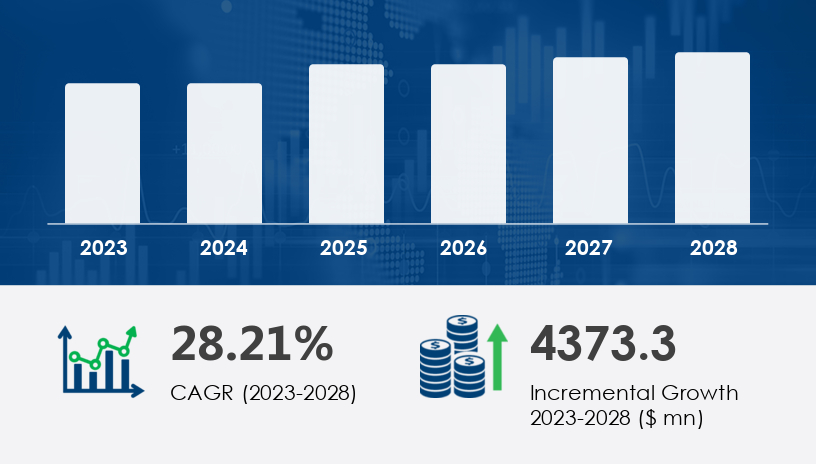

With a projected market expansion of USD 4.37 billion at a staggering CAGR of 28.21% between 2023 and 2028, the Duchenne Muscular Dystrophy (DMD) therapeutics market is entering a transformative era. In this 2025 outlook and comprehensive guide, we delve into the strategic dynamics, technological breakthroughs, and regional trends that define the rapidly evolving landscape of Duchenne Muscular Dystrophy treatment. With biotech innovation accelerating and regulatory green lights paving new pathways, the DMD therapeutics market stands at the intersection of urgent medical need and revolutionary science.

For more details about the industry, get the PDF sample report for free

The Duchenne Muscular Dystrophy (DMD) Therapeutics Market is witnessing significant growth, driven by advances in genetic medicine and increasing clinical research. Key treatment strategies include exon-skipping, gene therapy, and antisense oligonucleotide technologies, all aimed at addressing the underlying genetic mutations that lead to DMD. Agents such as eteplirsen, golodirsen, viltolarsen, and casimersen are designed to promote dystrophin restoration, a crucial protein lacking in DMD patients. Additionally, corticosteroids and steroid therapy options like deflazacort and vamorolone remain standard treatments for slowing disease progression. Other emerging approaches include mutation suppression with drugs like ataluren, and mitochondrial enhancers such as idebenone. Innovations in delivery mechanisms like AAV vectors are enabling more effective administration of genetic materials, while myoblast transfer and stem cell research offer potential regenerative strategies. The integration of physical therapy and NSAIDs complements pharmacological approaches by aiding mobility and managing inflammation.

Duchenne Muscular Dystrophy (DMD) is the most prevalent form of pediatric muscular dystrophy, affecting 1 in every 3,500 live male births globally. This X-linked recessive disorder leads to progressive muscle degeneration, loss of ambulation by adolescence, and premature death — often in early adulthood due to respiratory or cardiac failure.

Despite significant progress, no cure currently exists. Treatment strategies are focused on symptom management and disease progression delay, fueling an industry-wide race for disease-modifying solutions.

"We are standing at the precipice of a paradigm shift in the treatment of genetic neuromuscular disorders. With gene therapy becoming viable and exon skipping showing clinical promise, DMD care will never be the same," says a senior Technavio expert.

Pipeline Maturity: The market boasts a strong pipeline with gene-editing tools (like CRISPR), biologics, and antisense oligonucleotides in advanced trials.

Regulatory Momentum: The FDA's accelerated approval pathways and Orphan Drug Designation programs are fueling investment.

Patient-Centric Innovation: Personalized medicine and AI-driven diagnostics are optimizing treatment paths.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Type Insights:

Biologics: Poised for significant growth, with gene therapy leading the way. EXONDYS 51 and upcoming exon-skipping variants are gaining traction.

Small Molecules: Offering affordability advantages but often limited in efficacy.

Distribution Channel Insights:

Online platforms are gaining popularity over offline distribution due to increased DMD awareness and telehealth integration.

Route of Administration Insights:

Intravenous (IV) and intramuscular routes dominate emerging therapies, though oral options remain relevant for corticosteroid-based interventions.

In February 2025, Sarepta Therapeutics secured another FDA approval for EXONDYS 51, its flagship exon-skipping therapy. This marked a strategic milestone, not only reinforcing Sarepta’s market dominance but also validating the therapeutic potential of RNA-targeting biologics. Clinical trials showed a 16% improvement in respiratory muscle strength and delayed onset of cardiomyopathy.

Pros:

Targets root genetic defect

Demonstrated functional improvement

Backed by strong IP protection

Cons:

Cost exceeds USD 300,000/year

Effective only in patients with specific exon mutations

Long-term safety data still emerging

North America contributes 39% of global DMD therapeutics revenue, thanks to:

Advanced newborn screening programs

Robust clinical infrastructure

High drug affordability through insurance systems

Notable Regional Players:

Sarepta Therapeutics

PTC Therapeutics

Pfizer (in collaboration with Sangamo Therapeutics)

Therapies are increasingly mutation-specific. Platforms using antisense oligonucleotides and exon skipping focus on tailored intervention — a strategy now being validated through regulatory and patient acceptance.

Gene therapy candidates such as BMN 351 (BioMarin) aim to replace defective dystrophin genes using viral vectors. The prospect of a one-time, curative intervention is drawing major biotech investment — but manufacturing scalability and long-term safety remain barriers.

| Challenges | Impact |

|---|---|

| High Treatment Costs | Limits access and payer adoption |

| Regulatory Delays | Slows market entry of new drugs |

| Complex Clinical Trial Design | Hampers recruitment & timelines |

| Genetic Diversity in Patients | Requires tailored therapeutic models |

By 2028, over 50% of newly diagnosed DMD patients will have access to a disease-modifying treatment.

Emerging markets, particularly in APAC and South America, will see double-digit adoption growth fueled by localized manufacturing and regulatory harmonization.

AI-powered diagnostics and next-gen sequencing will enhance early detection and mutation-specific therapy mapping.

Get more details by ordering the complete report

Research analysis in the DMD therapeutics space emphasizes the development of advanced therapies focused on gene correction and muscle regeneration. Cutting-edge techniques like CRISPR/Cas9-based gene editing and molecular therapy approaches are rapidly evolving, aiming to provide long-term benefits by targeting the root cause of DMD. Promising pipeline candidates include micro-dystrophin constructs such as PF-06939926, BMN 351, and SGT-003, which are designed to restore partial dystrophin function in muscle cells. Other investigational treatments like CAP-1002, GNT 0004, and AGAMREE target broader mechanisms such as muscle repair, anti-inflammatory effects, and reduction of fibrosis through fibrosis inhibitors. Novel therapies are also exploring utrophin upregulation as a dystrophin-independent approach to stabilizing muscle fiber membranes. The increasing focus on personalized medicine and combination treatments is driving the DMD market forward, with collaborative research fueling the next generation of disease-modifying therapies.

Target companies with Phase II or III gene therapy candidates and strong IP portfolios.

Implement mutation screening as standard practice to match patients with precise treatment protocols.

Prioritize orphan drug designations and collaborative partnerships to reduce R&D risk and accelerate time-to-market.

The Duchenne Muscular Dystrophy (DMD) therapeutics market is no longer in the shadows of rare disease care. Fueled by genomic insights, biotech advances, and global advocacy, it is poised to redefine expectations for chronic genetic disorders. The 2025 outlook offers a rare convergence of science, policy, and patient empowerment — but only if stakeholders remain committed to affordability, access, and agile innovation.

Safe and Secure SSL Encrypted