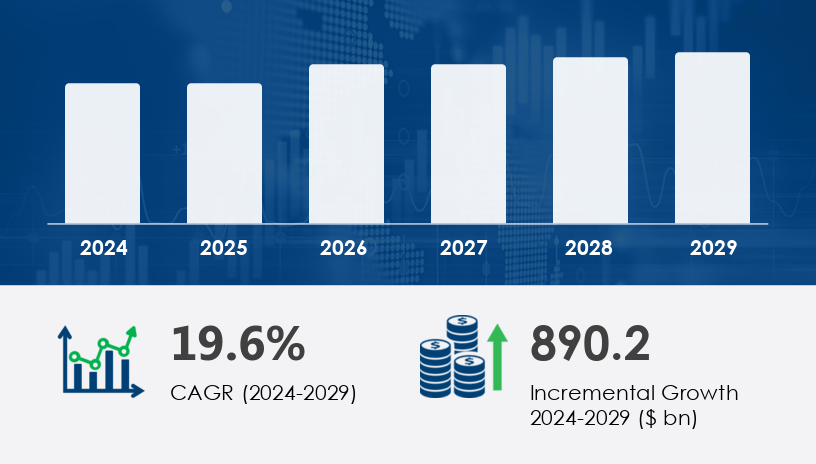

The global digital video content market is entering a transformative phase, projected to increase by USD 890.2 billion between 2025 and 2029, growing at a CAGR of 19.6%. Driven by evolving consumption habits, expanding OTT ecosystems, and a wave of strategic partnerships, the digital content revolution is reshaping how businesses, consumers, and industries interact with video.

For more details about the industry, get the PDF sample report for free

Pay TV

The Pay TV segment is forecast to witness substantial growth due to the rising popularity of Internet Protocol Television (IPTV), which delivers live or on-demand TV over dedicated provider infrastructure. Unlike OTT, IPTV leverages private networks, ensuring quality control and reliability.

In 2019, the segment was valued at USD 183.80 billion and has steadily grown as 4G networks and smart devices proliferate.

OTT

Smartphones

Desktop and Laptop

Smart TV

Others

Subscription

Advertising

Download-to-own (DTO)

Others

Smart devices have revolutionized video consumption, with users favoring platforms that offer on-demand access to TV shows, music videos, educational content, and advertisements across screens—ranging from smartphones to smart TVs.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

A primary driver of this market’s explosive growth is the increasing number of strategic alliances and acquisitions in the Video on Demand (VOD) sector. Companies are consolidating resources and market presence to meet rising demand for digital content among the younger, mobile-first population.

These moves enable broader distribution of content across devices, ranging from laptops to televisions, while enhancing engagement and content protection.

The widespread availability of high-speed internet and digital platforms—such as tablets, smart TVs, laptops, and personal computers—has made access to digital video content more seamless than ever before. This infrastructure fuels not only consumer demand but also business content use in industries like hotels, media, healthcare, pharmaceuticals, and corporate communications.

Cross-platform collaboration is a defining trend, with traditional Pay TV operators forming alliances with OTT providers to retain users and expand offerings.

This convergence has led to bundled services combining SVOD (Subscription Video on Demand) and AVOD (Advertising Video on Demand) models—exemplified by streaming giants like Netflix and Amazon Prime partnering with telecom and Pay TV networks.

AI is at the core of the digital content transformation, enabling real-time personalization and content recommendations. This trend is visible in:

AI-enhanced voice search

Personalization marketing

Smart tagging for targeted advertising

Content delivery now spans tablets, laptops, mobiles, smart TVs, and desktops—enabling continuous user engagement and making multi-screen viewing an industry standard.

Live streaming on social media and AI-generated visual assets are also shaping content marketing.

Despite the sector’s rapid growth, the availability of pirated video content on online platforms remains a serious challenge.

Torrent sites, offering metadata-rich files for unauthorized content downloads, undermine paid subscription models.

To combat this, providers are:

Investing in advanced content protection technologies

Collaborating with law enforcement agencies

Enhancing DRM (Digital Rights Management) mechanisms

Contribution to Global Growth: 42%

United States and Canada lead the shift towards OTT, with SVOD platforms experiencing subscriber booms.

OTT saturation is prompting traditional Pay TV providers to adapt or integrate with streaming services.

Digital devices and AI-driven content platforms are mainstream, with strong uptake in media, healthcare, and pharma sectors.

Germany

UK

France

Italy

Europe maintains a stronghold in advertising and subscription-based streaming, with regional regulations guiding content distribution and anti-piracy efforts.

China

India

Japan

South Korea

Fast-developing nations in APAC are seeing massive OTT growth, driven by mobile-first populations and cloud infrastructure investments.

Emerging video content consumption patterns, driven by internet access expansion.

An evolving digital content ecosystem supported by smartphone penetration and youthful demographics.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

The digital video content market has expanded rapidly with the surge in short-form video, live streaming, and video on demand, primarily driven by the proliferation of OTT platforms. As content consumption diversifies, trends such as multi-device streaming, interactive video, and 360-degree video continue to gain traction, especially in immersive and experiential formats like virtual reality. The growth of video playlists and enhanced playback quality reflects increasing user demand for seamless viewing, while providers focus on DRM protection, watermarking tech, and video metadata to secure and manage content. Delivery infrastructure has improved significantly through peer-to-peer streaming, SRT protocol, and WebRTC, all aimed at reducing lag and improving latency reduction. The evolution of QoS metrics and video analytics further supports strategic content optimization and performance tracking.

Businesses are implementing diversified strategies—strategic alliances, acquisitions, product launches, and geographic expansions—to expand their foothold in the digital video content market.

Amazon.com Inc.

Apple Inc.

AT and T Inc.

Chicken Soup for the Soul LLC

Lions Gate Entertainment Corp.

Meta Platforms Inc.

NBCUNIVERSAL MEDIA LLC.

Netflix Inc.

One Day Video Ltd.

Roku Inc.

Snap Inc.

Sony Group Corp.

Stir Fry Content Kitchen

The Walt Disney Co.

Verizon Communications Inc.

Viacom18 Media Pvt. Ltd.

Walmart Inc.

X Corp.

Youku Tudou Inc.

YouTube

These firms are categorized by their business strategies and market positions—ranging from dominant and diversified to category-focused or tentative. Companies like Netflix, Amazon, YouTube, and Disney remain central to both SVOD and AVOD revenue models.

Get more details by ordering the complete report

From a technical standpoint, research into the digital video content market highlights major advancements in video compression and codec efficiency, with standards such as AV1 Codec, H.265, VP9, WebM, and HEVC offering enhanced performance. Supporting technologies like MPEG-DASH, HLS streaming, and adaptive bitrate facilitate smooth content delivery across varied network conditions. Solutions like video transcoding, cloud encoding, and edge computing play a crucial role in enhancing efficiency and bandwidth usage. Innovations in AI upscaling, HDR10, and Dolby Vision, paired with ultra-high-definition standards like 4K resolution and 8K resolution, deliver visually stunning experiences. Technical considerations such as bitrate optimization, frame rate, and buffering prevention are critical in maintaining viewer satisfaction. Together, these elements shape a landscape where advanced technology and viewer experience converge to define the future of digital video.

Safe and Secure SSL Encrypted