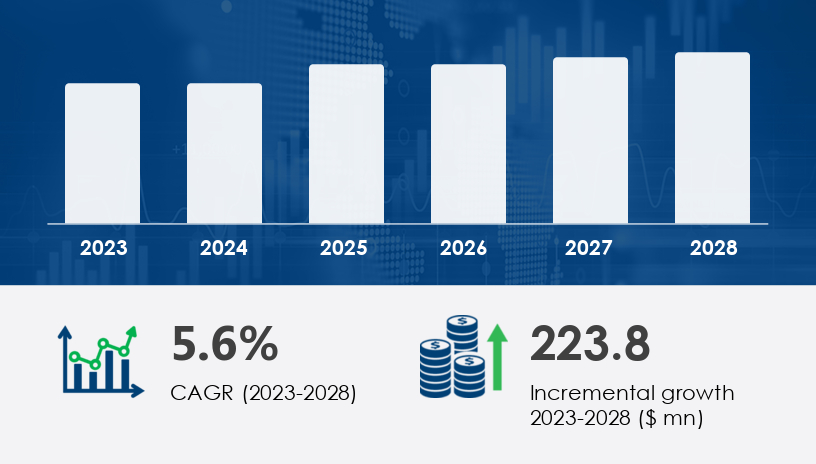

The global electric motors for IC engine vehicles market is forecast to grow by USD 223.8 million at a CAGR of 5.6% between 2023 and 2028. This momentum reflects how electrification is redefining traditional ICE platforms with efficiency-focused innovations. With the rise of power window systems and evolving consumer demands for convenience and sustainability, electric motors are becoming indispensable components even in non-electric vehicles.

In this comprehensive guide to the Electric Motors for IC Engine Vehicles Market, we dive deep into segment-level insights by vehicle type and geography, delivering a 2025 outlook framed by expert analysis, growth challenges, and actionable strategies. This article blends expert commentary with relevant data to empower automotive leaders navigating an increasingly hybridized vehicle ecosystem.

For more details about the industry, get the PDF sample report for free

Electric motors in ICE vehicles are no longer niche—they're essential. From power steering to window regulators, these motors enhance performance, fuel efficiency, and comfort in modern vehicles. Electrification efforts and emission regulations are fueling widespread integration across all vehicle classes.

| Segment | Key Insights |

|---|---|

| Forecast (2023–2028) | USD 223.8 million increase; CAGR of 5.6% |

| Top Region | Asia-Pacific (58% of global market growth) |

| Top Vehicle Segment | Passenger Cars (PC) dominate due to comfort features and electrification trends |

| Growth Driver | Rising demand for power window systems, zero-emission targets, in-house motor production |

| Major Markets | China, India, Japan, US, Germany |

Passenger cars continue to dominate the market. Increasing adoption of entry-level sedans, SUVs, and MPVs—especially in Asia-Pacific—is fueling demand for electric motors powering windows, seats, and steering systems. The drive for comfort, fuel efficiency, and emission compliance makes electric motor integration essential.

Challenge: Rising regulatory complexity and supply chain constraints for components such as rare earth magnets and lithium.

"The electrification of ICE passenger cars is not just about propulsion—it’s about enhancing every driving experience touchpoint, from windows to HVAC systems," says a Lead Analyst for Technavio's Automotive Research.

APAC holds 58% of global growth in this segment.

The PC segment was valued at USD 468.2 billion in 2018, showing a sustained upward trend.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Commercial fleets are undergoing partial electrification to meet CO2 reduction targets without transitioning entirely to EVs. Integration of electric motors for power steering, HVAC, and lift gates in delivery vans and trucks helps optimize fuel usage.

Challenge: Maintaining cost-efficiency for fleet operators while adhering to strict emission norms.

"Commercial vehicles are where electric motor innovations can significantly impact operating margins and regulatory compliance," notes a Commercial Fleet Technology Consultant.

A logistics firm in Germany upgraded its delivery vans with electric HVAC and lift systems. This reduced fuel consumption by 7% annually while improving driver comfort and reliability in urban routes.

Electrification in CVs is closely tied to urban mobility trends and government incentives.

Demand is rising for motors that support multi-functional upgrades without increasing vehicle weight.

Emerging economies are seeing a surge in electric-assisted two-wheelers, especially for deliveries and last-mile connectivity. Small electric motors improve throttle control, braking systems, and lighting—key to safety and user experience.

Challenge: Battery availability and lightweight integration remain concerns, especially in price-sensitive markets.

"Two-wheelers are proving to be the perfect gateway for scaled electric motor deployment in cost-sensitive urban markets," says a Senior Mobility Analyst.

Two-wheeler market growth is aligned with zero-emission transport goals.

Popular in South Asia and Southeast Asia, where two-wheelers dominate personal transport.

Emerging Markets: India, Brazil, and Southeast Asia offer high growth potential for motorized ICE vehicles.

Smart Features: Demand for convenience features like automated windows, seats, and doors is pushing OEMs to integrate more electric motors.

In-House Manufacturing: Companies producing electric motors internally reduce supply dependency and enhance R&D agility.

Battery Supply Chains: Critical mineral shortages and environmental scrutiny challenge scalability.

Regulatory Hurdles: Varying emission norms across regions add complexity.

Cost Pressure: Balancing electrification with affordability is essential, particularly in mass-market segments.

The Electric Motors for IC Engine Vehicles Market is evolving as automakers increasingly integrate electric motors to enhance traditional internal combustion (IC) engine performance. Essential components like the starter motor and alternator system play critical roles in initiating engine function and maintaining battery charging. The use of brushless motors, along with DC motors and AC generators, is expanding to support improved power output and torque delivery in various vehicle classes. Hybrid vehicles, in particular, benefit from these advancements, as electric motors contribute to fuel efficiency and overall engine performance. Components such as the engine starter, electromagnetic coil, rotor assembly, and stator core are key to optimizing motor efficiency and enabling reliable engine support. With increasing emphasis on vehicle refinement, innovations like voltage regulators, cooling fans, and motor housings ensure smoother operation and better thermal management, ultimately supporting modern automotive power demands.

The market will increase by USD 223.8 million between 2023 and 2028, growing at a CAGR of 5.6%. Demand will be led by APAC, driven by rapid urbanization, expanding middle-class segments, and policy support for green mobility. Are automakers ready to pivot from ICE powertrains to electric motor ecosystems at scale?

"By 2028, over 70% of new ICE vehicle models will incorporate advanced electric motor systems as standard, not optional, features," predicts a senior Technavio expert.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Here’s how OEMs and suppliers can seize the moment:

Prioritize electric motor integration for windows, HVAC, and seats to meet comfort expectations.

Explore government incentive programs in APAC for hybridization initiatives.

Invest in electrified HVAC and lift systems for fuel efficiency gains.

Utilize urban charging infrastructure incentives for retrofitted vehicles.

Collaborate with motor suppliers for cost-effective custom solutions.

Integrate compact electric motor systems for safety and throttle enhancements.

Target subsidies and regulatory alignment for urban electric mobility in Asia.

In-depth analysis of the market reveals growing adoption of advanced motor technologies like permanent magnet motors, synchronous motors, and induction motors to improve electric drive systems in IC engine vehicles. These motors are integral powertrain components, offering advantages such as high torque, low noise, and improved load capacity. Key elements including armature winding, field magnets, and commutator rings are engineered for enhanced motor durability and precise motor control. Applications like crankshaft drive and ignition system synchronization benefit from refined speed regulation and efficient energy conversion. Moreover, the integration of electric circuits within vehicle architecture supports better vibration reduction and thermal stability, contributing to long-term engine and motor health. As manufacturers seek to balance efficiency with performance, electric motors are becoming indispensable in elevating the capabilities and sustainability of conventional vehicle platforms.

The electric motors for IC engine vehicles market is more than a transitional phase—it’s a strategic inflection point for the global automotive industry. As passenger cars, commercial vehicles, and two-wheelers integrate electric motor technologies, the line between ICE and EV continues to blur.

Download our free Strategic Report for full 2025 insights and discover how your business can drive innovation through intelligent electrification.

Safe and Secure SSL Encrypted