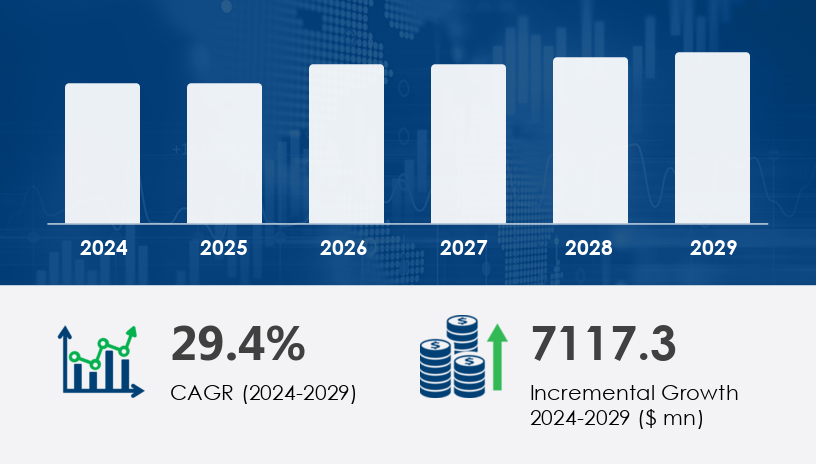

The Bus Seating Systems Market is poised for substantial expansion, driven by growing urbanization, evolving commuter needs, and government investments in public transportation infrastructure. Innovations in seat design and a push toward sustainable materials are transforming bus interiors to enhance both comfort and efficiency.The global bus seating systems is projected to grow by USD 7.12 billion by 2029, expanding at a CAGR of 29.4% during the forecast period.For more details about the industry, get the PDF sample report for free

One of the primary drivers of the bus seating systems market is the increased investment by governments in public transport infrastructure. Countries worldwide, particularly India and the US, are developing Bus Rapid Transit Systems (BRTS) to tackle urban congestion and promote eco-friendly travel. For instance, India’s Union Ministry proposed BRTS expansion across expressways, incorporating air-conditioned buses and modern seating features. Cities like Ahmedabad and Pune already serve over 1.75 million passengers daily through BRTS. These systems demand durable and comfortable bus seats, thereby stimulating growth in the market. According to analysts, the integration of modern, space-efficient seating enhances capacity and ride quality, playing a pivotal role in public transport system effectiveness.

A key trend shaping the market is the rising demand for smart seating solutions. Passengers increasingly expect ergonomic and feature-rich seating experiences, prompting manufacturers to innovate. Features such as lumbar support, ventilation, massage functions, and integrated child seats are now integrated even in public transit and electric buses. Moreover, the shift toward eco-friendly seating materials like plant-based composites aligns with regulatory requirements and environmental goals. Analysts note that these technologies not only improve passenger comfort but also position OEMs favorably in a competitive, sustainability-driven market.

The Bus Seating Systems Market is experiencing strong growth, driven by evolving passenger comfort expectations and regulatory requirements. Key components like bus seats, seat cushions, seat frames, and upholstery materials are being re-engineered for enhanced durability, comfort, and safety. Modern designs emphasize ergonomic seats, recliner seats, passenger seats, and folding seats, all developed with foam padding, seat belts, and headrests to ensure secure and comfortable transit. Additional features such as armrests, seat adjusters, and lumbar support enhance ride experience, especially in long-haul and intercity buses.

The Bus Seating Systems Market is segmented by:

Type

Standard seats

Recliner seats

Vehicle Type

Transit buses

Coach buses

School buses

Transfer buses

Material

Leather

Fabric

Vinyl

Composite materials

End-user

OEMs

Aftermarket

Among all segments, Standard Seats dominate the market in both adoption and projected growth. Valued at USD 1.1 billion in 2019, this segment continues to grow steadily. These bench-style seats, often 40–45 cm wide with recline functionality, are favored for extended commute routes, including sleeper buses. The cost-effectiveness of public transport over air travel further boosts demand for such seating. Analysts emphasize that public sector investments and low operating costs make standard seats a logical choice for most transit authorities, especially in emerging markets.

Get more details by downloading the sample PDF report

Covered Regions:

APAC

Europe

North America

South America

Middle East and Africa

Europe is projected to contribute 52% of the global market growth between 2025 and 2029. Government programs and retrofitting of legacy bus fleets with modern seating systems are accelerating adoption. Additionally, regulatory pressure to reduce carbon emissions has led to the incorporation of lightweight, sustainable seating options. Meanwhile, APAC is seeing a surge in demand due to rapid urbanization in countries like India and China, and the expansion of electric bus fleets. These electric buses demand advanced seating systems with features like air cushions and eco-materials. According to the report, Asia’s growing middle class and investments in last-mile connectivity play an important role in stimulating market growth.

A major challenge facing the bus seating systems market is the requirement to reduce seat weight while enhancing safety. Regulatory bodies such as the European Union and CAFE in North America enforce stringent fuel economy and emission standards. The 54.5 mpg CAFE target for 2025 compels OEMs to innovate with lighter yet structurally strong seating systems. Striking the right balance between safety, comfort, and fuel efficiency remains complex and cost-intensive. OEMs are under pressure to meet compliance while maintaining profitability and consumer satisfaction.

Seat configuration types vary between fixed seats, modular seats, suspension seats, and seat recliners, addressing both functional and space-saving needs. Material differentiation—like vinyl upholstery, leather seats, and fabric seats—caters to multiple market tiers, while innovations in fire-resistant materials and anti-slip upholstery are reinforcing safety standards. Critical components such as seat springs, seat rails, mounting brackets, seat anchors, and seat sliders play a vital role in structural integrity and flexibility. Design enhancements also include adjustable headrests, seat mechanisms, seat swivels, seat bases, and seat backrests to support comfort and customization.

Technological integration is gaining prominence, with trends like seat sensors, seat actuators, seat dampers, and seat tilt mechanisms enabling automated comfort adjustments and condition monitoring. New comfort-focused features like heated seats, seat ventilation, seat stitching, seat contours, and seat supports align with the growing demand for premium transit experiences. Furthermore, the use of lightweight seats and advanced seat ergonomics helps reduce vehicle weight, contributing to improved fuel efficiency and sustainability in public transportation systems. As urbanization expands, the market continues to see rising demand for customizable, safe, and tech-enabled seating solutions across all categories of buses.

Manufacturers are responding to evolving demands by introducing smart, lightweight, and eco-conscious seating systems. Recent innovations include climate-controlled ergonomic seats, active air cushions, and modular seat designs for flexible configurations. Notably, companies are also leveraging recycled materials and composite fabrics to meet sustainability goals. Analysts suggest that retrofitting older buses with advanced smart seats offers a lucrative opportunity for vendors, especially in countries modernizing their transit fleets.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 Type

6.1.1 Standard Seats

6.1.2 Recliner Seats

6.2 Vehicle Type

6.2.1 Transit Buses

6.2.2 Coach Buses

6.2.3 School Buses

6.2.4 Transfer Buses

6.3 Material

6.3.1 Leather

6.3.2 Fabric

6.3.3 Vinyl

6.3.4 Composite Materials

6.4 End-user

6.4.1 OEMs

6.4.2 Aftermarket

6.5 Geography

6.5.1 North America

6.5.2 Europe

6.5.3 APAC

6.5.4 South America

6.5.5 Middle East and Africa

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted