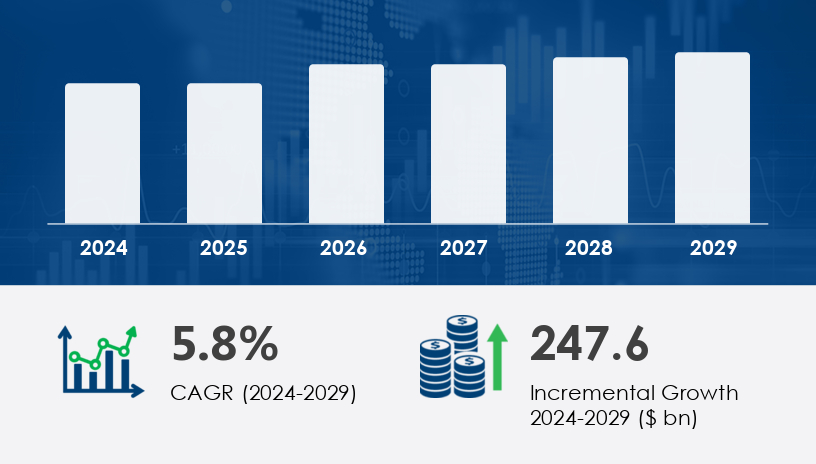

The European foodservice market is set to expand by USD 247.6 billion, with a projected CAGR of 5.8% between 2024 and 2029. This growth is driven by the rising consumer demand for convenient and indulgent food options, alongside increased consumption of snacks. The market is also witnessing a surge in demand for ethnic cuisine as Europe’s diverse population seeks varied culinary experiences. However, labor shortages continue to be a significant challenge for the foodservice industry, affecting restaurant operations, catering services, and commercial kitchens alike. The growth of food delivery and quick service establishments has intensified as consumers increasingly turn to digital ordering. Meanwhile, fine dining establishments are focusing on sustainable practices and improved food packaging to cater to evolving customer preferences.

For more details about the industry, get the PDF sample report for free

The European foodservice market is segmented by sector, service type, and geography. Below is a detailed breakdown of each of these segments:

Commercial

The commercial segment, including QSRs and full-service restaurants, dominates the European foodservice market. This segment is crucial due to its focus on convenience and diversity. Quick-service restaurants, including takeout, delivery, and counter-service establishments, continue to be popular among consumers seeking convenience. This segment will drive market growth throughout the forecast period.

Non-commercial

The non-commercial segment includes institutional foodservices such as those found in hospitals, schools, and corporate cafeterias. Though not as dominant as the commercial sector, it plays a significant role in providing foodservice solutions to specific consumer groups.

Conventional

Conventional foodservice establishments prepare and serve fresh food daily. This traditional method is still widely adopted in various sectors, particularly in full-service restaurants and some independent outlets.

Centralized

Centralized services involve food preparation at a central location and then distribution to satellite facilities. This method is particularly popular with institutional settings.

Ready-Prepared

Ready-prepared foodservice establishments focus on pre-cooked or pre-prepared meals. This service type is growing in popularity due to the increasing demand for convenience.

Assembly-Serve

This type of service involves minimal food preparation, focusing on assembling ready-made food components before serving. It is common in mobile food services, food trucks, and some fast-food chains.

The European foodservice market operates within several key regions:

These countries represent the largest markets in the European foodservice industry, each contributing significantly to market growth through evolving food preferences and foodservice innovations.

Increased Snacking and Indulgent Consumption

One of the main drivers of growth in the European foodservice market is the increasing trend of snacking and indulgence. Consumers seek variety and convenience, driving demand for quick bites and indulgent foods across a range of establishments. This trend has boosted the growth of cafes, bars, and QSRs, which cater to these preferences.

Cloud Kitchens and Convenience-Driven Demand

The rise of cloud kitchens is transforming the foodservice landscape. These delivery-only outlets allow foodservice providers to operate without a physical storefront, reducing overhead costs and improving efficiency. Cloud kitchens meet consumer demands for quick, convenient meal solutions, especially in urban areas where delivery options are increasingly popular.

Sustainable Practices and Local Sourcing

Sustainable practices, such as sourcing organic and locally produced ingredients, are becoming increasingly important in the European foodservice market. Many restaurant owners and foodservice operators are embracing this trend, incorporating ethical and environmentally friendly practices into their operations. This focus on sustainability resonates with a growing number of consumers who prioritize environmentally conscious choices.

Ethnic Cuisine and Diverse Menu Offerings

The highly diverse population in Europe is driving demand for ethnic cuisine, including dishes from regions such as the Middle East, South Asia, and the Mediterranean. Restaurants are increasingly offering unique and authentic menu items, catering to the tastes of diverse consumer groups. Popular menu items include Arabian appetizers, Poulet tandoori, and bouillabaisse. Independent outlets and local businesses are also thriving by offering diverse, healthy menu options such as quinoa bowls and plant-based alternatives.

Technology and Personalization

The integration of technology into the foodservice industry is revolutionizing the customer experience. Mobile applications, online ordering, and personalized menu recommendations are becoming standard offerings for many foodservice establishments. Consumers expect a seamless digital experience when interacting with their favorite restaurants, and technology enables operators to cater to this demand effectively.

Community Outreach and E-commerce Channels

Many foodservice operators are engaging with local communities through outreach programs and partnerships with local organizations. E-commerce channels are also growing in importance, allowing restaurants to expand their reach beyond physical locations. These channels are vital for building strong relationships with consumers and fostering loyalty through digital platforms.

Labor Shortages

The foodservice sector in Europe faces significant challenges related to labor shortages. Staffing issues are particularly prevalent in full-service restaurants and QSRs, where high employee turnover rates and increasing labor costs are common problems. Foodservice operators are turning to innovative solutions, such as automation and streamlined operations, to mitigate the impact of these shortages.

Maintaining Operational Efficiency

In addition to labor shortages, foodservice operators face challenges in maintaining operational efficiency. With the rise of cloud kitchens and mobile food services, operators must adapt to evolving consumer demands while keeping costs under control. This balance between innovation and efficiency is critical for sustaining long-term growth in the market.

Get more details by ordering the complete report

The foodservice market is experiencing rapid growth, with rising demand driving innovations across sectors such as commercial kitchen equipment and restaurant supply chains. Key players in food delivery services and quick service restaurants are expanding their operations to meet customer expectations for convenience and efficiency. Meanwhile, the catering industry trends indicate a shift towards more flexible and customer-centric solutions. Additionally, institutional foodservice providers are adopting sustainable food practices to align with environmental concerns. Innovations in foodservice packaging and cloud kitchen models are gaining popularity, helping businesses optimize operations and enhance their market presence.

The European foodservice market features several prominent players, each contributing to the market's growth and development. These companies implement strategies such as partnerships, mergers, acquisitions, and geographical expansion to strengthen their market presence:

In-depth research into the fine dining operations and menu innovation trends reveals a strong focus on meeting evolving customer preferences while adhering to stringent food safety standards. The demand for contract catering services has surged, particularly in the corporate and education sectors. Companies offering hospitality food solutions are now exploring new avenues for foodservice market growth by implementing takeaway food systems and embracing plant-based foodservice options. With the rise of digital ordering platforms, foodservice logistics have become more efficient, allowing businesses to better manage delivery and supply chain challenges while ensuring customer satisfaction.

Safe and Secure SSL Encrypted