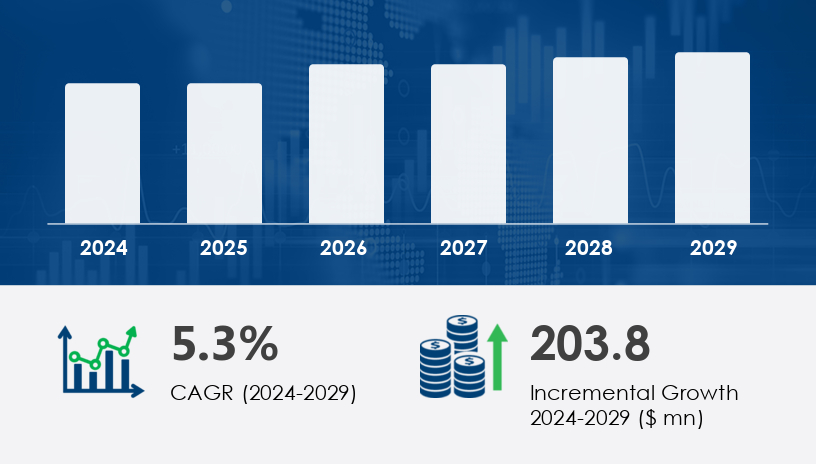

The Commercial Aircraft Parts Manufacturer Approval (PMA) market is poised to grow by USD 203.8 million, at a CAGR of 5.3% between 2024 and 2029, driven by a surge in global air travel, demand for fuel-efficient aircraft, and a robust aftermarket ecosystem. This dynamic market, fundamental to global fleet operations, is becoming increasingly relevant for airlines, MRO providers, and leasing companies navigating regulatory and cost pressures.For more details about the industry, get the PDF sample report for free

The primary growth driver is the escalating number of air passengers, especially in emerging markets. Countries such as India, Vietnam, Iran, Colombia, and Saudi Arabia are heavily investing in their commercial aviation sectors. A key indicator, Revenue Passenger Kilometers (RPKs), rose by 26.2% in July 2023 year-over-year, reinforcing the strong post-pandemic rebound in air travel demand. These trends translate to growing demand for PMA parts to support expanding fleets and maintenance needs.

A key market trend is the rising interest in electric commercial aircraft, prompted by the aviation sector’s substantial carbon footprint—currently 3-4% of global emissions, projected to hit 10% by 2050 without corrective measures. As urbanization, industrialization, and air traffic expansion continue to pressure air quality, fleet operators are looking toward greener technologies, boosting PMA parts adoption designed for fuel efficiency and emissions reduction.

However, growth is tempered by the stringent standards set by aviation authorities like the FAA and EASA, presenting a significant regulatory compliance challenge. The FAA’s 14 CFR part 21 and part 33 demand rigorous testing, technical documentation, and ongoing validation for PMA certification. These protocols ensure safety but require significant investment and technical expertise, impacting time-to-market and operational agility.

The PMA market is segmented into:

Aircraft Aftersales OEM Licensed PMA Parts

Aircraft Line-Fit Engine & Avionics PMA Parts

Aircraft Line-Fit Airframe Systems & Other PMA Parts

Aircraft Line-Fit Cabin Interiors & IFEC PMA Parts

Of these, the engine segment is projected to see significant growth. As of 2019, it was valued at USD 290.00 million, and continues its upward trajectory. This segment includes high-precision parts such as air intakes, combustors, turbines, afterburners, and nozzles, which require strict adherence to FAA standards.

Technologies such as 3D printing, composites, and lightweight materials play an increasingly vital role, supported by engineering services including certification support and supply chain optimization. These innovations reduce cost and turnaround time, making them crucial for fleet modernization and aircraft lifecycle management.

Aircraft classified under:

Small, Medium, and Large Widebody

Narrowbody

Regional Jets

Business Aviation

This segmentation ensures that PMA suppliers can tailor solutions to specific aircraft categories, enhancing reliability and cost-effectiveness for fleet operators.

Online

Offline

Digital transformation is gradually shifting the market toward online channels, with catalog integration enabling seamless access to PMA databases, enhancing inventory visibility and reducing procurement timelines.

Airlines

MRO Providers

Leasing Companies

Each stakeholder requires tailored PMA support—from technical documentation and repair to customization and warranty management—to ensure airworthiness and operational efficiency.

Get more details by ordering the complete report

China, India, Japan, South Korea

The APAC region leads global growth, spurred by rising passenger traffic, government aviation initiatives, and the penetration of low-cost carriers. In China, the shift toward a service-based economy is driving long-term air travel demand. The regional market is open to PMA entrants due to the current reliance on imported aircraft.

Engineering services, especially those focused on performance monitoring, regulatory compliance, and technical support, are vital. Additive manufacturing and advanced materials are increasingly used to meet local demand for lightweight, fuel-efficient components.

US, Canada

With the FAA headquartered in the US, North America remains a hub for PMA innovation and regulatory development. The region supports a mature ecosystem of PMA manufacturers, certification bodies, and MRO facilities, fostering market stability and technical sophistication.

France, Germany, Italy, UK

Europe is a strong secondary market where environmental regulations are also pushing for the adoption of electric and fuel-efficient aircraft. The EASA’s stringent certification standards make the region competitive but demanding for PMA suppliers.

UAE

The UAE, a regional aviation hub, is investing in fleet expansion and airport infrastructure, offering a fertile ground for aftermarket PMA parts, particularly for widebody aircraft used in long-haul operations.

Brazil

Brazil’s aviation sector is rebounding, with growing investments in MRO facilities and increasing demand for cost-effective, aftermarket components. PMA adoption here is growing, particularly in regional and narrowbody segments.

The aviation aftermarket is undergoing a significant transformation, with increasing emphasis on PMA certification, FAA approval, and EASA standards to ensure safety and quality in aircraft parts and replacement components. The growing demand for cost-efficiency has spurred the use of OEM alternatives and cost-effective parts, especially in engine components, airframe parts, and avionics systems. Technological advancements like additive manufacturing and 3D printing are playing a pivotal role in developing parts using advanced materials, which help enhance fuel efficiency and reduce maintenance costs. The rise in MRO services is closely tied to evolving regulatory compliance and adherence to stringent safety standards. Critical systems such as thrust reversers, turbine blades, air intakes, and landing gear require precise engineering, while innovations in hydraulic systems, composite materials, and digital tools are streamlining operations. Furthermore, advancements in data analytics and the restructuring of the supply chain are enabling greater transparency and responsiveness in the aviation components industry.

Prominent companies shaping the industry include:

ADPma LLC

Aero Brake and Spares Inc.

Airforms Inc.

AirGroup America Inc.

AMETEK Inc.

Aviation Component Solutions

BAE Systems Plc

Berkshire Hathaway Inc.

Fluid Components LLC

General Electric Co.

HEICO Corp.

Kellstrom Aerospace

Parker Hannifin Corp.

RTX Corp.

RBC Bearings Inc.

Safran SA

Spirit AeroSystems Inc.

The Timken Co.

Triumph Group Inc.

Wencor Group LLC

Among them, ADPma LLC stands out for delivering Performance Improvement Parts covering engine turbines, exhaust components, wings, and lighting, all engineered for compliance with OEM specifications and aimed at boosting fleet efficiency

Analysis of the aviation components market shows a growing interest in sustainable innovations like hybrid propulsion and lightweight engine nacelles, which are redefining efficiency benchmarks. Components such as wing flaps, control surfaces, and cabin interiors are being optimized with electrical systems, pneumatic systems, and advanced thermal coatings that contribute to noise reduction and environmental compliance. The integration of lightweight alloys is instrumental in improving aircraft performance while reducing operational costs. Additionally, predictive maintenance and robust quality assurance measures are being enabled by emerging repair techniques and advanced diagnostics in flight controls and structural components. The focus on reliability extends to anti-icing systems and upgraded cockpit displays, ensuring optimal functionality across various flight conditions. The combination of innovation and regulatory rigor is positioning the market to meet the evolving needs of modern aviation while maintaining the highest standards of safety and performance.

For more details about the industry, get the PDF sample report for free

Safe and Secure SSL Encrypted