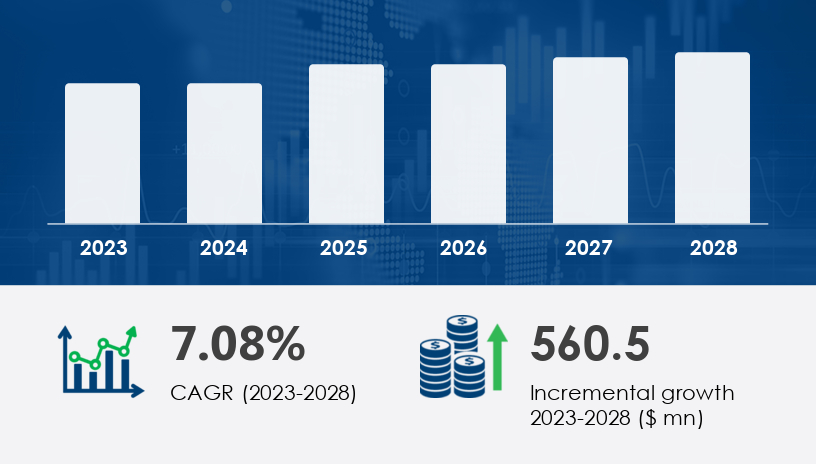

The dental implant abutment systems market is projected to grow by USD 560.5 million between 2023 and 2028, at an impressive CAGR of 7.08%. This surge underscores a transformative shift in restorative dental solutions amid the rising burden of oral diseases worldwide. With over 3.5 billion individuals affected by dental caries, according to the World Health Organization, the global demand for reliable, biocompatible, and aesthetically pleasing dental prosthetic components is accelerating. This 2025 Outlook offers a comprehensive guide into market trends, regional dynamics, technological shifts, and strategic recommendations for stakeholders aiming to gain competitive leverage.

For more details about the industry, get the PDF sample report for free

Dental implant abutment systems serve as the vital link between the implant fixture (anchored into the jawbone) and the dental restoration (such as a crown or bridge). These abutments ensure structural stability and alignment while influencing the cosmetic result of the prosthetic tooth. Common materials used include titanium and zirconia, both valued for their strength, durability, and biocompatibility. Technological innovations such as CAD/CAM and pre-mill systems have further optimized these components for precision fit and patient-specific customization.

According to recent market analysis, the dental implant abutment systems market was valued at approximately USD 767.30 million in 2018 and is expected to experience a robust upward trajectory through 2028. The primary growth catalysts include:

Rising prevalence of dental disorders like tooth decay, periodontitis, and edentulism

Advancements in implant materials and surface treatments, improving osseointegration and patient outcomes

Increased adoption of digital dentistry solutions like 3D printing and CAD/CAM systems

Expanding insurance coverage and awareness of cosmetic dental procedures

Expert Insight: “We’re witnessing a convergence of aesthetics and performance in implantology,” says Senior Technavio Expert.. “CAD/CAM-customized abutments now provide patient-specific solutions that not only integrate seamlessly with tissue but also replicate natural tooth coloration with high fidelity.”

Get more details by ordering the complete report

Product Segment: Stock vs. Custom Abutments

Stock or pre-fabricated abutments currently dominate the market, primarily due to their cost-effectiveness, widespread availability, and standardized design. However, custom abutments, enabled by CAD/CAM and 3D printing, are gaining favor for their precision fit and enhanced esthetics—particularly in anterior restorations.

Technology Segment: Pre-Mill vs. CAD/CAM

CAD/CAM systems are seeing rapid adoption due to their ability to streamline fabrication workflows, reduce chair time, and produce highly accurate abutments tailored to individual patient anatomy. Pre-mill technologies remain relevant for mass production and standardized implants.

North America is set to contribute 34% to the global market growth, driven by advanced dental infrastructure, a high number of practicing prosthodontists, and robust insurance support. The U.S. leads in digital dentistry adoption, with increasing demand for aesthetic restorations and growing awareness of implant therapy benefits.

For more details about the industry, get the PDF sample report for free

Pros

Biocompatible materials enhance longevity

CAD/CAM and 3D printing offer personalization

Improved esthetics and osseointegration

Expanding insurance coverage aids affordability

Cons

High initial cost of digital equipment

Risk of peri-implantitis due to poor fit or bacterial leakage

Material incompatibility in some patients

Limited reimbursement in certain regions

Technological Evolution

Digital dentistry is reshaping workflows. 3D printing enables rapid, custom-fabricated abutments using plastic and metal. These allergy-free, biocompatible components are becoming the norm rather than the exception.

Material Innovation

Titanium remains the gold standard due to its strength and osseointegration, but zirconia is growing in popularity for its esthetic advantages. Hybrid materials such as titanium-zirconia alloys are under development for optimized performance.

Strategic Takeaways

Manufacturers should invest in R&D focused on biocompatibility and antimicrobial coatings to combat peri-implantitis

Dental clinics must adopt digital tools (CAD/CAM, intraoral scanners) to remain competitive

Policy-makers and insurers need to revise reimbursement models to make implant therapy more accessible

Get more details by ordering the complete report

Despite robust growth, the market is not without hurdles. Chief among them is the risk of implant failure due to abutment misfit or poor osseointegration. Also, cost barriers—especially in emerging economies—restrict access. Additionally, early failure rates within three to four months post-implantation raise concerns, often tied to improper prosthesis-abutment adaptation or mechanical stress.

The Dental Implant Abutment Systems Market is expanding rapidly due to advancements in digital dentistry, CAD/CAM technology, and 3D printing, which have enhanced the precision of abutment design and implant interface compatibility. Clinicians are increasingly opting for both stock abutments and custom abutments, depending on the clinical need and aesthetic goals. Materials like titanium abutments, zirconia abutments, and biocompatible materials such as ceramic materials and titanium alloys play a crucial role in ensuring long-term implant stability and compatibility with soft tissue. Key components such as pre-mill abutments, temporary abutments, healing abutments, impression copings, and scan-bodies contribute to accurate placement and impression-taking. Additionally, osseointegration and mucointegration are vital biological processes that support functional restorations and aesthetic restorations. Dental practices and dental clinics are integrating intraoral scanning, digital impressions, and virtual planning to improve treatment planning, optimize tissue contouring, and streamline digital workflows in implant procedures.

With the continued rise in dental tourism, aging populations, and lifestyle-induced tooth loss, the demand for long-lasting, esthetically superior implants will only intensify. This creates an urgent need for globally scalable, cost-effective, and personalized abutment solutions. Furthermore, advancements in biomaterials and AI-driven diagnostics could redefine patient outcomes over the next decade.

Expert Prediction: “By 2030, we’ll see AI-integrated diagnostic tools driving automated abutment design, slashing lead times and improving precision,” predicts Senior Technavio Expert.

For more details about the industry, get the PDF sample report for free

Analytical trends in the Dental Implant Abutment Systems Market reveal growing emphasis on patient-specific abutments and precision milling to meet individualized anatomical and aesthetic demands. Research shows that bone density and soft tissue conditions significantly impact abutment connection and long-term outcomes. There is increased usage of surgical guides to support accurate implant placement and integration with restorative dentistry protocols. Abutment retention types, such as screw-retained, cement-retained, and overdenture abutments, are analyzed based on clinical scenarios. Innovations like angled abutments, multi-unit abutments, and surface coatings improve prosthetic adaptability and reduce complications. Furthermore, prosthetic components are selected to enhance aesthetic restorations while supporting function. The market's progression is marked by data-driven enhancements in digital workflows and virtual planning, as well as improved materials and engineering, all aiming to elevate long-term success rates and patient satisfaction in dental implant therapy.

For Manufacturers: Prioritize customizable CAD/CAM workflows and explore partnerships for AI-based diagnostics

For Dental Clinics: Train staff in digital dentistry tools and expand cosmetic dentistry offerings

For Policymakers: Address reimbursement gaps and promote awareness campaigns around oral health

Safe and Secure SSL Encrypted