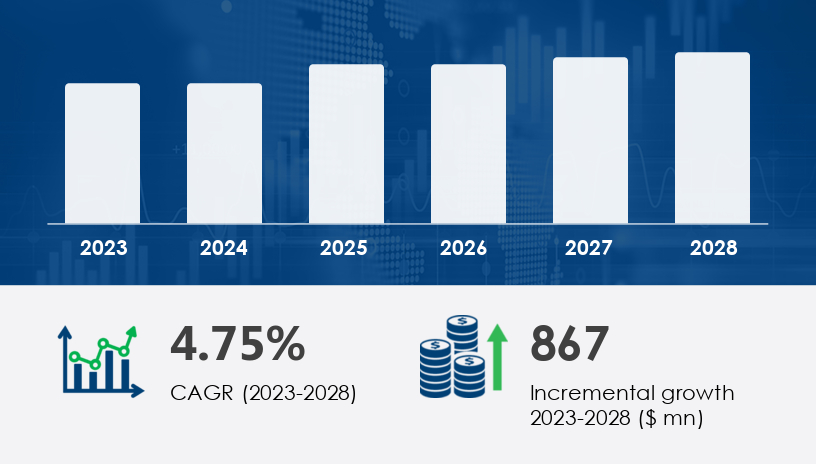

The discrete diode market size is forecast to increase by USD 867 billion at a CAGR of 4.75% between 2023 and 2028. This robust growth trajectory is fueled by escalating demand for Internet of Things (IoT) devices, increased adoption of wearable technology, and the rising complexity of compact electronic devices. A surge in vehicle electrification and power management applications is also accelerating the expansion of this critical segment in the semiconductor landscape.

For more details about the industry, get the PDF sample report for free

The discrete diode market refers to the global trade and application of semiconductor components that operate independently, rather than being embedded within integrated circuits. These devices—ranging from power diodes and Schottky diodes to fast recovery and signal diodes—regulate current flow and protect electronic circuits.

Discrete diodes are essential in:

Power management

Rectification and voltage regulation

Switching applications

Signal modulation in communication systems

They are foundational to the operation of consumer electronics, automotive systems, communications infrastructure, and computer hardware.

The Discrete Diode Market is witnessing robust growth due to increasing demand across industries like automotive, telecommunications, and consumer electronics. Core products such as Schottky diodes, Zener diodes, Rectifier diodes, and TVS diodes are widely used in electronic circuits for various applications including voltage regulation, surge protection, and signal processing. The market also benefits from innovations in semiconductor materials, particularly silicon wafers, silicon carbide, and gallium nitride, which enable enhanced thermal stability and high efficiency. Components such as power diodes, freewheeling diodes, and fast recovery models are critical in power supplies, motor control, and power conversion applications. The use of PN junctions, Germanium diodes, and low-frequency diodes remains relevant, especially in niche areas requiring low leakage and voltage multipliers. The push for miniaturized diodes in ultra-small packages further highlights the trend toward compact, high-performance solutions.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

The competitive landscape features major global manufacturers innovating rapidly to meet evolving technological demands and reduce production costs. Strategic alliances, geographic expansions, and new product launches dominate the corporate playbook.

Infineon Technologies AG

STMicroelectronics

ON Semiconductor Corp.

Texas Instruments Inc.

NXP Semiconductors NV

ROHM Co. Ltd.

Littelfuse Inc.

Vishay Intertechnology Inc.

Microchip Technology Inc.

These firms are not just responding to market demand—they're shaping it, especially in vehicle electrification, wearable technology, and industrial automation.

Understanding the segmentation is critical to identifying growth opportunities within the discrete diode market. This industry is categorized based on product type, end-user industry, and geography.

Power Diodes: Largest and fastest-growing segment, particularly Schottky and fast-recovery diodes.

Small Signal Diodes: Used in compact and low-power applications.

RF Diodes: Essential for radio frequency applications in telecom and broadcasting.

Power diodes dominate due to their role in:

Rectification circuits

Voltage clamping and multiplication

Freewheeling in automotive applications

Automotive: Rapid vehicle electrification is fueling demand.

Consumer Electronics: Smartphones, tablets, and wearables rely heavily on discrete diodes.

Computers and Communications: Data centers, routers, and computing devices require reliable diode-based circuitry.

Others: Includes industrial equipment, aerospace, and medical devices.

Asia Pacific (APAC): The undisputed leader, contributing 72% of global market growth. China, India, and South Korea are innovation hubs.

North America: Strong R&D presence and a growing electric vehicle market.

Europe: Focused on automotive innovation and renewable energy.

Middle East & Africa / South America: Emerging opportunities in infrastructure and manufacturing.

Several long-tail keyword trends such as “rising adoption of wearable electronics” and “impact of miniaturization on diode demand” are reshaping this landscape.

IoT integration is no longer optional. From smart homes to industrial automation, every node in a networked system requires robust power management. Discrete diodes offer the necessary precision and reliability.

The acceptance of wearable devices like fitness trackers, smartwatches, and AR glasses has increased dramatically. These compact, power-sensitive gadgets need highly efficient diodes to manage battery consumption and signal routing.

As gadgets shrink in size but grow in function, the pressure to integrate smaller and more efficient discrete diodes intensifies. This requires significant R&D investment and manufacturing innovation.

With China, India, South Korea, and Singapore at the forefront, APAC is the heartbeat of the discrete diode market. The region benefits from:

High-volume electronics manufacturing

Government incentives for electric vehicle production

Rapid industrial automation in factories and logistics

Industrial development and export-oriented policies have created a fertile ground for the adoption of advanced semiconductor technologies, including discrete diodes.

North America focuses on innovation and R&D, particularly in the automotive and renewable sectors. Europe’s push toward green technologies and ADAS (Advanced Driver Assistance Systems) is creating demand for high-efficiency power diodes in EVs and hybrid systems.

Get more details by ordering the complete report

Miniaturization isn't just a trend—it’s a manufacturing puzzle. Creating discrete diodes that perform well in ever-smaller footprints, while managing heat and voltage precisely, is a persistent challenge.

With commoditization creeping into certain segments, especially general-purpose diodes, manufacturers face pricing pressure from both established competitors and low-cost entrants.

To stay competitive, companies must:

Invest in R&D for ultra-efficient diodes

Expand into high-growth regions

Partner with OEMs and integrators in emerging markets

The discrete diode market in 2025 is not just growing—it’s transforming. Key players must anticipate demand shifts, adapt to miniaturization, and invest in strategic partnerships and product innovation. As consumer electronics, electric vehicles, and smart systems grow increasingly complex, the role of discrete diodes becomes even more indispensable.

Analysis of the Discrete Diode Market reveals growing adoption in high-tech sectors that require precision and performance. Technologies such as switching diodes, high-voltage diodes, and diode arrays are integral to advanced applications like traction inverters, battery management, and signal conditioning. Manufacturers are leveraging precision doping, advanced lithography, and improved diode packaging to meet evolving design requirements. Innovations in wire bonding and ESD protection are enhancing product reliability, particularly in sensitive electronic environments. The demand for voltage clamping, high-speed switching, and transient suppression continues to rise with the proliferation of smart devices and automotive electronics. Additionally, the role of low leakage, high-efficiency components is critical for maintaining system stability. As small signal and power diode technologies evolve, the focus remains on delivering reliable solutions for both high- and low-power systems in a variety of end-use sectors.

Safe and Secure SSL Encrypted