Group Plc

Elite Surgical Pvt. Ltd.

Meril Life Sciences Pvt. Ltd.

These firms are leveraging technological capabilities, material innovations, and strategic M&As to enhance their footprint globally.

Improved mobility and quality of life

Wide range of material and bearing options

Minimally invasive surgical techniques available

High upfront and surgical costs

Risk of revision surgery

Potential for allergic reactions or implant failure

For more details about the industry, get the PDF sample report for free

Invest in R&D for 3D printing and bioengineered materials.

Focus on cost-effective solutions for emerging markets.

Strengthen hospital partnerships for product trials and long-term procurement.

Educate patients on risks, benefits, and innovations in hip replacement.

In-depth research into the Femoral Head Prostheses Market has highlighted the significance of biomechanical analysis, dual mobility systems, and smart prostheses in improving patient outcomes and reducing the risk of revision surgeries. Advances in prosthesis design and advanced materials support enhanced joint function, especially in hip arthroplasty and joint replacement scenarios. Researchers are emphasizing the integration of femoral stem technology and improvements in hip socket compatibility to further extend the lifespan and functionality of implants. The global trend towards ambulatory centers and outpatient care settings is encouraging the development of lighter, adaptable prosthetics tailored to diverse anatomical needs. Studies also point to the growing collaboration between orthopedic experts and materials scientists to engineer high-performance prostheses that balance strength, weight, and bone integration while offering customizable solutions for complex clinical cases.

Get more details by ordering the complete report

The femoral head prostheses market is not just growing—it’s evolving. With new materials, surgical technologies, and demographic trends converging, this sector stands at a pivotal point. Industry players who act swiftly and smartly will not only capture market share but redefine orthopedic care for decades to come.

Safe and Secure SSL Encrypted