Child Care Market Size 2025-2029: Key Trends and Growth Insights

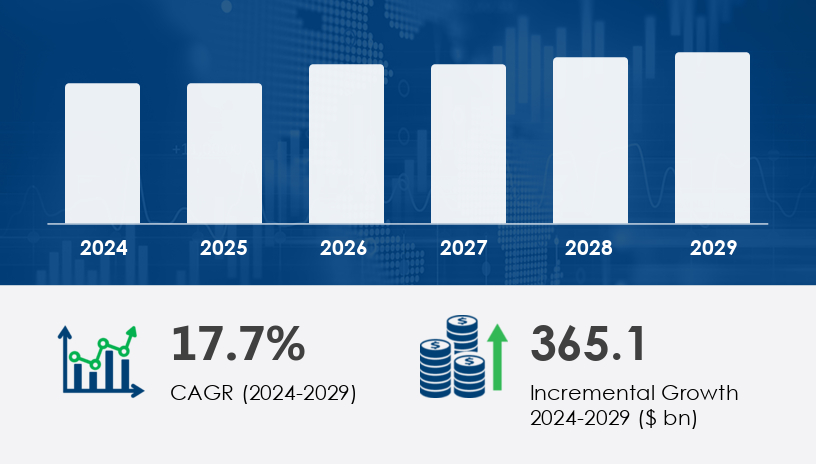

The Global Child Care Market is set to grow significantly, with a forecasted increase of USD 365.1 billion at a CAGR of 17.7% from 2024 to 2029. This growth is driven by various socio-economic factors, such as the increasing awareness of early childhood education, the rise in dual-income households, and a shift towards flexible child care solutions. Here's a deeper dive into the market's segmentation, dynamics, and regional trends.

For more details about the industry, get the PDF sample report for free

Market Segmentation

The child care market is divided into several key segments, focusing on delivery, type, and geography. Here are the primary segments:

By Delivery

- Organized Care Facilities: This segment is predicted to experience significant growth due to the increasing number of working parents. These facilities, including child care centers, preschools, and daycare services, offer structured early education programs that promote overall child development.

- Home-Based Settings: A growing demand for home-based child care solutions also exists, as some parents seek more personalized care in a home environment.

By Type

- Early Education and Daycare: These services prioritize children's cognitive, social, and emotional development through structured curricula.

- Early Care: Focused on infants and toddlers, providing foundational care for early development.

- Backup Care: A growing solution for parents who need temporary care when regular arrangements fall through.

Geography

- North America: The region is expected to contribute significantly to the global market growth, driven by high working mother participation and increasing disposable income.

- Europe: Key countries such as Germany, the UK, France, and Italy are seeing a rise in demand for quality child care services.

- APAC: Countries like China, India, and Japan are witnessing expanding demand due to changing family structures and increasing working women.

- South America: Brazil is experiencing a growing need for reliable child care services.

- Middle East and Africa: The region is gradually increasing its adoption of child care services as the workforce evolves.

Child Care Market Dynamics

Drivers

- Growing Parent Awareness: Parents are increasingly aware of the long-term benefits of early childhood education, which drives demand for quality child care services.

- Women in the Workforce: As more women enter the workforce, the demand for child care services continues to rise, especially in dual-income households.

- Disposable Incomes: As household incomes rise, families are investing in higher-quality care options, including educational advising services and healthcare solutions.

Trends

- Corporate Child Care Services: A rising trend among corporations is offering child care services to employees, which not only helps with employee retention but also promotes a better work-life balance.

- Integration of Technology: Companies like Fisher-Price have integrated technology into child care products, such as smart baby monitors, to provide enhanced convenience and safety for parents.

Challenges

- Health and Safety Concerns: Concerns over children's health in child care centers, such as disease outbreaks and poor sanitation, continue to affect enrollment and disrupt operations in some regions.

- Regulatory Pressure: As child care centers grow in popularity, there is an increased demand for stricter health and safety regulations to ensure a safe environment for children.

Get more details by ordering the complete report

Key Players

- Beanstalk Education Group

- Benesse Holdings Inc.

- Bright Horizons

- Cadence Education

- Child Development Schools

- Crestar Education Group

- Fortune Kindergarten

- Goddard Franchisor LLC

- Kids and Co.

- KinderCare Learning Centers LLC

- Learning Care Group Inc.

- Pigeonhearts Corp.

- Poppins Corp

- Primrose School Franchising SPE LLC

- Smartkidz Educare Global Pvt. Ltd.

- Spring Education Group

- The Learning Experience

- Tree House Education And Accessories Ltd.

Latest Market Developments

- November 2024: Johnson & Johnson launched a new line of organic and hypoallergenic baby care products to meet the growing demand for safe and environmentally friendly child care solutions.

- October 2024: Procter & Gamble expanded its product range with new child care wipes featuring advanced moisture-lock technology for enhanced protection.

- September 2024: Fisher-Price introduced a smart baby monitor connected to a mobile app for real-time tracking of a child's health and sleep patterns.

- August 2024: Pampers released a new line of eco-friendly diapers made from plant-based materials to cater to environmentally conscious parents.

The child care market's rapid growth is supported by key industry trends, with significant contributions from both established and new players. The market continues to evolve, driven by a focus on child development, corporate involvement, and technological innovation.