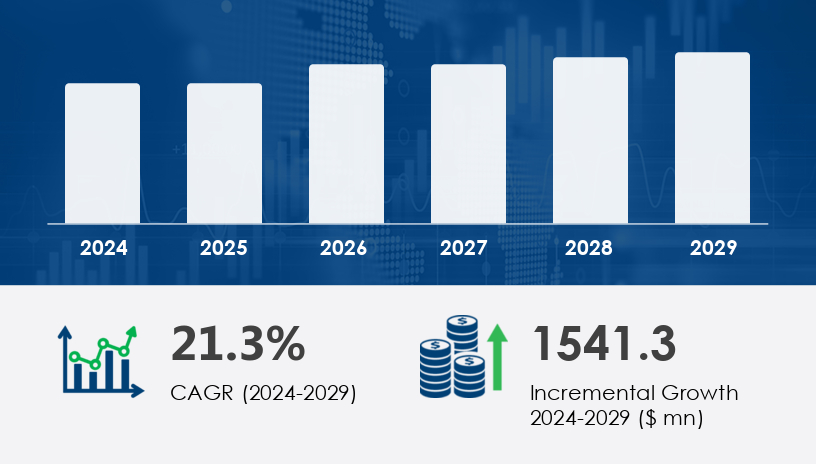

ESG Reporting Software Market Size 2024-2028

The ESG reporting software market is forecast to grow by USD 1.18 billion, with a compound annual growth rate (CAGR) of 19.63% between 2023 and 2028. This growth is driven by the increasing volume of corporate data and the rising importance of Environmental, Social, and Governance (ESG) reporting. With growing demand from investors and regulatory bodies, organizations across various sectors are adopting ESG reporting solutions to assess sustainability performance and enhance transparency.

For more details about the industry, get the PDF sample report for free

Market Segmentation

Deployment Insights:

- On-premises: The on-premises segment is expected to witness significant growth during the forecast period. The benefits of reduced energy usage and potential cost savings (estimated at 80-85%) make it a favorable option. On-premises solutions offer enhanced security, giving organizations more control over their data and IT infrastructure.

- Cloud-based: Cloud-based solutions remain popular due to their flexibility, scalability, and cost-effectiveness.

End-User Insights:

- Large Enterprises: Larger organizations are increasingly adopting ESG reporting software to streamline their sustainability efforts and meet regulatory requirements.

- SMEs: Small and medium-sized enterprises (SMEs) are also recognizing the value of ESG reporting software for ensuring compliance and enhancing corporate governance.

Regional Market Trends

North America:

- United States is a key contributor, accounting for 41% of the global market growth. This region is experiencing significant growth due to increased regulatory focus on workplace safety and sustainability practices, with organizations using ESG reporting software to manage ESG initiatives. Other than United States, Canada is a key contributor.

Europe:

- Germany plays a crucial role in ESG adoption, with numerous industries implementing ESG reporting systems to align with evolving sustainability mandates.

Asia-Pacific (APAC):

- China and Japan are key players in the ESG software market in APAC, focusing on climate risk, corporate governance, and sustainability practices.

South America:

- Emerging markets are adopting ESG solutions to meet the growing demand for sustainability reporting and investor transparency.

Middle East and Africa (MEA):

- ESG reporting is gaining traction as the region shifts toward more sustainable and socially responsible business practices.

Market Dynamics

Drivers:

- Increasing Corporate Data Volumes: The growth in corporate data is driving demand for advanced ESG reporting solutions.

- Investor Demand for Sustainability Transparency: There is an increasing need for businesses to disclose sustainability performance, which has led to wider adoption of ESG reporting software.

- Advanced Analytics Adoption: Cloud-based, SaaS-based AI, and other advanced analytics tools have made it easier for businesses to track and report on sustainability metrics.

Trends:

- Emergence of Analytics in ESG Software: Advanced analytics, including artificial intelligence, predictive analytics, and satellite imagery, are enhancing the capabilities of ESG reporting software. These technologies enable more effective climate change monitoring, emissions management, and stakeholder engagement.

- Sustainability Reporting for Green Bonds: The demand for green bonds has increased the adoption of ESG software, as financial institutions require detailed sustainability assessments.

Challenges:

- High Initial Capital Investments: One of the biggest challenges facing smaller organizations is the high initial investment required for implementing ESG reporting software.

- Integration with Existing Systems: Integrating ESG reporting solutions with ERP systems remains a barrier for some organizations, impacting adoption.

Get more details by ordering the complete report

Key Players

- Benchmark Digital Partners LLC

- Brightest Inc.

- Diginex

- Diligent Corp.

- DNV Group AS

- ESG Enterprise

- GS Topco GP LLC

- Intelex Technologies ULC

- International Business Machines Corp.

- Metrix Software Solutions Pty Ltd.

- Morningstar Inc.

- Nasdaq Inc.

- Newgen Software Technologies Ltd.

- PricewaterhouseCoopers LLP

- Salesforce Inc.

- Sustain.Life Inc.

- UL Solutions Inc.

- Updapt CSR Private Ltd.

- Wolters Kluwer NV

- Workiva Inc.

Recent Developments

- October 2023: Benchmark Digital Partners LLC launched its ESG Compass software, enabling businesses to effectively assess, monitor, and disclose their ESG performance using advanced analytics.

- January 2024: Salesforce Inc. introduced new AI-powered tools to help businesses enhance their sustainability reporting and meet the evolving demands of investors and regulators.