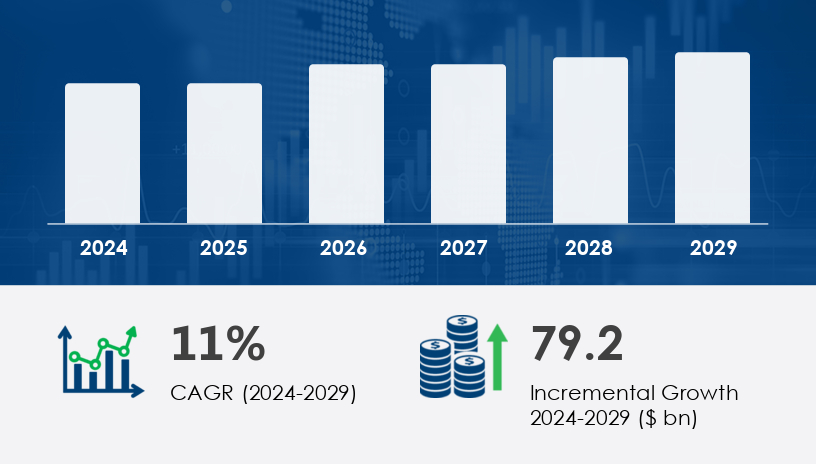

The fast fashion market 2025-2029 is set to witness unprecedented growth, driven by evolving consumer demographics, technological advancements, and shifting distribution channels. With an expected surge of USD 79.2 billion and a robust CAGR of 11% from 2024 to 2029, the industry remains a dynamic force in global apparel. In this comprehensive guide, we explore critical segments — gender, distribution channels, product types, and consumer demographics — providing strategic insights to help businesses navigate this fast-paced landscape.

For more details about the industry, get the PDF sample report for free

Fast fashion continues to dominate the global apparel industry by offering affordable, trend-responsive clothing that appeals to a broad consumer base. The market thrives on rapid design-to-retail cycles, social media influence, and expanding online and offline retail infrastructure.

| Segment | Key Highlights |

|---|---|

| Region | North America leads with 53% growth contribution |

| Product Types | Apparel, Footwear, Accessories |

| Distribution | Online and Offline channels balanced |

| Gender | Female segment valued highest |

| Consumer Demographics | Adults, Teens, Kids |

Growth Drivers & Challenges:

The female segment remains the largest revenue contributor, valued at USD 53.3 billion in 2019, with sustained growth expected through 2029. This segment’s expansion is fueled by increasing disposable income among women and their growing participation in the workforce, demanding both professional and casual apparel options. However, this segment faces challenges such as intense competition and counterfeit product availability that dilute brand value.

Expert Insight:

The female fast fashion market's growth is anchored in rapid trend cycles and strong social media engagement, but brands must innovate to protect authenticity.

Case Study:

Zara’s flagship stores globally serve as a tangible example of female segment dominance, where strategic location choices and curated collections capture urban female consumers seeking instant trend gratification.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Growth Drivers & Challenges:

While online sales have accelerated with the rise of e-commerce, physical stores remain crucial. Brick-and-mortar locations offer immersive brand experiences and instant gratification unavailable online. Offline channels, including pop-up shops and department stores, also enable localized marketing tailored to regional trends. However, online growth challenges offline retail, necessitating omni-channel strategies.

Expert Insight:

Offline stores continue to drive brand loyalty through experiential retail, even as online channels dominate convenience and reach.

Case Study:

H&M’s blend of online and offline sales channels highlights this dual strategy. Their in-store personalization and sustainable collection launches have enhanced customer engagement and retention.

Growth Drivers & Challenges:

The teen demographic is a powerful growth engine due to youth’s hunger for trendy, affordable apparel and heavy social media influence. Adults and kids also show rising demand, but teens exhibit the fastest adoption of fast fashion trends. Challenges include balancing affordability with sustainability concerns, especially as younger consumers grow environmentally conscious.

Expert Insight:

Teens are the trendsetters, and their purchasing habits shape the entire fast fashion supply chain.

Case Study:

Boohoo.com UK Ltd. has effectively targeted the teen segment via influencer marketing and frequent product drops aligned with social media trends.

Opportunities:

Expansion into emerging markets with rising youth populations

Leveraging social media marketing for real-time consumer engagement

Introduction of sustainable collections to meet growing eco-conscious demand

Customization and personalization technologies enhancing customer experience

Risks:

Proliferation of counterfeit products affecting brand integrity and pricing

Environmental regulations pressuring the use of synthetic fabrics and waste management

Intense market fragmentation increasing competition and price wars

Supply chain disruptions affecting ultra-fast production cycles

The fast fashion market size is forecast to increase by USD 79.2 billion with an impressive CAGR of 11% from 2024 to 2029. North America is expected to contribute 53% of the market growth, driven by rising incomes and shifting consumer preferences toward affordable fashion. Experts predict a growing blend of sustainability within fast fashion, with companies increasingly adopting eco-friendly materials and ethical production methods. Are companies ready to pivot from mere trend replication to sustainable fashion leadership?

The fast fashion industry has rapidly expanded, driven by fast fashion brands offering affordable fashion that appeals to Millennial and Gen Z consumers. The fast fashion supply chain plays a crucial role in enabling quick turnaround times and meeting the demand for the latest fast fashion trends and cheap fashion trends. This rapid production cycle has fostered growth in online fast fashion and fast fashion e-commerce, helping fast fashion retailers capture significant fast fashion market share and boost fast fashion sales globally. The industry’s digital transformation in fast fashion incorporates innovative fast fashion technology and leverages social media in fast fashion to influence consumer behavior and enhance fast fashion marketing strategies. However, as the fast fashion market size grows, challenges around fast fashion supply chain management and fast fashion supply chain issues are becoming more prominent.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

For Gender Segment Players:

Develop targeted marketing campaigns using data-driven insights on female consumer preferences

Invest in brand protection technologies to combat counterfeit goods

Expand plus-size and niche collections to capture diverse female demographics

For Distribution Channels:

Create seamless omni-channel shopping experiences integrating online convenience and offline engagement

Utilize pop-up shops and flagship stores for brand storytelling and localized trend testing

Harness social media influencer partnerships to drive both in-store and online traffic

For Consumer Demographics:

Leverage influencer marketing tailored to teens with fast product cycles and exclusive online launches

Incorporate sustainable and ethical product lines to appeal to eco-aware adults and younger consumers

Personalize offerings through AI-driven recommendations and customization

In-depth fast fashion market analysis reveals a growing awareness of the fast fashion impact on the environment and concerns about fast fashion and labor practices, pushing the rise of sustainable fast fashion and sustainable fashion alternatives. The juxtaposition of fast fashion vs. slow fashion highlights industry tensions between rapid consumption and sustainability goals. Despite these challenges, fast fashion companies continue to innovate with new fast fashion business models and tap into emerging fast fashion markets. Influencers and brands alike are driving consumer interest through fast fashion influencers and targeted campaigns, contributing to ongoing fast fashion sales trends. Moreover, the ongoing debate over luxury vs. fast fashion underscores consumer choices shaped by price, quality, and ethical considerations, all critical to understanding fast fashion consumer behavior and the future trajectory of the fast fashion industry.

Our analysis confirms the fast fashion market's rapid growth from 2025 to 2029, driven primarily by the female segment, a balanced online-offline retail approach, and trend-sensitive youth consumers. While opportunities in emerging markets and sustainable innovation abound, companies face significant risks from counterfeit products and environmental challenges. Adopting strategic marketing, leveraging social media, and embracing sustainability will be critical to winning in this competitive landscape.

Download our free Strategic Report for full 2025 insights and to stay ahead in the fast fashion market.

Safe and Secure SSL Encrypted