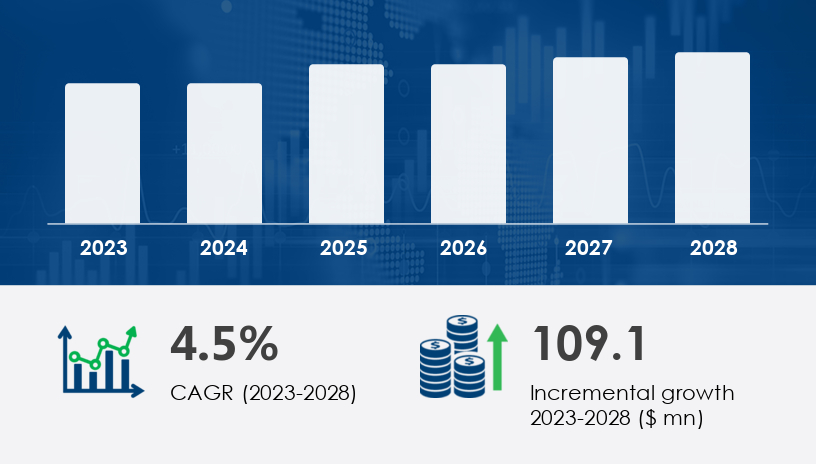

The global broaching machines market is poised to surge by USD 109.1 million between 2023 and 2028, expanding at a steady CAGR of 4.5%. This impressive growth underscores the mounting demand for high-precision metal cutting solutions across a spectrum of industrial sectors. In this 2025 Outlook and Strategic Insights report, we explore the key drivers, trends, regional dynamics, and competitive landscape shaping the broaching machines market — a crucial segment of the evolving industrial manufacturing ecosystem.

For more details about the industry, get the PDF sample report for free

“As manufacturers strive for zero-defect production and cycle time reductions, broaching machines — especially those integrated with CNC and servo technologies — have become indispensable,” says a senior automation engineer at a German precision tooling company. “These machines aren’t just about cutting metal; they define the standard for surface finish and geometrical consistency in mass production.”

Among the product segments, vertical broaching machines (VBMs) continue to dominate the landscape. These machines are especially vital in gear making, where accuracy and repeatability are paramount. VBMs are categorized into:

Table-Up: The broach remains stationary while the workpiece moves, ensuring precision.

Pull-Up and Push-Down: Variants cater to different industrial applications based on space and stroke requirements.

Power transmission options such as hydraulic drives offer robustness for heavy-duty applications, whereas electromechanical actuators provide the finesse required for precision machining.

Ideal for large-scale operations, horizontal broaching machines use a horizontal feed to achieve efficient material removal. Automotive OEMs frequently deploy these for crankshafts, camshafts, and steering components. Electric motors offer a precision boost, reducing downtime and tool changeovers.

The Asia-Pacific region, led by China and Japan, is forecasted to contribute a staggering 38% to global market growth during 2024–2028. The region's burgeoning automotive and heavy machinery manufacturing industries are prime demand generators.

Countries like Germany, Italy, and France are propelling market expansion through R&D investment and automation adoption. Electromechanical broaching systems — known for their energy efficiency — are gaining popularity.

With advanced production setups and significant aerospace investments, the U.S. remains a crucial market for high-end CNC broaching equipment.

South America

Middle East and Africa

Get more details by ordering the complete report

Computer Numerical Control (CNC) has transformed broaching into a high-precision, automated process. These systems eliminate manual pressure estimation and streamline complex geometries.

Expert Quote: “CNC broaching allows manufacturers to cut intricate internal gears and helical shapes with unmatched consistency,” explains a technical manager at a leading European automotive supplier.

Strategic partnerships are enabling the fusion of robotics, servo motors, and software platforms with broaching machines. For example, Cabe Stozzatrici’s adoption of FANUC panels exemplifies the shift toward smart manufacturing.

A mid-sized automotive components company in Germany implemented electromechanical vertical broaching machines with CNC integration. Result?

reduction in cycle time

cost savings on raw materials due to precision

improvement in defect rates for transmission shafts

For more details about the industry, get the PDF sample report for free

In a world chasing sustainability, modern broaching machines are now equipped with servo-driven motors and optimized hydraulic systems to balance energy consumption with output precision.

VBMs with modular tool support adaptors allow manufacturers to switch between parts with minimal downtime, supporting lean manufacturing goals.

The primary challenge facing broaching machine manufacturers lies in fluctuating prices for steel, bronze, iron, and copper. While industry giants mitigate this through long-term contracts, smaller firms remain vulnerable.

Strategic Takeaway: Firms must consider vertical integration or strategic alliances with suppliers to stabilize their input costs.

The market is highly competitive, with innovation, energy efficiency, and customization being key differentiators. Notable players include:

American Broach and Machine Co. – Table-up and twin-cylinder vertical broaching systems

Accu Cut Diamond Tool Co.

Apex Broaching Systems Inc.

Arthur Klink GmbH

Mitsubishi Heavy Industries Ltd.

NACHI FUJIKOSHI Corp.

Phoenix Inc.

YEOSHE HYDRAULICS CO. LTD.

These players vary in focus from pure-play broaching solutions to diversified machinery portfolios. The availability of both new and refurbished machines also supports cost-sensitive markets.

For more details about the industry, get the PDF sample report for free

Software-driven controls will redefine user interfaces.

Predictive maintenance via IoT sensors could reduce machine downtime by up to 40%.

Eco-broaching fluids and sustainable tooling systems will emerge as regulatory pressure on industrial emissions grows.

Invest in CNC Retrofits: For legacy systems, upgrading to CNC can extend equipment lifespan and improve ROI.

Partner with Automation Providers: Tap into the benefits of servo technology and smart controls.

Diversify Supply Chain: To hedge against input cost fluctuations, explore multi-supplier procurement models.

Broaching machines are more than just metal cutting tools — they are enablers of quality, consistency, and cost-efficiency in today’s industrial production lines. From aerospace to automotive, the demand for high-precision components is growing. Companies that embrace automation, CNC technology, and energy efficiency will hold the competitive edge.

Safe and Secure SSL Encrypted