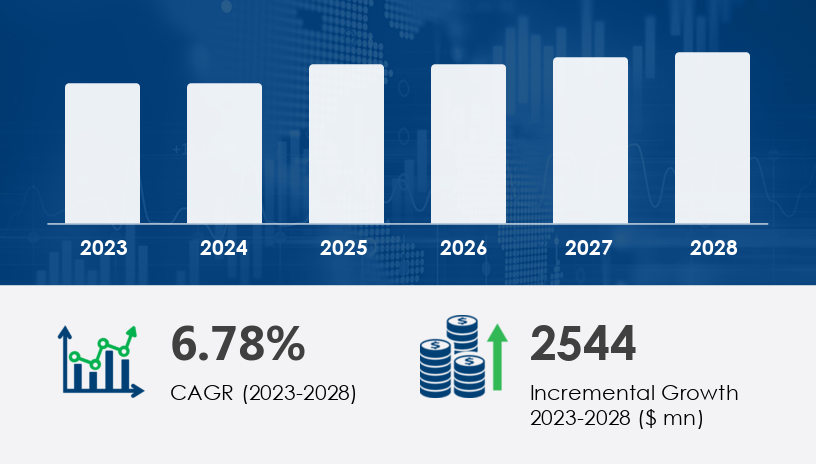

The global casting resin market is set to experience substantial growth, with an estimated increase of USD 2.54 billion at a CAGR of 6.78% from 2023 to 2028. As electric vehicles and wind turbines reshape global supply chains, casting resins are emerging as the unsung hero of material innovation. “We’re no longer just pouring molds—we’re designing the future,” . This shift marks a new chapter: Market Redefined. The casting resin market is poised for breakthrough growth between 2025 and 2029, fueled by lightweight engineering, sustainable coatings, and new energy applications.For more details about the industry, get the PDF sample report for free

From its early role in prototyping and small-scale crafts to its current applications in automotive components, electronics, and renewable energy systems, the casting resin market has matured significantly. In 2020, it was valued under USD 3 billion with modest growth, mostly in artisan sectors. By 2024, increased demand from auto OEMs and the rise of waterborne polyurethane coatings in construction and aerospace began to transform the space. Now, entering 2025–2029, the market is entering its most dynamic phase, predicted to grow by USD 2.54 billion at a CAGR of 6.78% through 2028.

Legacy Disruption: Traditionally used for surface coatings in niche applications, polyurethane resins were largely restricted to wood finishes and some industrial uses.

New Strategy Emerging: Their role has expanded significantly due to superior durability, environmental benefits, and flexibility across automotive, construction, and renewable sectors.

Analyst Insight: "Polyurethane's ability to resist abrasion and adapt to sustainable standards is redefining what industrial coatings can achieve."

Business Case: In India, a construction firm retrofitting affordable housing switched from solvent-based paints to polyurethane casting resins, cutting VOC emissions by 45% and extending material lifespan.

Stats: Polyurethane was the largest segment in 2018 at USD 3.81 billion; coatings are gaining momentum due to low VOC emissions and cost efficiency.

Legacy Disruption: Metal-heavy vehicle components such as crankshafts and cylinder heads relied on cast iron, limiting design flexibility.

New Strategy Emerging: OEMs are turning to casting resins to produce complex, lightweight parts—especially in the shift toward electric vehicles.

Analyst Insight: "What used to require a die-cast factory now fits inside a moldable innovation lab."

Business Case: A U.S. auto manufacturer partnered with Huntsman International LLC to prototype resin-based suspension components, reducing part weight by 28% and boosting fuel efficiency.

Stats: U.S. automotive market expansion is a core driver of demand; increased HP engine production is spurring resin use in cylinder blocks and heads.

Legacy Disruption: DIY projects and 3D modelers relied on lower-grade materials with limited resilience.

New Strategy Emerging: Polymeric compounds like epoxy and polyurethane are enabling small-batch, high-density casting in toys, miniatures, and prototyping.

Analyst Insight: "We’re seeing a fusion of consumer creativity and industrial capability through casting resins."

Business Case: A German startup uses resin molds in tabletop gaming figurines, achieving custom quality with rapid production cycles.

Stats: Polyester and polyurethane resin categories are leading innovation; 3D printing integration is accelerating across segments.

Get more details by ordering the complete report

3 Forces Shaping Competition

Material Innovation & Sustainability

Companies like Covestro AG and Hexion Inc. are investing in bio-based and waterborne polyurethane resins, responding to global regulations on emissions and sustainability in coatings.

Vertical Integration Amid Price Volatility

With raw material costs fluctuating, players such as China Petrochemical Corp. and Chang Chun Group are expanding upstream operations to stabilize costs and protect margins.

Global Expansion & Customization

Firms are diversifying into fast-growing markets like APAC, where infrastructure and automotive demand fuel expansion. Kolon Industries Inc. has tailored resin solutions for regional applications in wind energy.

Bio-Based Resins as Default: By 2029, environmentally friendly casting resins will dominate R&D budgets as industries align with ESG goals.

AI-Simulated Mold Design: Real-time, simulation-based casting workflows will reduce waste and speed up time-to-market in automotive prototyping.

Decentralized Manufacturing with Resin Kits: Distributed manufacturing using high-grade resin kits for local production of spare parts, even in remote regions.

Get more details by ordering the complete report

The Casting Resin Market is experiencing strong momentum, driven by advancements in materials engineering and demand across diverse industries. Resins such as epoxy resin, polyurethane resin, polyester resin, acrylic resin, and silicone resin are widely used for applications including electronics encapsulation, transformer insulation, and circuit board coating. The versatility of phenolic resin and vinyl ester further expands casting potential across automotive composites, aerospace components, and wind turbine blades. The increasing use of marine coatings, construction adhesives, and electrical insulators is propelling demand, particularly in sectors requiring robust thermal and dielectric properties. Innovations in potting compounds, casting molds, and resin casting techniques have enabled broader adoption in fiber reinforcement and polymer matrix applications. As composite materials gain traction, processes like resin infusion, vacuum casting, injection molding, and resin transfer have become essential to manufacturing workflows. Moreover, the integration of dielectric materials, thermal insulation, and flame retardants in resin systems underpins their critical role in electrical and electronics industries.

Innovation Example:

Gougeon Brothers Inc. is piloting a smart resin formulation that adapts viscosity based on external humidity—ideal for marine and aerospace use.

Provocative Question:

If casting resin becomes as customizable as software code, will traditional manufacturing even be needed in the next decade?

Invest in APAC Expansion

With APAC accounting for 61% of global market growth, prioritizing local manufacturing and distribution is essential.

Prioritize R&D in Polyurethane and Bio-Based Resins

The shift to low-VOC, waterborne coatings demands significant technological adaptation.

Mitigate Raw Material Volatility

Vertical integration or strategic supply partnerships can buffer against fluctuating input costs.

Explore Simulation-Based Casting

Adopt simulation tools to boost accuracy and reduce time-to-market in custom component design.

Embrace Customization in Consumer Markets

Tapping into DIY, toys, and small-scale art applications can diversify revenue streams and improve brand perception.

Align with ESG Standards

Regulatory trends increasingly favor green chemistry. Position your product lines for circular economy relevance.

Get more details by ordering the complete report

Cutting-edge advancements in UV curing, resin additives, and hardener systems—including epoxy hardeners—are enhancing performance in high-demand environments. The emergence of polyurethane foam, controlled resin viscosity, and specialized curing agents supports tailored applications such as resin coatings, industrial adhesives, and resin lamination. The market is increasingly aligned with global sustainability efforts, with significant investment in renewable energy solutions like solar panel encapsulation and battery encapsulation. In the healthcare sector, medical device coating is a fast-growing niche, while creative applications including art resin and jewelry casting are expanding consumer-level demand. Key performance factors such as resin durability, high-voltage insulation, and anti-corrosion coatings continue to drive innovation. With manufacturers prioritizing multifunctional materials that combine strength, thermal resistance, and ease of application, casting resins are becoming indispensable in both industrial and artisanal use cases. This market’s trajectory is firmly supported by the ongoing demand for lightweight, high-performance materials across energy, transportation, electronics, and consumer sectors.

Conclusion

The casting resin market between 2025 and 2029 will not be defined merely by scale, but by sophistication. From high-performance vehicle components to eco-conscious surface coatings, casting resins are redefining what’s possible in material science. This is not just growth—it’s a reinvention. For companies ready to align with sustainability, customization, and technological agility, the next era offers more than competitive advantage. It offers leadership. Are you ready to pour the future into your mold?

Get more details by ordering the complete report

Safe and Secure SSL Encrypted