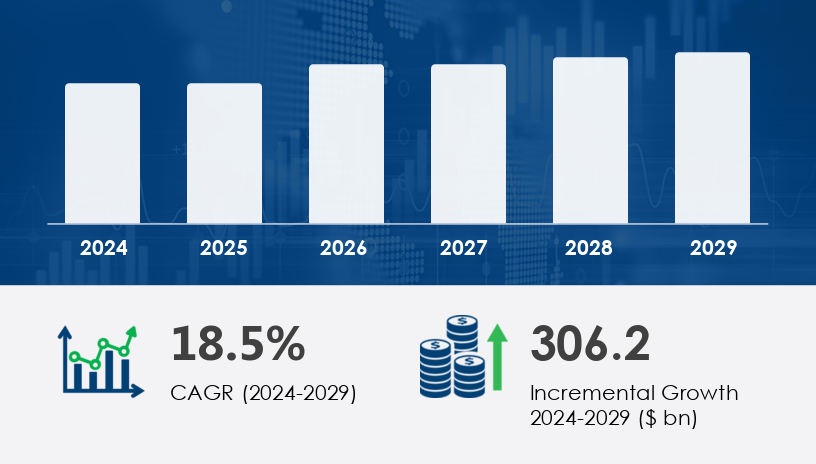

The data center colocation and managed hosting services market is set to grow by USD 306.2 billion from 2025 to 2029, accelerating at a CAGR of 18.5%. In today’s hyper-connected world, the data center colocation and managed hosting services market is rapidly becoming the backbone of global digital transformation. The widespread adoption of hybrid work models, growing reliance on cloud infrastructure, and the surge in data-intensive applications like AI and IoT have magnified the need for resilient, scalable, and secure IT infrastructure. Colocation and managed hosting services present a compelling solution for enterprises looking to avoid the capital burden and operational complexities of managing in-house data centers.

For more details about the industry, get the PDF sample report for free

A significant driver behind the growth of the Data Center Colocation And Managed Hosting Services Market is the rising demand for colocation facilities by businesses aiming to avoid the high capital and operational expenditures of building in-house data centers. For example, constructing a tier 3 data center costs approximately USD 800 per square foot, while tier 4 facilities reach up to USD 1,000 per square foot. Small and medium enterprises (SMEs), in particular, find colocation an affordable alternative. This has led to increased collaboration between cloud service providers (CSPs) and colocation firms for developing and managing modern data center facilities. The shift is further driven by the need for robust security, uptime guarantees, and regulatory compliance offered through colocation and managed hosting solutions.

One of the top emerging trends is the investment in hyperscale data centers by colocation providers. With the explosion of data from smart cities, IoT devices, and AI-driven applications, there is a pressing need for high-performance infrastructure capable of supporting large-scale workloads. Hyperscale facilities, such as the AWS data center in Hyderabad launched in 2023, offer improved scalability, energy efficiency, and data sovereignty compliance. Additionally, cloud providers are integrating services like automation, machine learning, and hybrid cloud deployment into managed hosting offerings, aligning with the evolving needs of businesses and regulatory standards.

The Data Center Colocation and Managed Hosting Services Market is rapidly evolving due to the growing demand for scalable, secure, and energy-efficient infrastructure. The rise of hyperscale data centers has enabled enterprises to meet increasing computational needs, particularly for cloud computing, artificial intelligence (AI), and IoT devices. Businesses are now prioritizing cybersecurity solutions and data management to support remote work solutions and hybrid work models, which require robust data security and endpoint security measures. As companies strive for greater operational efficiency, compliance with standards like HIPAA compliance and business continuity planning has become crucial. DCaaS providers are increasingly seen as strategic partners for organizations looking to modernize IT infrastructure while minimizing complexity.

By End-user:

BFSI

Healthcare

E-commerce

Telecommunication

Others

By Type:

Colocation Services (Wholesale and Retail)

Managed Hosting Services

By Enterprise Size:

Small and Medium Enterprises (SMEs)

Large Enterprises

Among end-users, the BFSI (Banking, Financial Services, and Insurance) segment holds a leading position in the Data Center Colocation And Managed Hosting Services Market. In 2019, the BFSI segment was valued at USD 40.80 billion and has shown steady growth since. With financial institutions needing stringent compliance with data privacy regulations and guaranteed uptime, colocation and managed hosting providers are critical partners. As one analyst insightfully notes, “The BFSI sector’s need for secure, compliant, and scalable IT solutions makes it a consistent driver of colocation demand.” Managed hosting services support this need with offerings like disaster recovery, technical support, and software updates, ensuring minimal service disruption.

Covered Regions:

North America

Europe

APAC

South America

Middle East and Africa

North America stands out as the leading contributor, expected to account for 45% of global market growth during the 2025–2029 forecast period. The U.S. is particularly active, with large-scale investments in hyperscale data centers. Notable projects include DC Blox’s data center campus in Georgia and DAMAC Properties’ USD 20 billion investment across eight states. Additionally, the USD 500 billion Stargate Initiative, backed by OpenAI, SoftBank, and Oracle, aims to build up to 20 new data centers to support AI and cloud infrastructure demands. Analysts emphasize that “North America’s leadership in cloud adoption, AI development, and regulatory alignment makes it a powerhouse for colocation and managed hosting services.”

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Despite robust growth, the high power consumption of data centers remains a significant challenge. Data centers are projected to be the largest global consumers of electricity by 2030, with the ICT sector consuming about 23% of global power. The energy demands of powering and cooling infrastructure, particularly in hyperscale facilities, are substantial. Companies must now innovate with energy-efficient cooling systems, power redundancy strategies, and renewable energy adoption. Balancing performance with sustainability is a growing concern, particularly as regulations tighten around environmental impact and carbon footprints.

Market research indicates that sectors handling sensitive information, such as the BFSI sector, are driving demand for enhanced network monitoring and financial data protection. Regulatory frameworks like GDPR compliance are influencing service design, especially in regions with strict data sovereignty laws. Additionally, the rise of m-commerce and e-commerce is intensifying the need for reliable hosting services capable of managing high transaction volumes and traffic spikes. Emerging urban technologies such as smart cities, smart grids, and smart homes also depend on seamless data processing and scalable colocation facilities. Growing interest in server leasing, network security, and maintaining data integrity reflects businesses’ efforts to balance flexibility with risk mitigation. Uptime reliability and advanced connectivity solutions are now core metrics for evaluating service providers.

Detailed analysis of the market shows a shift in capital strategy, where organizations reduce capital expenditure by outsourcing to providers offering private servers, cloud platforms, and comprehensive IT consulting services. The deployment of edge computing is enabling real-time data handling, especially important for latency-sensitive applications. Efficiency and sustainability are becoming competitive differentiators, with rising focus on power consumption, green computing, and liquid cooling technologies. Adoption of renewable energy sources is also gaining momentum as part of broader ESG goals. Support for complex AI workloads further fuels demand for high-performance, specialized infrastructure, positioning colocation and managed hosting services as critical enablers of digital transformation.

Digital Realty Trust completed its USD 8.4 billion acquisition of Interxion in 2024, significantly expanding its European presence and managed hosting capabilities.

Equinix partnered with Microsoft in January 2024 to extend Azure services via Equinix’s colocation data centers, enhancing hybrid multicloud offerings in the U.S.

IBM announced the expansion of its cloud data center footprint in France in March 2023, targeting local compliance and demand for managed services.

In October 2025, Google Cloud launched Anthos-as-a-Service to streamline hybrid and multicloud application deployment, further integrating colocation with managed application services.

These strategic moves show a clear trend toward regional expansion, cloud integration, and multicloud enablement, reinforcing the value of colocation and managed hosting in enterprise IT strategies. According to industry analysts, “Providers that combine energy-efficient infrastructure with cloud-native services will dominate future market growth.”

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 End-user

6.1.1 BFSI

6.1.2 Healthcare

6.1.3 E-commerce

6.1.4 Telecommunication

6.1.5 Others

6.2 Type

6.2.1 Colocation Services (Wholesale and Retail)

6.2.2 Managed Hosting Services

6.3 Enterprise Size

6.3.1 Small and Medium Enterprises (SMEs)

6.3.2 Large Enterprises

6.4 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 Europe

6.4.4 South America

6.4.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted