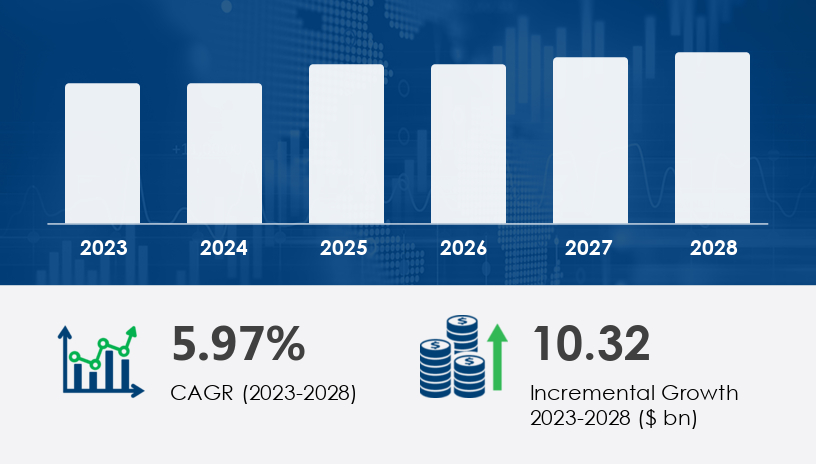

As the global personal care industry enters a new era of conscious consumerism, sustainability, and technological innovation, the chemicals for cosmetics and toiletries market stands at a pivotal crossroads. Forecast to grow by USD 10.32 billion from 2023 to 2028 at a CAGR of 5.97%, the market is evolving beyond traditional formulations to embrace personalization, green chemistry, and multifunctionality. From active ingredients like retinol, vitamin C, and hyaluronic acid to indispensable excipients such as emollients, surfactants, and preservatives, the diversity and complexity of cosmetic chemicals are expanding in tandem with consumer expectations.For more details about the industry, get the PDF sample report for free

The backbone of every personal care product—from daily cleansers to premium anti-aging serums—lies in its chemical composition. These chemicals not only dictate product efficacy but also determine safety, texture, shelf-life, and sensory appeal. Key ingredient categories driving the market include exfoliants (AHAs, BHAs), surfactants (SLES, CAPB), emulsifiers (Polysorbate 80, Steareth-20), emollients (Shea Butter, Dimethicone), alcohols (Ethanol, Propylene Glycol), and colorants (both natural and synthetic).

An interesting shift has been the growing preference for conditioning agents, particularly cationic polymers such as polyquaternium-10, dimethiconol, and Cyclopentasiloxane. These are widely used in haircare to reduce frizz and tangles, enhance shine, and improve manageability. Their increasing use in skincare products, too, underscores a trend toward multifunctional formulations—products that hydrate, condition, and protect all at once.

With a rising awareness of ingredient safety and transparency, synthetic ingredients like formaldehyde and parabens are under increasing scrutiny. Formaldehyde, a known carcinogen, is gradually being phased out in favor of alternative preservation systems, while consumers are leaning toward products with “clean labels” and plant-derived actives.

Segment Analysis: Where Growth is Coming From

The market is segmented by Type (Cosmetics Chemicals and Toiletries Chemicals), Application (Hair Care, Skin Care, Color Cosmetics, Perfumes & Fragrances, Others), and Region (APAC, North America, Europe, South America, Middle East & Africa).

The cosmetics chemicals segment is set to dominate the market, fueled by demand for ingredients that enhance aesthetic appeal and functionality. These chemicals include petroleum derivatives, essential oils, polymers, pigments, and fatty chemicals—used across skin, hair, and color cosmetics. Notably, polymers are increasingly used not only as film-forming agents in hairsprays but also as texturizers in creams and lotions, highlighting their versatile application potential.

By application, hair care and skincare lead in consumption, driven by global megatrends such as “skinimalism,” gender-neutral beauty, and hair health optimization. Active ingredients like peptides, botanical extracts, and vitamins are frequently paired with sophisticated carriers and stabilizers to ensure both performance and safety.

Regionally, Asia Pacific (APAC) is poised to contribute 34% of the global market growth, led by dynamic markets in China, India, and Japan. Consumer inclination toward natural and organic products, especially in countries with rich herbal traditions, is prompting brands to establish local production hubs and integrate sustainable supply chains. In contrast, North America and Europe continue to drive innovation through biotechnology, clean labeling, and regulatory compliance, reflecting a mature but progressive landscape

Get more details by ordering the complete report.

A key growth driver in the next five years is the increasing demand for grooming products among men, a segment that is no longer niche. Men’s skincare and haircare products are becoming more sophisticated, often borrowing advanced actives and textures traditionally reserved for women’s lines. This shift necessitates diverse chemical formulations tailored for thicker skin, oilier complexions, and specific hair types.

Additionally, eco-conscious consumers are demanding alternatives to synthetic compounds, which has accelerated R&D in green chemistry and biotechnology. Ingredients sourced from sustainable farming practices—like cold-pressed plant oils, marine extracts, and biodegradable surfactants—are gaining traction. However, these alternatives often come at a premium, posing cost challenges for mass-market adoption.

One of the most pressing hurdles remains consumer health concerns regarding synthetic ingredients. Chemicals such as benzyl alcohol, acetone, ethanol, camphor, and ethyl acetate, commonly found in skincare and fragrance products, are increasingly scrutinized for their potential toxicity. Regulatory agencies worldwide are responding by updating ingredient safety profiles and labeling requirements, urging manufacturers to reformulate existing products without compromising efficacy.

Looking ahead, the chemicals for cosmetics and toiletries market will see significant transformation shaped by the following trends:

Personalization and Direct-to-Consumer Platforms: With tools for skin diagnostics and AI-based product recommendations becoming mainstream, chemical formulations will increasingly need to support customizable products tailored to individual skin and hair profiles.

Rise of Multifunctional Ingredients: Time-starved consumers are gravitating toward products that serve multiple purposes. Ingredients such as alpha hydroxy acids, peptides, and botanical extracts will be engineered to deliver anti-aging, brightening, and hydration benefits in a single formulation.

Clean and Transparent Labeling: “Free from” claims (e.g., paraben-free, sulfate-free) will continue to dominate packaging. This demands innovation in natural preservatives and stabilizers to maintain shelf-life without synthetic additives.

Regulatory Pressure and Ingredient Innovation: Stricter global regulations, especially in the EU and US, will force chemical suppliers and cosmetic brands to invest in compliant yet effective alternatives, accelerating the pace of ingredient innovation.

M&A and Global Expansion: Expect increased mergers, acquisitions, and strategic alliances among ingredient suppliers and cosmetics giants aiming to expand regional footprints and technology portfolios. Companies like AAK AB are already leveraging their expertise in versatile chemicals like glycerin to meet growing demand.

For more details about the industry, get the PDF sample report for free

The Chemicals for Cosmetics and Toiletries Market is witnessing robust growth, driven by rising demand for advanced formulations containing bioactive and functional compounds. Key components such as hyaluronic acid, peptides, vitamin C, and retinol are widely used as anti-aging ingredients and skin brightening agents in facial creams and serums. Preservatives, surfactants, colorants, and fragrances form the backbone of product stability, sensory appeal, and shelf life across various cosmetic categories. Additionally, emulsifiers, antioxidants, moisturizers, and conditioning agents are integral for texture improvement and product efficacy. The rising popularity of natural ingredients and organic chemicals is shaping consumer preferences, especially in clean beauty products. The inclusion of UV filters like zinc oxide and titanium dioxide further enhances sun protection functionality. The market is increasingly focused on solutions that combine efficacy and safety, particularly in applications like hair conditioning and skin repair.

For manufacturers and brands, the winning strategy lies in the intersection of efficacy, ethics, and experience. Here’s how to capitalize on the forecasted market trends:

Invest in green R&D: Focus on developing natural emulsifiers, biodegradable surfactants, and botanical actives that meet performance and safety benchmarks.

Enhance regulatory agility: Stay ahead of compliance curves by collaborating with toxicologists and legal experts to ensure product portfolios align with global standards.

Double down on personalization: Partner with AI startups or skincare labs to deliver made-to-order cosmetics based on consumer skin/hair diagnostics.

Optimize global sourcing: Establish local sourcing partnerships in APAC and LATAM to tap into indigenous ingredients and cost-effective production.

Leverage digital channels: Build direct-to-consumer models with online customization tools, clean beauty storytelling, and community engagement strategies.

Get more details by ordering the complete report

Recent analysis of the market reveals growing interest in multifunctional and plant-derived compounds such as glycerin, collagen boosters, botanical extracts, and essential oils, which align with trends toward holistic personal care. Advanced formulations now commonly include silicone compounds, parabens, sulfates, and emollients, though the shift toward sulfate- and paraben-free alternatives is gaining momentum. Innovations focus on hydration and repair, with humectants, active ingredients, and ceramides leading development pipelines. Dermatologically relevant actives like niacinamide, salicylic acid, alpha hydroxy, beta hydroxy, polyphenols, and squalane are at the forefront of acne, aging, and sensitive skin treatments. Meanwhile, natural emollients such as jojoba oil, argan oil, shea butter, and aloe vera are being incorporated for their nourishing and soothing properties. Extracts like green tea extract, chamomile extract, and exfoliants such as lactic acid and glycolic acid are also finding broader usage across both cosmetic and toiletry applications. The market continues to evolve toward more functional, eco-conscious, and science-backed formulations

The chemicals for cosmetics and toiletries market is more than just a supply chain of ingredients—it’s the engine behind the beauty industry’s next frontier. As consumers become more informed, regulatory bodies more vigilant, and technology more accessible, the future of cosmetic chemistry is firmly rooted in sustainability, personalization, and transparency. Between 2025 and 2029, companies that reimagine ingredient science with a conscience will not only drive growth but redefine the standards of beauty itself.

For more details about the industry, get the PDF sample report for free

Safe and Secure SSL Encrypted