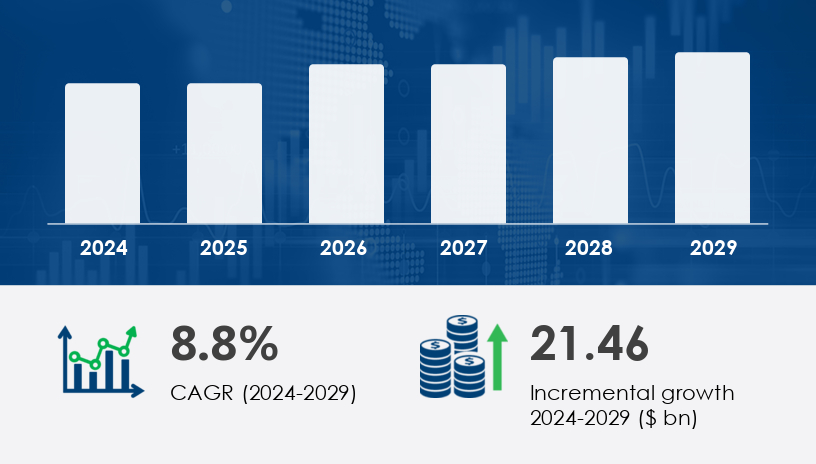

The Europe Vehicle Rental Market is poised for substantial expansion between 2025 and 2029, driven by evolving consumer behavior, increased travel demand, and the widespread adoption of tech-driven rental solutions. According to recent data, the Europe vehicle rental market is projected to grow by USD 21.46 billion during the forecast period, with a compound annual growth rate (CAGR) of 8.8%. The integration of advanced technologies such as GPS tracking, telematics, and mobile applications has revolutionized the vehicle rental experience. These innovations enable real-time vehicle tracking, streamlined booking processes, and enhanced customer service.

For more details about the industry, get the PDF sample report for free

One of the key growth drivers for the Europe Vehicle Rental Market is the growing awareness and preference for rental cars among European consumers, particularly within the upper-middle-class demographic. The shift from ownership to mobility solutions is becoming more pronounced as consumers seek flexibility, affordability, and environmental responsibility. Vehicle rental services are increasingly seen as a cost-effective and sustainable alternative to car ownership. In addition, online platforms and mobile apps have simplified the rental process, offering real-time booking, insurance options, and vehicle selection. According to analysts, this shift in consumer mindset has dramatically expanded the customer base for rental companies, especially in urban centers where car ownership is less practical.

A notable trend shaping the Europe Vehicle Rental Market is the growing reliance on technology-driven services to enhance customer experience and expand market penetration. Online booking platforms and mobile apps are now the primary interfaces for vehicle rentals, allowing customers to access real-time vehicle availability, integrated GPS, entertainment systems, and insurance options. Operators like Enterprise Rent-A-Car and National Rental Car are leveraging these platforms to streamline their services. This trend is particularly relevant as environmental regulations and emission standards influence vehicle fleets, pushing rental companies to adopt more fuel-efficient and electric vehicles. Additionally, urban consumers’ rising preference for self-driven rentals and digital-first solutions reflects a larger shift toward independent, tech-enabled travel.

The Europe Vehicle Rental Market is undergoing a significant transformation driven by evolving mobility trends and increased travel activity. Traditional car rental services are being complemented by the growing demand for electric vehicle rentals, as sustainability becomes a top priority. Companies are investing heavily in fleet management software to streamline operations and improve customer service. Emerging technologies like self-driving cars are also beginning to shape the landscape, particularly in urban centers. Niche segments such as luxury car rentals and airport car hire continue to attract high-end travelers and business clients. With diverse customer needs, providers are offering long-term rentals and short-term leases, catering to everything from extended business trips to weekend getaways. The rise of vehicle sharing platforms and ridesharing services adds further complexity to the ecosystem, while advancements in battery technology and charging infrastructure are facilitating the shift toward eco-friendly vehicles.

The Europe Vehicle Rental Market is segmented by:

Distribution Channel

Offline

Online

Type

Short term

Long term

Among all segments, the offline distribution channel is anticipated to experience significant growth through 2029. This segment includes rental offices, travel agents, and hotel partnerships, which remain vital in serving spontaneous or non-digital-native customers. Offline channels are particularly useful for tourists and business travelers who often rely on hotel concierges or travel agents for car bookings. Offline distribution enables faster resolution of issues, personal interaction, and immediate service — advantages that online-only platforms may lack. Analysts note that this segment appeals especially to customers seeking immediate assistance, driving a substantial share of bookings in high-traffic locations like airports and hotels. Offline rentals are expected to play a pivotal role in bridging traditional customer expectations with evolving service offerings.

Covered regions:

Germany

UK

France

Italy

Within the global landscape, Europe itself holds the leading market share for vehicle rentals and is projected to sustain this dominance through 2029. Germany, the UK, France, and Italy are among the key contributors to regional growth. Germany-based Sixt, for instance, announced plans in January 2024 to acquire 250,000 vehicles from Stellantis to strengthen its European and North American operations by 2026. Additionally, in June 2023, Europcar partnered with BringOz to automate vehicle logistics, enhancing operational efficiency. The region benefits from high travel volume, especially around airports and metropolitan areas, combined with a mature consumer base that values both convenience and sustainability. Analysts indicate that these structural advantages and tech-driven innovations will solidify Europe’s leading role in the vehicle rental space.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Despite its upward trajectory, the Europe Vehicle Rental Market faces growing pressure from car-sharing services, which pose a significant challenge to traditional rental business models. Services like Bolt Drive, which expanded through a €126 million leasing agreement in 2023, appeal to cost-conscious and environmentally aware consumers seeking flexible urban transport. Carpooling, ride-hailing, and other mobility-as-a-service platforms are increasingly popular, especially among young urban dwellers. These alternatives often offer similar convenience without the commitment or cost structure of traditional rentals. According to market insights, the growing popularity of such services is diluting market share for conventional rental providers, particularly in cities with robust public transit and mobility options.

Current market research highlights the increasing importance of dynamic rental pricing models and personalized customer loyalty programs in retaining and expanding the customer base. The adoption of online booking systems by travel rental companies has significantly improved booking convenience and operational efficiency. Trends in passenger logistics reveal that modern travelers demand flexibility and speed, making vehicle maintenance and rental car affordability essential factors in competitiveness. With rising international tourism across Europe, the need for digital payment options and enhanced in-car infotainment systems has grown. Meanwhile, the concept of autonomous vehicle rentals is gaining traction, especially among tech-savvy users. Businesses are increasingly utilizing corporate car hire, and innovations like peer-to-peer rentals are democratizing access to mobility. The demand for fuel-efficient vehicles is also rising, while providers are expanding offerings like rental car insurance and implementing real-time fleet tracking systems to improve user trust and safety.

Detailed research analysis reveals growing interest in alternative mobility models such as subscription rental plans and hybrid vehicle rentals, which provide cost-effective and flexible solutions for long-term users. The integration of car rental apps and comprehensive mobility services has made renting more accessible than ever. Technologies like vehicle telematics are playing a critical role in enhancing operational transparency and optimizing usage. Promotional strategies involving rental car discounts are being used to attract seasonal travelers, especially in the tourism vehicle rentals segment. The trend toward on-demand transportation is pushing providers to focus on rental car availability and ensure efficient allocation of vehicles across popular destinations. Technical aspects such as electric car range are influencing customer choices, especially for regional travel. Marketing campaigns are being reinforced by customer rental incentives, and strategic vehicle rental partnerships are forming to improve car hire convenience and meet the growing demand across urban and rural Europe.

Leading companies in the Europe Vehicle Rental Market are adopting a mix of strategic partnerships, fleet expansion, and digital transformation to remain competitive. For example, Sixt's acquisition plan to add 250,000 vehicles to its fleet reflects a major investment in scalability. Meanwhile, Europcar’s digital collaboration with BringOz represents a shift toward logistics automation to enhance operational efficiency. Another notable development came in December 2023, when Sixt began phasing out Tesla electric vehicles due to declining resale values — a decision showcasing the complex balance between innovation and profitability.

Key companies active in the market include:

Avis Budget Group Inc.

Enterprise Holdings Inc.

Europcar Group UK Ltd.

SIXT SE

Hertz Global Holdings Inc.

LeasePlan Corp. NV

BNP Paribas SA

TIP Trailer Services Management B.V.

City Vehicle Rentals Ltd.

Petit Forestier

These players are focused on digital booking tools, international partnerships, and eco-friendly vehicle fleets to meet evolving customer expectations. Analysts emphasize that investment in digital transformation and fleet electrification will be essential for sustained market leadership.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Distribution Channel

6.1.1 Offline

6.1.2 Online

6.2 Type

6.2.1 Short term

6.2.2 Long term

6.3 Geography

6.3.1 Germany

6.3.2 UK

6.3.3 France

6.3.4 Italy

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted