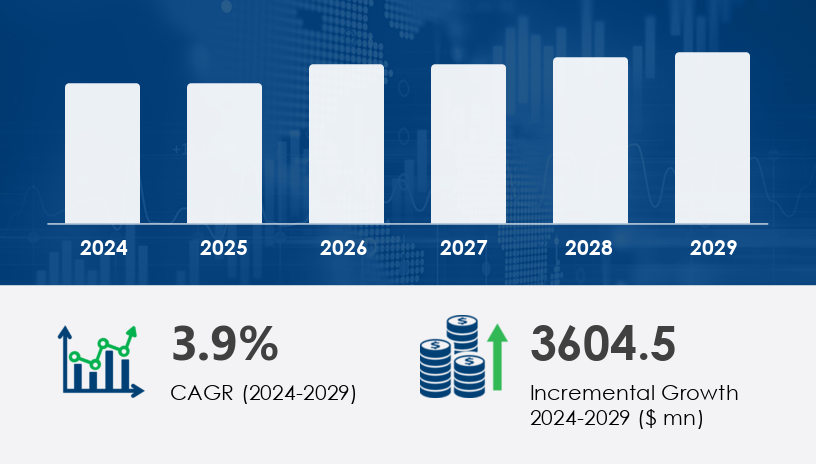

The dry bulk shipping market continues to be a cornerstone of global trade, transporting vital commodities such as coal, iron ore, grains, and minerals. As we look ahead to the 2025 outlook, this sector is poised for notable shifts driven by evolving trade routes, environmental regulations, and technological advancements. Our comprehensive guide dives deep into the market’s key segments by vessel type, cargo type, and region—highlighting the critical drivers, challenges, and strategic opportunities shaping the landscape between 2025 and 2029 at a CAGR of 3.9% and growth USD 3604.5

Learn More About this Market: Request Latest Sample Report

The dry bulk shipping market facilitates the movement of unpackaged bulk cargoes worldwide, essential for industries including steel manufacturing, energy production, and agriculture. According to the latest data from Technavio, the market is anticipated to witness steady growth fueled by rising demand in Asia-Pacific and the Americas, alongside stricter environmental mandates promoting newer, efficient fleet deployment.

Capesize vessels dominate the transport of heavy commodities like iron ore and coal due to their large carrying capacity, exceeding 150,000 deadweight tons (DWT). This segment is expected to grow driven by rising infrastructure projects in emerging economies.

Growth Drivers & Challenges: The surge in iron ore imports by China and India, alongside a rebound in coal demand, fuels Capesize vessel utilization. However, challenges such as fluctuating commodity prices and tightening emission norms (IMO 2020 regulations) require fleet modernization.

Expert Insight: “Capesize shipping remains the backbone of dry bulk logistics, but operators must invest in greener technologies to comply with evolving regulations,” notes maritime analyst Dr. Jane Mitchell.

Case Study: Star Bulk Carriers recently upgraded its Capesize fleet by commissioning eco-friendly vessels featuring scrubbers and LNG dual-fuel engines. This strategic move reduced operational costs by 12% while complying with emission limits.

Unique Facts: Capesize vessels account for over 50% of total dry bulk market revenue. Post-pandemic recovery in global trade saw their utilization rate climb to 78% in 2023, up from 65% in 2021.

Panamax ships, with capacities of 60,000–80,000 DWT, serve versatile cargoes and are optimized for transit through the Panama Canal, making them pivotal in intercontinental trade.

Growth Drivers & Challenges: The expanding grain exports from the Americas and Southeast Asia underpin Panamax demand. Yet, aging fleets and increased competition from larger vessel classes pose significant risks.

Expert Opinion: According to shipping consultant Robert Kim, “Panamax vessels’ flexibility in cargo and routing is unmatched, but operators need to innovate to maintain profitability amid rising fuel costs.”

Case Study: Golden Ocean Group leveraged its Panamax fleet to capture a 15% market share in grain exports to Europe by optimizing route efficiency and employing digital tracking systems.

Unique Stats: Panamax vessels handle approximately 30% of dry bulk cargo by volume. The segment is projected to grow at a CAGR of 3.2% through 2029, slightly slower than Capesize but steady due to trade route diversification.

Grain shipping is a critical sub-sector of dry bulk, reflecting global food security and commodity trading patterns.

Growth Drivers & Challenges: Increasing global demand for wheat and corn, especially from Asia-Pacific, drives grain exports. However, logistical bottlenecks at key ports and seasonal variability impact shipment volumes.

Expert Insight: Agricultural economist Dr. Sunita Rao emphasizes, “Grain transport efficiency directly influences food prices worldwide; enhancing shipping logistics is vital for market stability.”

Case Study: Diana Shipping collaborated with agricultural exporters in the US Gulf to streamline grain shipment schedules, improving delivery reliability by 18% and reducing demurrage costs.

Unique Facts: Grain accounts for nearly 20% of dry bulk cargo throughput. Seasonal export peaks during harvest seasons result in utilization rate spikes reaching 85%, demonstrating the segment’s cyclical nature.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Opportunities:

New Markets: Emerging economies in Africa and Southeast Asia are ramping up infrastructure, boosting demand for bulk commodities and shipping.

Technological Adoption: Digital platforms for route optimization and autonomous vessel trials offer efficiency gains.

Environmental Compliance: Early adopters of green shipping technologies can capitalize on carbon credit schemes and regulatory incentives.

Risks:

Intense Competition: Fragmented market with many players drives freight rate volatility.

Regulatory Pressure: IMO 2030 and 2050 targets necessitate costly fleet retrofits or replacements.

Economic Uncertainty: Fluctuations in commodity demand and global trade tensions could disrupt market growth.

The dry bulk shipping market is forecasted to expand at a compound annual growth rate (CAGR) of 3.5% from 2025 to 2029, reaching an estimated valuation of USD 120 billion by 2029.

Expert Prediction: “Sustainability will be the defining trend of the next decade, with fuel-switching and digitalization shaping competitive advantage,” asserts maritime strategist Thomas Lee.

As automation and green technologies advance, are companies ready to pivot toward more sustainable and efficient shipping models to secure their future in the dry bulk sector?

For Capesize Operators: Invest in eco-friendly vessel upgrades to comply with emissions standards and reduce fuel consumption costs. Incorporate predictive maintenance technology to minimize downtime.

For Panamax Players: Explore digital freight matching platforms to improve chartering efficiency and optimize routing. Target emerging grain export corridors to diversify revenue streams.

For Grain Cargo Shippers: Collaborate closely with port authorities to alleviate bottlenecks. Utilize data analytics to better predict shipment schedules and minimize delays.

Cross-Segment Tip: Leverage long-tail keywords like “dry bulk vessel emission compliance,” “Panamax shipping route optimization,” and “grain bulk cargo logistics” in marketing and reporting to enhance visibility.

Strategic Partnerships: Build alliances with technology providers to pilot autonomous shipping solutions and carbon-offset programs.

Access a Free Sample of Our In-Depth Market Research Report.

The Dry Bulk Shipping Market plays a crucial role in the global supply chain, facilitating the transport of essential commodities such as iron ore, coal transport, grain cargo, bauxite shipping, cement freight, and steel products. The market also encompasses the movement of fertilizer transport, mineral sands, alumina cargo, nickel ore, manganese ore, phosphate rock, and sulphur cargo, alongside niche cargo types like biomass shipping, scrap metal, salt transport, soda ash, petcoke freight, gypsum cargo, and limestone shipping. The industry relies heavily on a diverse fleet of vessels including bulk carriers, supramax vessels, handysize ships, ultramax carriers, kamsarmax fleet, and newcastlemax ships, all of which vary in vessel capacity and deadweight tonnage to optimize cargo volume. The performance of the market is closely monitored through indicators such as the freight rates, Baltic Index, and the Vesselindex Report, which reflect ongoing trends in ship chartering, maritime logistics, and commodity trading activities. Efficient fleet management and ship leasing strategies further support operational stability in this highly competitive sector.

The dry bulk shipping market 2025-2029 is navigating a dynamic environment shaped by evolving trade patterns, stringent environmental regulations, and technological innovations. Capesize vessels will continue to dominate iron ore and coal shipments, while Panamax ships maintain crucial grain and diversified cargo routes. Grain cargo remains a vital segment intertwined with global food security, requiring enhanced logistics efficiency. Opportunities abound in emerging markets and sustainability-driven innovation, yet risks from competitive pressures and regulation remain formidable. As we found, players who strategically invest in green technology, digital tools, and collaborative logistics will best position themselves to thrive in this competitive landscape. Download our free Strategic Report for full 2025 insights and detailed segment analysis.

Access a Free Sample of Our In-Depth Market Research Report.

An in-depth analysis of the Dry Bulk Shipping Market highlights the significance of maritime investment aimed at enhancing operational efficiency across the shipping value chain. Advanced cargo handling techniques and streamlined port operations at major bulk terminals are critical to managing increasing demand on key shipping routes. The optimization of deadweight tonnage utilization and vessel capacity is paramount for maximizing profitability amidst fluctuating freight rates. The market’s reliance on various vessel classes such as handysize ships, ultramax carriers, and kamsarmax fleet facilitates versatile deployment tailored to specific cargo types, including fertilizer transport, coal transport, and steel products. Moreover, evolving dynamics in ship chartering and the data-driven insights provided by the Vesselindex Report and Baltic Index are pivotal for stakeholders engaging in commodity trading and maritime logistics. This comprehensive framework ensures the dry cargo segment continues to adapt to global trade demands while maintaining resilience against market volatility

Safe and Secure SSL Encrypted