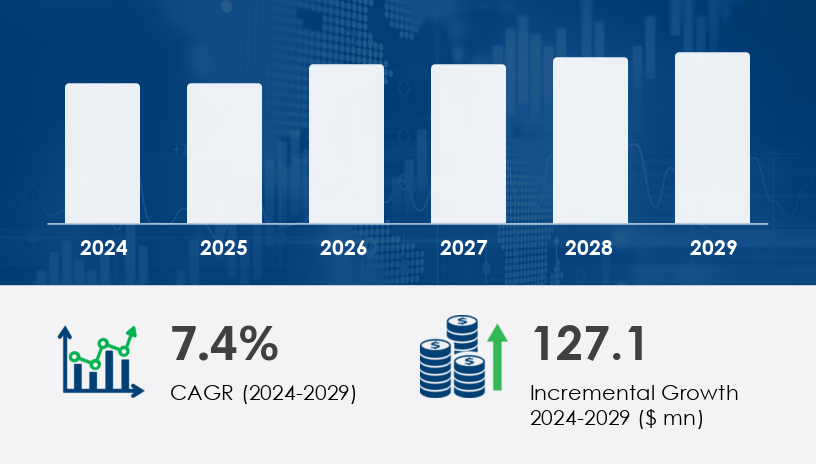

The Commercial Aircraft In-Seat Power Supply System Market is poised for substantial expansion, driven by increasing passenger demand for in-flight device charging, the rise in cabin retrofitting initiatives, and the push for more electric aircraft. In 2024, the market was already witnessing notable activity, and it is forecast to grow by USD 127.1 million by 2029, progressing at a CAGR of 7.4% during the 2025–2029 period.

For more details about the industry, get the PDF sample report for free

A key driver of the Commercial Aircraft In-Seat Power Supply System Market is the growing investment by airlines in cabin retrofitting programs aimed at enhancing passenger comfort and experience. Airlines are increasingly upgrading older aircraft with modern amenities to keep up with passenger expectations and competitive pressures. The installation of in-seat power supply systems—enabling travelers to charge smartphones, tablets, and laptops during long haul flights—has become essential. The rise in business travel and tech-savvy consumers has accelerated this shift. As more airlines retrofit existing fleets and equip new aircraft with advanced power systems like USB-C ports, AC sockets, and wireless charging pads, the demand for integrated in-seat power continues to rise, aligning with broader modernization efforts and emission regulations.

One of the most significant trends shaping the market is the transition toward "more electric aircraft." Aircraft manufacturers are integrating advanced power electronics and electrical systems to improve energy efficiency, reduce emissions, and streamline cabin infrastructure. This trend includes the development of wireless chargers embedded into aircraft seating and the miniaturization of power supply components. Modern cabins are now incorporating features such as Bluetooth-enabled seats, USB-C outlets, and 4K OLED screens, particularly in economy and premium economy classes. These advancements not only enhance passenger convenience but also align with sustainability objectives and regulatory requirements for modern aviation.

The Commercial Aircraft In-Seat Power Supply System Market is experiencing strong growth, driven by rising expectations for enhanced passenger experience and continuous in-flight connectivity. Modern aircraft are increasingly equipped with in-seat power solutions, including USB power supply, AC power outlets, DC power outlets, and wireless charging, to meet the rising demand for device charging and passenger comfort. Innovations like smart power management, energy-efficient systems, and lightweight designs are being adopted to optimize power efficiency without compromising aircraft weight limits. These developments align with ongoing cabin modernization initiatives, as airlines aim to improve passenger amenities and differentiate through upgraded services. Enhancements in electrical systems and seat integration are also pivotal in offering seamless power access to all passengers.

Segmentation Categories:

Channel: OEM, Aftermarket

End-user: Economy class, Business class, Premium economy class, First class

Aircraft Type: Narrow-body aircraft, Wide-body aircraft, Regional transport aircraft

The OEM (Original Equipment Manufacturer) segment leads the market in terms of share and expected growth. OEMs design and install in-seat power supply systems directly into new aircraft, aligning with growing orders for next-generation planes like the A320 Family, B737 MAX, B787 Dreamliner, and B777X. In 2019, the OEM segment was valued at USD 166.80 million and has shown consistent growth since. Analyst insights suggest that OEMs benefit from a strategic advantage due to their integration capabilities and knowledge of aircraft safety and regulatory standards. Their deep involvement in cabin modernization, such as the inclusion of USB-C power outlets and wireless charging features, ensures that OEMs will remain dominant in the market throughout the forecast period.

Covered Regions:

North America

Europe

APAC

South America

Middle East and Africa

The Asia-Pacific (APAC) region is projected to contribute 44% to the global market growth during the forecast period, making it the fastest-growing regional market. This expansion is fueled by increasing aircraft deliveries, growing middle-class air travel demand, and massive infrastructure development in countries like China, India, and Japan. The region’s aerospace supply chain is rapidly advancing, with manufacturers focusing on economy class retrofitting and enhanced cabin interfaces. Analyst commentary notes that APAC’s rising passenger traffic and ongoing investment in new-generation aircraft position it as the most dynamic market for in-seat power systems. The integration of wireless charging and energy-efficient cabin designs is also accelerating adoption rates in the region.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

A significant barrier facing the Commercial Aircraft In-Seat Power Supply System Market is the presence of diverse customs and regulatory requirements across different regions. Manufacturers must navigate a complex landscape of international safety, electrical, and material standards, which vary from country to country. This creates challenges in product design, certification, and cross-border deployment. For example, differing plug configurations, power supply ratings, and safety codes can slow the introduction of new systems. These regulatory inconsistencies require additional investment in compliance testing, specialized manufacturing processes, and region-specific customization, thereby increasing the cost and time to market.

Market research highlights growing adoption of advanced power distribution systems, including USB-C ports, USB-A ports, and charging ports, supporting a wide range of devices with improved power compatibility. Airlines are also investing in modular configurations, power supply units, and power adapters to enable efficient maintenance and future upgrades. The inclusion of power converters, power outlets, and power modules ensures stable power delivery across the cabin, while charging stations and touchless technologies reflect shifting trends toward hygiene-focused passenger amenities. New retrofit systems are being introduced to upgrade existing fleets with minimal disruption, accompanied by enhanced seat electronics that support the integration of in-seat power with entertainment systems and connectivity solutions. This evolution is closely tied to broader efforts in cabin upgrades and enhancing overall customer satisfaction.

Analytical insights reveal that robust power infrastructure, precise aircraft wiring, and sophisticated battery management systems are vital for ensuring operational reliability and safety in in-seat power systems. As airlines pursue smart charging capabilities, technologies that enable real-time power monitoring, power safety, and optimal device connectivity are gaining traction. The use of smart power management systems helps in balancing energy loads efficiently across cabins, while prioritizing power for critical applications. Additionally, researchers are focusing on the role of connectivity solutions in enhancing device connectivity and power access, particularly as more passengers bring power-hungry electronics onboard. The market is projected to expand further as technological advancements align with the increasing need for high-quality, adaptable, and future-proof power solutions in modern aircraft cabins.

Innovations or Recent Developments

Companies operating in the Commercial Aircraft In-Seat Power Supply System Market are pursuing innovation-led growth through product development, partnerships, and strategic acquisitions:

In response to rising demand, Astrodyne TDI offers advanced AC and DC connectors and cooling systems tailored for aircraft applications.

The launch of specialized seats with USB-C power outlets, Bluetooth integration, and 4K OLED displays has become a standard feature in modern aircraft interiors.

Airlines and manufacturers are investing in miniaturized, energy-efficient power systems to reduce aircraft weight and improve fuel efficiency.

Strategic collaborations between OEMs and seat manufacturers have resulted in highly integrated cabin systems, such as BL3530 seats equipped with wireless charging pads and modular power sockets.

Recent aircraft procurement programs, like those involving the A350, B787 Dreamliner, and B777X, increasingly prioritize electrical system integration, including advanced in-seat power modules.

Analyst insights indicate that continued advancements in cabin technologies and production tools (e.g., floor panels, sidewalls, power outlets) will play a critical role in improving supply chain responsiveness and meeting evolving passenger needs. The emphasis on aesthetics, safety, and real-time connectivity underscores the industry’s commitment to delivering seamless, modern in-flight experiences.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Channel

6.1.1 OEM

6.1.2 Aftermarket

6.2 End-user

6.2.1 Economy class

6.2.2 Business class

6.2.3 Premium economy class

6.2.4 First class

6.3 Aircraft Type

6.3.1 Narrow-body aircraft

6.3.2 Wide-body aircraft

6.3.3 Regional transport aircraft

6.4 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 Europe

6.4.4 South America

6.4.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted