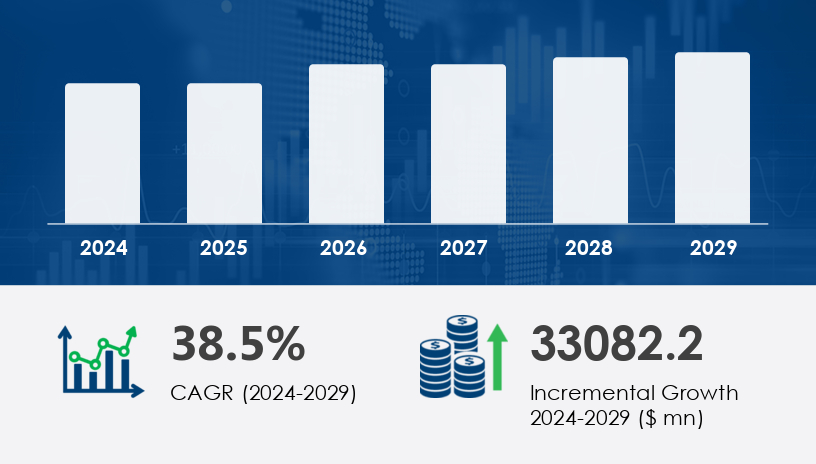

In a bold projection, the carbon accounting software market is set to expand by USD 33.08 billion between 2025 and 2029, achieving a remarkable CAGR of 38.5%. As global enterprises intensify decarbonization efforts, demand is surging across key segments—particularly cloud-based solutions and SMEs. This sharp upward trend is driven by a combination of rising global awareness, stricter environmental regulations, and an increasing demand for software-as-a-service (SaaS)-based carbon accounting solutions. In this comprehensive guide, we provide strategic insights into the Carbon Accounting Software Market from 2025 through 2029, dissecting the sector by end-user, deployment model, and enterprise size.

Whether driven by ESG reporting requirements, regulatory compliance, or the pursuit of operational sustainability, businesses now view carbon accounting software as essential to their climate strategy. This article delivers a segment-by-segment analysis, market forecasts, and expert-backed insights to help stakeholders prepare for the opportunities—and risks—ahead.

For more details about the industry, get the PDF sample report for free

The carbon accounting software market is undergoing rapid transformation, fueled by rising emissions regulations, investor pressure for ESG transparency, and technological advancements in SaaS and AI. From data centers to city infrastructure, enterprises are turning to digital tools to measure, manage, and report emissions efficiently.

| Segment | Details |

|---|---|

| Forecast Period | 2025–2029 |

| Market Growth | USD 33.08 billion increase at a CAGR of 38.5% |

| Top Region | North America (48% contribution to market growth) |

| Deployment Types | Cloud-based, On-premises |

| Enterprise Size | SMEs, Large Enterprises |

| Key End-Users | Telecommunications, Oil & Gas, Technology, Power & Utilities |

| Leading Drivers | Emissions regulations, SaaS adoption, demand for real-time reporting |

| Top Challenge | Difficulty capturing accurate energy usage data |

Growth Drivers: The telecom sector is increasingly dependent on carbon accounting tools to manage massive energy usage across data centers and mobile networks. Integration with renewable energy sources and real-time carbon tracking is now crucial.

Challenges: Complexity in measuring emissions from vast infrastructure and aligning multiple systems.

Expert Insight: “Telecom companies are pivoting toward integrated software that aligns sustainability goals with energy infrastructure,” says an ESG Analyst at Technavio.

Case Study: GreenSignal, a mid-size telecom firm, reduced operational emissions by 24% over two years by deploying a cloud-based carbon accounting suite integrated with their network monitoring system. The system highlighted inefficiencies in legacy infrastructure and enabled smart grid integration.

Key Stat: The segment was valued at USD 478.50 million in 2019, showing consistent growth since.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Growth Drivers: Businesses across the board are embracing SaaS-based carbon accounting for its flexibility, low upfront costs, and scalability. It also enables remote collaboration for sustainability teams.

Challenges: Concerns over data security and integration with legacy systems persist.

Analyst Comment: “SaaS carbon solutions have become indispensable—especially for SMEs—due to ease of access and cost-efficiency,” notes a Sustainability Architect.

Case Study: EcoBank, a regional financial institution, transitioned from spreadsheets to a cloud-based system, cutting compliance report generation time by 40% and improving emissions accuracy through automated utility data imports.

Key Fact: SaaS solutions are growing fastest among SMEs, who often lack the resources for in-house infrastructure.

Growth Drivers: With funding support (e.g., US Department of Energy’s USD 52.5 million IAC program), SMEs are adopting tools to enhance energy efficiency and meet regulatory expectations.

Challenges: Limited budgets, lack of internal expertise, and fragmented data sources.

Expert Quote: “SMEs have shifted from awareness to action. Carbon tools are no longer optional—they’re a license to operate,” says a Sustainability Strategist at Technavio.

Case Study: SolarCraft LLC, a 40-person manufacturing SME in Ohio, used DOE’s IAC program to deploy a SaaS-based platform. Within one year, they cut carbon emissions by 15% and attracted new investors impressed by their ESG maturity.

Key Stat: North America, home to many such SMEs, accounts for 48% of global market growth.

New Markets: Emerging economies in APAC and Latin America present untapped potential for scalable SaaS tools.

AI & Digital Twins: Integration with AI-driven digital twins allows simulation and optimization of building and traffic systems for carbon minimization.

Financial Incentives: Carbon credits and green financing increasingly reward verified emissions reductions.

City-Level Implementation: Urban planners adopting carbon accounting for net-zero cities.

Data Quality Gaps: Accurate energy usage data remains hard to obtain, especially for decentralized operations.

Greenwashing: Overstated sustainability claims may erode public trust and bring regulatory scrutiny.

Technology Fragmentation: Lack of standardization can lead to compatibility issues across platforms.

Regulatory Heterogeneity: Differing global rules create complexity in cross-border reporting.

The carbon accounting software market is projected to grow by USD 33.08 billion from 2025–2029, expanding at a CAGR of 38.5%. The primary growth levers will be regulatory compliance, ESG integration, and widespread SaaS adoption across sectors. Are enterprises ready to pivot from manual tracking to autonomous carbon intelligence?

Future Outlook: “Carbon software is evolving from compliance tool to strategic asset,” forecasts a Climate Analytics expert at Technavio. “AI will play a central role in driving autonomous emissions tracking and predictive modeling.”

The Carbon Accounting Software Market has seen significant growth due to rising corporate focus on Carbon Accounting, Emissions Tracking, and Carbon Footprint management. As businesses increasingly prioritize Greenhouse Gas reduction and transparent Sustainability Reporting, the demand for platforms capable of monitoring Energy Consumption has surged. Solutions offered are typically either Cloud-Based or On-Premises, depending on the operational scale and security requirements. The push for ESG Compliance is another major driver, encouraging firms to invest in tools that assist with Carbon Reduction and robust Data Analytics. These tools often provide Real-Time Monitoring of Scope 1, Scope 2, and Scope 3 emissions, aligning with organizational Climate Goals and long-term strategies for achieving Net Zero status through Carbon Offsets and improved Regulatory Compliance.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Invest in digital twins for network energy modeling and optimization.

Use cloud-based platforms to unify carbon data from towers, offices, and data centers.

Partner with renewable energy firms to integrate and report green sourcing.

Offer integration APIs for ERP, HR, and IoT systems to improve usability.

Enhance cybersecurity features to ease enterprise compliance fears.

Provide flexible pricing for SMEs and emerging markets to boost adoption.

Leverage government grants like the DOE IAC initiative for free or subsidized audits.

Choose plug-and-play SaaS tools that minimize onboarding time.

Start with scope 1 and 2 emissions and expand gradually for sustainable scaling.

In-depth analysis reveals that Carbon Accounting Software increasingly incorporates Emission Factors and promotes Energy Efficiency through AI Integration and Machine Learning to quantify and reduce Environmental Impact. Accurate Carbon Inventory capabilities are particularly crucial for sectors like Telecom Emissions, Power Generation, Oil Gas, and Industrial Engineering. Moreover, tools supporting Carbon Disclosure and tracking Sustainability Metrics play a pivotal role in streamlined Emission Reporting and comprehensive Carbon Management. Advanced platforms now feature Automated Tracking, dynamic Data Visualization, and enhanced Corporate Sustainability modules. These enable accurate Emission Calculations, management of Carbon Credits, and execution of effective Energy Audits. Key differentiators include adaptive Compliance Tools, actionable Carbon Insights, and the integration of Eco-Friendly Solutions that support both operational goals and environmental responsibility.

The Carbon Accounting Software Market is rapidly emerging as a foundational pillar of sustainability transformation. Segments like telecommunications, SaaS deployment, and SMEs are leading the charge, each with distinct drivers and challenges. As emissions tracking becomes an operational imperative, those who invest in robust, adaptable, and data-driven solutions will be best positioned to meet both regulatory demands and investor expectations.

Download our free Strategic Report for full 2025 insights and explore how your enterprise can lead in carbon intelligence.

Safe and Secure SSL Encrypted