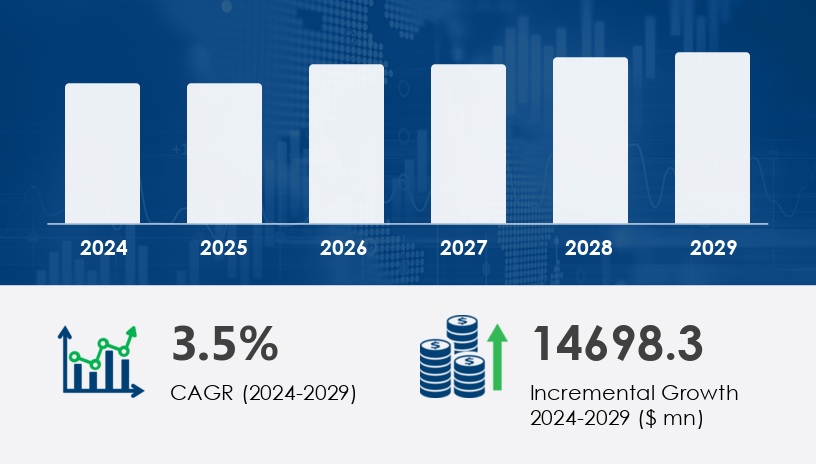

The Diesel Engines For Non-Automotive Applications Market is set for significant expansion during the forecast period, driven by the need for reliable, fuel-efficient, and powerful engines across industries such as construction, marine, agriculture, and power generation. These engines continue to dominate as a preferred power source for off-road applications due to their operational resilience and high torque output.The market size is projected to increase by USD 14.7 billion between 2024 and 2029, growing at a CAGR of 3.5%. This growth underscores the increasing adoption of diesel technologies for critical infrastructure and industrial machinery where uptime, efficiency, and durability are essential.For more details about the industry, get the PDF sample report for free

A primary driver of the diesel engines for non-automotive applications market is the ongoing technological advancement in diesel engine systems, particularly in improving fuel efficiency and reducing emissions. These improvements are mainly achieved through advanced fuel injection systems, turbocharging, and common rail technology, which have enhanced power output while ensuring lower fuel consumption. Diesel remains a dominant choice in industrial sectors due to its long-term fuel economy benefits and high energy density. As a result, many industries—especially construction and marine—continue to rely heavily on diesel engines to power heavy machinery and infrastructure.

According to industry analysts, the sustained focus on enhancing combustion efficiency and minimizing environmental impact is allowing diesel engines to maintain their relevance in the face of emerging alternative power sources. The importance of fuel economy, particularly in backup systems and high-load applications, makes diesel engines indispensable in many non-automotive sectors.

A major trend shaping the market is the conversion of traditional diesel engines into dual-fuel systems, enabling them to operate on both diesel and natural gas. This trend reflects the industry's push toward cost-efficient, environmentally friendly alternatives that still deliver the reliability and performance of conventional diesel. Dual-fuel engines are popular for their flexibility and ease of retrofitting, especially in remote industrial locations where infrastructure for alternative fuels is limited. However, challenges like lower power density in spark-ignited dual-fuel engines and increased valve wear need to be addressed.Nonetheless, the transition to dual-fuel and clean diesel technologies, including Selective Catalytic Reduction (SCR) and diesel engine optimization techniques, signals a strong shift toward balancing environmental compliance with operational performance.

The Diesel Engines for Non-Automotive Applications Market is a vital segment that supports a wide array of sectors including construction machinery, agricultural equipment, mining equipment, and marine transport. These industrial engines are designed for high performance and longevity in demanding settings. From power generation to backup power solutions, diesel engines remain a dominant technology thanks to their high fuel efficiency, strong engine durability, and ability to operate in remote or rugged environments. Applications span from heavy-duty trucks and off-road equipment to locomotives and marine propulsion, with various formats such as auxiliary engines, generator engines, and ship engines serving niche operational needs. The demand for high-speed engines, low-speed engines, and dual-fuel engines is expanding, driven by increasing infrastructure and industrialization activities worldwide.

The Diesel Engines For Non-Automotive Applications Market is segmented by:

Type:

Multi Cylinder

Single Cylinder

End-user:

Marine

Construction

Agriculture

Generators

Power Rating:

Below 0.5 MW

0.5–1 MW

1.1–2 MW

2.1–5.0 MW

Above 5.0 MW

Speed:

Low-speed

Medium-speed

High-speed

Geography:

APAC (China, India, Japan, South Korea)

North America (US, Canada)

Europe (France, Germany, Italy, UK)

Middle East and Africa

South America

Among the types, the multi-cylinder diesel engine segment is expected to lead the market during the forecast period. Valued at USD 44.36 billion in 2019, this segment continues to grow due to its operational efficiency and versatility across industries. Multi-cylinder engines are widely used in generators, compressors, pumps, construction equipment, and marine applications.

Their design enables efficient combustion cycles, resulting in better torque output and fuel economy. These engines are also crucial in freight logistics and infrastructure projects, making them a preferred choice for high-load applications. Analyst commentary notes that the multi-cylinder segment will maintain dominance due to its adaptability and role in both stationary and mobile heavy-duty operations.

Covered Regions:

North America

Europe

APAC

Latin America

Middle East & Africa

Rest of World (ROW)

APAC is expected to contribute 57% of the global market growth between 2024 and 2029, making it the leading region in the diesel engines for non-automotive applications market. Countries like China, India, and Japan are witnessing rapid industrialization, infrastructure expansion, and increasing investments in marine and construction sectors, which directly fuel the demand for diesel engines.

In particular, the region relies heavily on diesel-powered machinery for agriculture, remote energy generation, and critical infrastructure, such as data centers and offshore platforms. The region’s market share growth is also bolstered by the integration of Industry 4.0 technologies, such as remote diagnostics, predictive maintenance, and engine monitoring, which improve the reliability and efficiency of diesel-powered equipment. Analysts emphasize that APAC's industrial boom, combined with demand for dependable off-road engines, will sustain its dominance throughout the forecast period.

One of the primary challenges facing the market is the tightening of emission regulations in developed regions, particularly in North America and Europe. Diesel engines are known to emit nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons (HC), which have been linked to air pollution and health hazards. According to the EPA, reducing NOx emissions could prevent up to 12,000 premature deaths and 8,900 hospitalizations by 2030, highlighting the regulatory pressure on manufacturers.

These stringent rules necessitate investment in advanced emissions control technologies, which can increase production costs and slow down adoption rates. Compliance with evolving environmental policies is crucial, and companies must innovate continuously to stay competitive while ensuring sustainability.

Technological advancements are transforming engine architecture and performance, with a strong focus on thermal efficiency, combustion chamber design, and compression ratio optimization. Innovations in pre-chamber design and advanced turbocharging have contributed to enhanced output and lower fuel consumption. To address environmental concerns, manufacturers are integrating emission control technologies such as selective catalyst systems, exhaust recirculation, and SCR systems to meet global emissions regulations. Key supporting components like air filters, oil filters, fuel injectors, and fuel pumps ensure reliable engine function. Noise reduction measures and vibration dampers improve user experience, particularly in densely populated or sensitive zones. Engine architecture is also being refined through the use of ceramic fittings and robust cylinder heads, enhancing both performance and longevity.

The market is shifting towards smart, connected solutions with the adoption of smart monitoring systems and engine controllers that provide real-time diagnostics, performance tracking, and preventive maintenance. Cooling systems and heat exchangers are essential for ensuring operational stability, especially in engines subjected to continuous or heavy-duty use. The integration of hybrid systems is also gaining momentum, particularly in non-automotive applications where reducing carbon footprint is a priority. In the marine and industrial sectors, optimized turbochargers and precision-engineered piston rings are helping enhance engine responsiveness and extend lifecycle. As regulations tighten and industries demand greater efficiency, the Diesel Engines for Non-Automotive Applications Market is likely to see increased investment in R&D, digitalization, and sustainable technologies, creating a competitive landscape geared for long-term evolution.

To tackle both regulatory and market challenges, companies in the Diesel Engines For Non-Automotive Applications Market are actively investing in research and development. Key innovations include:

Selective Catalytic Reduction (SCR) to lower NOx emissions

Advanced turbocharging systems to boost power and efficiency

Remote engine monitoring for real-time diagnostics

Clean diesel and dual-fuel engine solutions for emission compliance

These innovations are aimed at reducing environmental impact while maintaining cost-effectiveness, reliability, and performance. Industry leaders are also forming strategic alliances with regulatory agencies to navigate compliance requirements while sustaining growth. According to analysts, firms that focus on emission-reducing technologies and operational optimization will have a significant competitive edge in this evolving market.

The Diesel Engines For Non-Automotive Applications Market is on a steady growth trajectory, driven by industrial demand, technical advancements, and the critical need for efficient off-road power solutions. With a forecasted USD 14.7 billion increase by 2029 and a CAGR of 3.5%, the market holds strong potential, especially in APAC, where infrastructure development and industrial expansion are robust. However, success in this market will require ongoing innovation in engine design, emission control, and digital integration to address challenges and capture new opportunities.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 By Type

6.1.1 Multi Cylinder

6.1.2 Single Cylinder

6.2 By End-user

6.2.1 Marine

6.2.2 Construction

6.2.3 Agriculture

6.2.4 Generators

6.3 By Power Rating

6.3.1 Below 0.5 MW

6.3.2 0.5–1.0 MW

6.3.3 1.1–2.0 MW

6.3.4 2.1–5.0 MW

6.3.5 Above 5.0 MW

6.4 By Speed

6.4.1 Low-speed

6.4.2 Medium-speed

6.4.3 High-speed

6.5 By Geography

6.5.1 North America

6.5.2 Europe

6.5.3 APAC

6.5.4 South America

6.5.5 Middle East and Africa

6.5.6 Rest of World (ROW)

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted