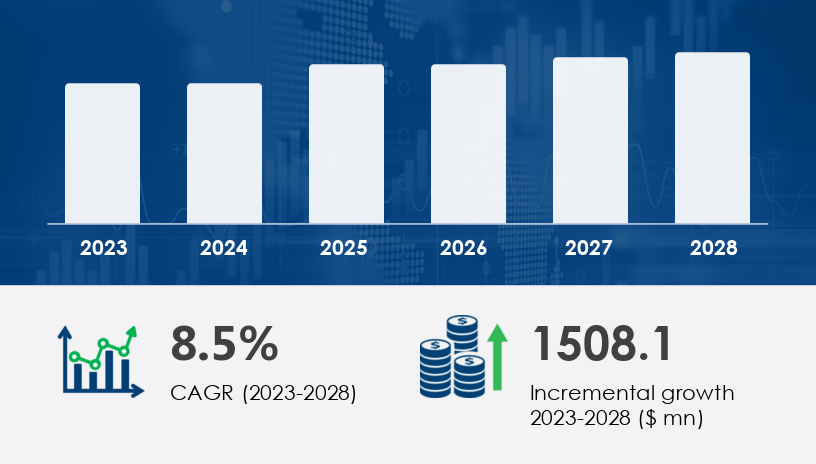

The APAC blood glucose monitoring market is poised for a transformative expansion, with projections estimating a USD 1.51 billion increase between 2023 and 2028, reflecting a robust CAGR of 8.5%. As diabetes rates surge across Asia-Pacific, the market for blood glucose monitoring systems becomes not only essential but highly strategic. This 2025 Outlook offers strategic insights into the region's evolving healthcare landscape, investment opportunities, and innovation trends that define this dynamic market.For more details about the industry, get the PDF sample report for free

“The APAC region is entering a phase where blood glucose monitoring is no longer optional but fundamental to public health,” says Dr. Meera Banerjee, Endocrinologist and Regional Diabetes Researcher. “The key drivers—an aging population, urban sedentary lifestyles, and rising obesity—are converging to increase diabetes prevalence exponentially.”

The Self-Monitoring Blood Glucose (SMBG) segment is projected to dominate the market, largely due to its affordability, ease of use, and technological adaptability. In 2018, the segment was already valued at USD 1.97 billion, and it has shown consistent year-on-year growth. From portable glucometers to advanced digital displays, SMBG devices empower patients to take control of their blood sugar management.

Pros:

Real-time blood glucose tracking

Portable and battery-efficient

Affordable and accessible

Digital interfaces enhance user experience

Cons:

Requires frequent manual testing

Risk of infection without proper hygiene

Limited in predictive trend analytics

Get more details by ordering the complete report

"SMBG is indispensable in APAC, especially in countries like India and Indonesia, where cost-effective healthcare solutions are necessary,” says Senior Analyst at Technavio. “While CGM adoption is growing, SMBG remains the backbone of diabetes care."

The increasing adoption of home healthcare devices is shaping the future of diabetes management. Glucometers, test strips, and lancets have become essential home-use tools. These devices enable patients to conveniently manage fasting levels, pre-meal and post-meal glucose readings, and stress-induced sugar fluctuations.

In Mumbai, a recent pilot program by a private hospital network distributed 500 smart glucometers to newly diagnosed Type 2 diabetes patients. Within six months, 72% of participants reported better glycemic control, fewer ER visits, and improved understanding of how diet and activity impacted their glucose levels. This low-cost intervention became a blueprint for state-level healthcare expansion.

For more details about the industry, get the PDF sample report for free

Despite the strong growth, the APAC market faces notable challenges:

High Undiagnosed Rates: Over 55% of diabetes cases in APAC go undetected, particularly in rural China and India.

Lack of Infrastructure: Many areas lack access to reliable diagnostics and treatment facilities.

Cost Sensitivity: High out-of-pocket expenses for BGM supplies discourage regular testing.

Limited Health Literacy: Misinformation and stigma around diabetes hinder early diagnosis and self-care.

Educational campaigns must be intensified in semi-urban and rural zones.

Subsidized diagnostic initiatives could dramatically improve early detection.

Mobile health clinics and e-pharmacy integrations hold promise for improving reach.

Get more details by ordering the complete report

As governments strengthen public health frameworks and telemedicine spreads, the future of blood glucose monitoring in APAC is increasingly digital and decentralized.

“By 2028, the integration of interstitial fluid sensors and continuous glucose monitoring (CGM) devices into public health schemes will reshape chronic disease management in countries like China, Singapore, and Malaysia,” predicts Dr. Yu Chen, Chief Medical Officer at Sinocare Inc.

These innovations allow for non-invasive tracking, reduced risk of infection, and AI-powered pattern recognition—ideal for tech-savvy urban populations.

Leading market participants such as Abbott Laboratories, Dexcom Inc., and Medtronic Plc are intensifying efforts through mergers, product launches, and regional expansions.

Abbott continues to dominate with its FreeStyle Libre systems, offering user-friendly CGMs.

Dexcom leads in sensor innovation with predictive analytics capabilities.

PHC Holdings focuses on SMBG for cost-conscious markets with energy-efficient devices.

Other emerging players like Hangzhou Sejoy, Bionime Corp., and Zhejiang POCTech are leveraging low-cost manufacturing and regional familiarity to carve out niche market share.

For more details about the industry, get the PDF sample report for free

The Blood Glucose Monitoring Market is rapidly growing due to increasing global diabetes prevalence and advancements in glucose monitoring technology. Key components such as glucose meters, blood glucose monitors, test strips, lancets, and lancing devices form the foundation of blood glucose testing and diabetes self-monitoring practices. The rise of continuous glucose monitoring (CGM) and flash glucose monitoring systems has enabled more accurate, real-time tracking through CGM sensors, CGM devices, and CGM transmitters. There’s also growing interest in non-invasive glucose and wearable glucose monitors that improve comfort and user compliance. These innovations are complemented by connected self-monitoring devices, smart glucose meters, and glucose monitoring apps, which are becoming central to personalized diabetes management. As technology evolves, blood glucose kits, blood sugar meters, and glucose sensors are integrating more seamlessly into everyday health routines, supported by innovations in digital diabetes tools.

Healthcare Providers: Promote SMBG and CGM use through training and affordable diagnostic plans.

Governments: Subsidize monitoring tools and integrate digital health solutions into primary care.

Investors: Focus on scalable SMBG tech startups and regional supply chain innovations.

Patients: Embrace regular monitoring, nutritional literacy, and digital health support apps.

Research into the Blood Glucose Monitoring Market highlights the integration of connected health solutions and smart delivery systems. Devices such as insulin pumps, smart insulin pens, insulin delivery devices, and reusable insulin pens are becoming more prevalent, improving adherence to insulin therapy. The market also includes prefilled insulin pens, insulin pen needles, and advanced diabetes care devices, providing patients with versatile tools for managing their condition. Sophisticated features like hypoglycemia detection, hyperglycemia monitoring, and glucose oxidase sensors are being embedded into glucose monitoring systems, enhancing early intervention. In parallel, software solutions such as glucose monitoring software and telemedicine diabetes platforms are helping physicians track data remotely, improving outcomes in diabetes monitoring tools. The emergence of CGM patches, glucose monitoring wearables, and broader glucose monitoring solutions reflects the market’s shift toward comprehensive, tech-enabled care ecosystems in the evolving landscape of blood glucose devices.

Blood glucose monitoring in APAC is no longer a niche market—it's a cornerstone of public health resilience. With lifestyle diseases on the rise and health infrastructure improving, the market is primed for transformation. Stakeholders who act now—whether through innovation, policy, or investment—stand to gain not only economic returns but a profound societal impact.

Get more details by ordering the complete report

Safe and Secure SSL Encrypted