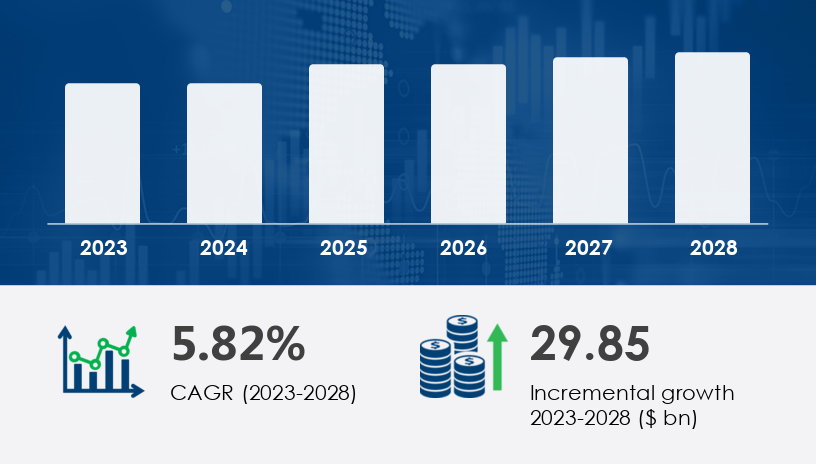

The dips and spreads market is poised for substantial growth, projected to surge by USD 29.85 billion between 2023 and 2028, at a CAGR of 5.82%. This momentum is fueled by evolving consumer preferences, rising demand for clean-label products, and the popularity of global cuisines. The increasing popularity of appetizers and finger foods that are often paired with dips and spreads, such as dumplings, pita bread, tortilla chips, and seafood, also boosts the market’s trajectory. As we enter 2025, strategic insights into distribution channels, end-user segments, and regional performance are critical for stakeholders aiming to capture market share. This comprehensive guide dives into key segment trends, offering expert analysis and data-backed forecasts to support strategic decisions in a competitive and flavor-driven industry.

For more details about the industry, get the PDF sample report for free

The global dips and spreads market is characterized by its diversity, flavor innovation, and cross-cultural appeal. From hummus and guacamole to spicy gochujang and vegan nut-based spreads, consumer appetite is shifting towards versatile, healthy, and international options.

| Segment Type | Key Highlights |

|---|---|

| Distribution Channel | Offline (Supermarkets, Specialty Stores), Online |

| End-user | Household, Foodservice Industry |

| Geography | APAC (42% market growth share), North America, Europe, South America, MEA |

| Market Size | USD 29.85 billion growth from 2023–2028 |

| Top Trends | Plant-based, Clean-label, Ethnic flavors, Nut spreads |

The offline distribution channel remains the cornerstone of the market, offering consumers immediate access to a wide array of products across supermarkets, hypermarkets, and gourmet stores. Consumer trust in physical product interaction—especially for food safety and freshness—continues to drive this segment.

However, health-conscious consumers demand better labeling and allergen-free assurances, presenting operational challenges around inventory control and in-store education.

Analyst Insight:

“While e-commerce grows, the tactile experience of buying dips and spreads offline—particularly premium items—remains irreplaceable,” says a senior Technavio analyst.

A US-based premium grocery chain, revamped its gourmet aisle in 2024 to feature over 150 SKUs of international spreads, leading to a 22% year-over-year sales increase. Strategic partnerships with small-batch producers helped them dominate the Northeast regional market.

Offline segment valued at USD 48.66 billion in 2018

Remains the largest contributor during the forecast period

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Households continue to drive volume purchases, propelled by snacking culture and home cooking trends, particularly in the post-pandemic landscape. Meanwhile, the foodservice industry is a hub for premium and niche spread innovation, including international and fusion offerings.

The key challenge lies in aligning product versatility with both home-cooked and professional culinary settings without compromising on taste, nutrition, and packaging formats.

Expert Commentary:

“Households want variety, but chefs demand authenticity. Meeting both markets requires a dual-channel R&D approach,” remarks a culinary strategist.

TacoBell Express introduced a plant-based queso spread in 2024 across 500 outlets in Asia, tailored for vegan customers. The innovation, created in partnership with a local food tech startup, resulted in a 30% increase in regional footfall.

Strong momentum from both household consumption and foodservice customization

Growing demand for jarred products due to premium and artisanal appeal

With APAC contributing 42% to global market growth, rapid urbanization, rising incomes, and a youth-driven demand for international flavors are driving sales. Countries like India, Japan, and China are witnessing increased adoption of ready-to-eat and global snack formats.

Still, the fragmented retail landscape and varied food safety regulations present hurdles for seamless market penetration.

Market Viewpoint:

“APAC isn’t just a growth engine—it’s a flavor lab. Regional twists on global dips are reshaping the innovation landscape,” explains a regional food analyst.

PepsiCo’s D2C push in India with plant-based hummus saw a 40% spike in online sales in Q1 2024, validating consumer readiness for clean-label, global products with a local twist.

APAC is the fastest-growing region, influencing product innovation cycles globally

Surge in demand for Mexican sauces, vegetable dips, and vegan-friendly spreads

Plant-based innovation: Tapping into vegan and flexitarian diets

Ethnic diversification: Launching region-specific flavor profiles (e.g., Asian chili dips, Mediterranean herb spreads)

Premium packaging: Leveraging glass jars and sustainable materials to enhance shelf appeal

Foodservice partnerships: Collaborations with restaurants to co-create signature sauces and spreads

Allergen sensitivity: Nuts, dairy, and soy-based spreads require rigorous labeling and compliance

Supply chain transparency: Sourcing natural ingredients sustainably without inflating costs

Intense competition: From legacy brands to artisanal newcomers, shelf space is highly contested

Regulatory fragmentation: Global operations face hurdles due to disparate labeling laws and food safety standards

The dips and spreads market is forecast to grow by USD 29.85 billion from 2023–2028, at a CAGR of 5.82%. With increasing interest in international cuisines and clean-label transparency, brands will need to evolve swiftly to remain competitive. Are brands ready to pivot to on-demand personalization and transparent sourcing?

Expert Prediction:

“Expect ‘customizable flavor bases’—spreads that consumers can tweak with add-ins—to be a breakout trend by 2026,” predicts a senior Technavio analyst.

The global Dips and Spreads market is experiencing dynamic growth, driven by the increasing popularity of diverse flavor profiles and convenience-oriented food options. Traditional favorites like Hummus, Guacamole, Salsa, and Cheese dip continue to dominate consumer preferences, while unique offerings such as Bean dip, Avocado spread, and Cream cheese are gaining traction. The market also shows strong demand for protein-enriched and nut-based options like Peanut butter, Almond butter, and Nutella. Regional specialties such as Tahini, Pesto, and Tapenade have carved a niche in the gourmet segment. Additionally, classic vegetable-based dips like Artichoke dip, Spinach dip, Ranch dip, and Onion dip remain staple offerings in North American and European markets. The rise in health-conscious consumers is fueling interest in plant-based alternatives like Garlic spread, Herb butter, and Fruit preserves.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Expand regional retail footprints with local gourmet stores and farmer's markets

Invest in in-store sampling to drive trial and repeat purchases

Use long-tail keywords in packaging like “low-fat jalapeño dip” or “vegan Mediterranean spread”

Tailor household products for convenience (e.g., single-serve packs, resealable jars)

Develop exclusive blends for foodservice partners to offer differentiation

Optimize recipes for both snacking and meal preparation versatility

Partner with local influencers and chefs for product co-creation

Navigate diverse regulations with dedicated regional compliance teams

Introduce hybrid products (e.g., Indian salsa or kimchi-based cheese spreads)

Further analysis of the Dips and Spreads market reveals a nuanced segmentation influenced by cultural preferences and evolving consumer behavior. Sweet and breakfast-centric items such as Jam, Jelly, Marmalade, and Honey spread maintain a steady presence, while indulgent choices like Chocolate spread, Hazelnut spread, and Olive spread appeal to premium shoppers. Mediterranean-inspired products like Sun-dried tomato spreads and Aioli are expanding globally. Condiment-based spreads, including Mayonnaise spread, Mustard spread, and Horseradish dip, reflect the market’s versatility across food applications. Spicy and bold-flavored items such as Buffalo dip, Queso, and Clam dip cater to consumers seeking adventurous taste profiles. Meanwhile, exotic and traditional options like Eggplant spread, Baba ganoush, Chutney, and Relish are growing in multicultural markets. The expansion into artisanal and gourmet offerings includes Curd spread, Caramel spread, and Truffle spread, which are increasingly featured in specialty stores and high-end food service channels.

The global dips and spreads market is entering a golden age of culinary convergence and health-conscious innovation. From traditional guacamole to new-age nut butters and Asian sauces, the landscape is broad, dynamic, and filled with promise. Brands that can innovate with purpose, label with transparency, and distribute with agility will own the future.

Safe and Secure SSL Encrypted