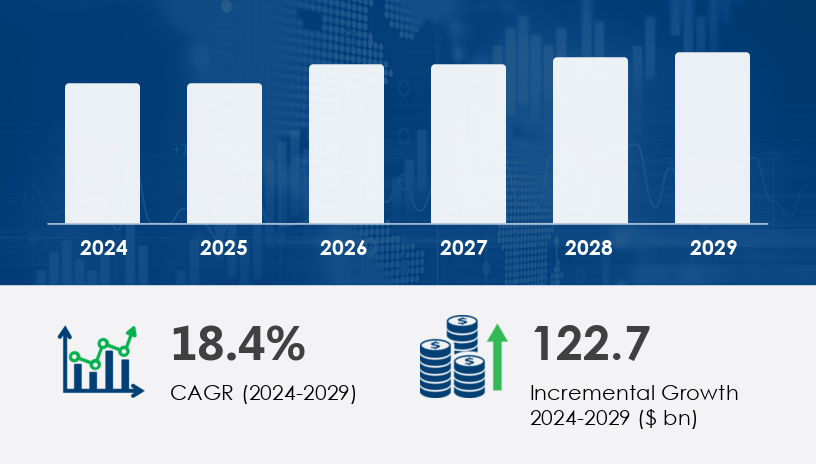

The European virtual cards market is poised for significant expansion, with projections indicating an increase of USD 122.7 billion between 2025 and 2029, reflecting a compound annual growth rate (CAGR) of 18.4%. This growth trajectory is primarily driven by the widespread adoption of contactless payment solutions, the integration of Near Field Communication (NFC) technology, and the escalating demand for secure, efficient digital payment methods across various industries.

For more details about the industry, get the PDF sample report for free

The surge in contactless payment adoption is a significant catalyst for the virtual cards market. Technologies like NFC enable secure, tap-and-go transactions, reducing the need for physical cards and enhancing user convenience. Major payment gateways, such as Stripe and Mastercard, have streamlined the bill payment process, allowing consumers to make transactions without the need for physical credit or debit cards. Retailers are increasingly adopting Point-of-Sale (PoS) systems designed for virtual payments, providing a faster checkout experience and effective information management.

NFC technology facilitates secure communication between devices in close proximity, enabling seamless contactless payments. This technology's convenience, speed, and enhanced security features have led to its widespread acceptance across Europe. Digital-first banks like Revolut Ltd. (UK) and N26 GmbH (Germany) have embedded NFC capabilities in their virtual cards, making them a mainstream choice for users seeking a plastic-less payment experience.

The increasing use of mobile payment applications, supported by biometric authentication such as fingerprint and facial recognition, is reshaping consumer behavior. Additionally, Europe’s mature payment infrastructure—boosted by 93% internet penetration in households (Eurostat, 2024)—is accelerating the integration of virtual cards into everyday transactions.

Virtual cards offer robust data encryption, cardholder authentication, and fraud prevention capabilities. These benefits, combined with reduced processing costs and enhanced workflow automation, are driving their adoption across industries. The emphasis on secure payments is driving the market's growth as virtual cards offer enhanced security features compared to traditional payment methods. The well-established payment infrastructure in Europe is expected to further fuel the demand for virtual cards during the forecast period.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Businesses are increasingly adopting real-time monitoring tools and API integrations to streamline payment processing. These technologies enable automated reconciliation, spend monitoring, and enhanced data analytics, providing businesses with greater control over their financial operations.

Companies are actively digitizing their payment operations. Whether through prepaid cards, cloud-based card management platforms, or blockchain integration, businesses are customizing card limits, monitoring usage, and complying with regulatory mandates while conducting international transactions seamlessly.

The integration of blockchain technology and smart contracts is transforming the virtual cards landscape. These innovations not only improve transaction security but also streamline processes for businesses. Companies like Stripe are leveraging these technologies to offer more flexible and secure virtual card solutions, promoting greater user confidence.

Although mobile payments complement the virtual card ecosystem, their dominance presents a challenge. Digital wallets using smartphones often leverage the same biometric and encryption technologies, but with broader consumer adoption, making it imperative for virtual card providers to differentiate through innovation and B2B-centric features.

The evolving regulatory landscape around data privacy and cybersecurity across Europe adds a layer of complexity. Companies must invest heavily in compliance, multi-factor authentication, and data protection standards to navigate regional nuances effectively. The rise in cyber fraud has led to heightened demand for secure payment solutions. According to the European Union Agency for Cybersecurity (ENISA), cyber incidents have increased by 75% over the past year, prompting businesses to adopt virtual cards for their enhanced security features.

B2B Virtual Cards: This segment is projected to witness substantial growth. The rise in mobile disbursements, driven by internet availability and digital transformation, is making B2B virtual cards essential for industries such as BFSI, healthcare, retail, and education. These cards offer cost control, fraud prevention, and operational efficiency.

B2C Remote Payment Virtual Cards

B2C POS Virtual Cards

B2B Payments

Consumer Purchases

Travel Bookings

Tokenization

Encryption

API Integration

The virtual cards market in Europe is segmented by country, with each nation showcasing unique growth patterns driven by local adoption and digital infrastructure maturity.

France

Italy

Switzerland

UK

The UK remains a hotspot for fintech innovation, hosting companies such as Monese Ltd., Curve OS Limited, Wise PLC, Checkout.com, Skrill Limited, Neteller, EcoPayz, Monzo Bank Limited, and Starling Bank Limited. These firms are leading the shift toward NFC-enabled and API-integrated virtual cards.

Switzerland, represented by major players like UBS Group AG and Credit Suisse AG, is focusing on enterprise-grade security and cross-border functionality, while France, home to BNP Paribas and Société Générale S.A., is investing in open banking and digital card management platforms. In Italy, FinecoBank S.p.A. is contributing to growing adoption among both SMBs and large enterprises.

The Europe Virtual Cards Market is experiencing rapid growth driven by the increasing demand for secure and seamless contactless transactions and innovative credit alternatives. Businesses and consumers alike are embracing prepaid cards, debit solutions, and corporate cards to streamline payments, particularly for business travel and employee spending. Virtual cards are being integrated into mobile wallets and banking apps, enhancing convenience and enabling features such as card reload, card personalization, and real-time tracking. The use of transaction limits, budget control, and expense management tools supports more efficient financial oversight. Additionally, the rise in payment gateways and payment processors across Europe is facilitating broader card integration, while features like card rewards and loyalty programs add value to the consumer experience. Secure authentication, supported by tokenized security and card tokenization, plays a critical role in fraud prevention, making virtual cards a trusted option for everyday digital transactions.

Get more details by ordering the complete report

The Europe virtual cards market is marked by intense competition and rapid innovation, as both fintech startups and established financial institutions race to capture market share. Leading companies are deploying a range of strategic initiatives—including alliances, mergers and acquisitions, regional expansions, and product innovations—to strengthen their positions and address evolving customer demands across industries.

The market is populated by a mix of digital-first disruptors and traditional banking giants. Prominent players include:

Research in the European virtual cards market is focused on advancing technologies that enhance security, functionality, and user experience. Features such as dynamic CVV, biometric security, and digital identity verification are becoming standard, especially for high-risk or cross-border payments. Innovations like blockchain payments, smart contracts, and peer-to-peer transfers are being explored for their potential to reshape the virtual payments landscape. Support for multi-currency support, currency exchange, and instant funding is also expanding the utility of virtual cards in international commerce. Providers are improving payment APIs to ensure seamless card issuance, card lifecycle management, and integration with virtual accounts. The growing demand for services like subscription billing and transparent transaction fees is pushing advancements in card analytics, allowing businesses to better understand usage patterns and improve services. Overall, Europe's virtual card ecosystem is evolving rapidly, driven by the intersection of financial innovation and digital transformation.

Safe and Secure SSL Encrypted