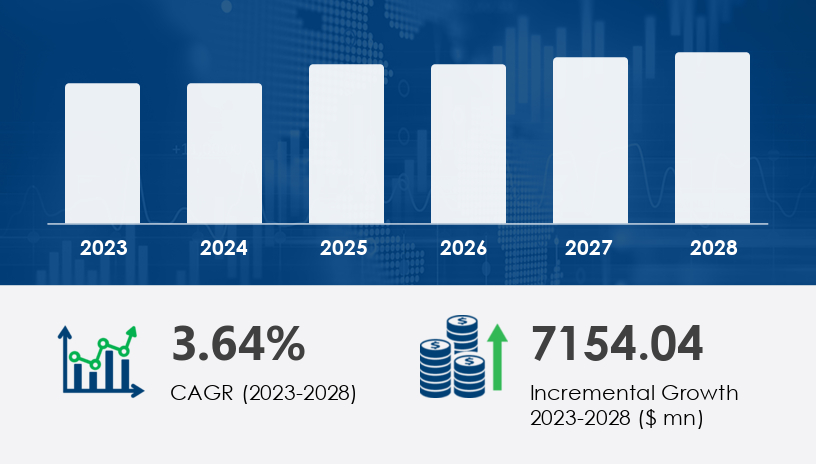

The Europe beverage packaging market is projected to grow by USD 7.15 billion between 2024 and 2028, fueled by a 3.64% CAGR, driven by sustainability imperatives, e-commerce acceleration, and rising demand for functional beverage packaging. As consumers and regulators demand more eco-conscious and functional formats, companies must adapt or risk falling behind.

In a comprehensive guide to the Europe beverage packaging market, we uncover how evolving consumer expectations, regulatory shifts, and logistical demands are reshaping an industry once dominated by traditional plastics and glass. The sector, spanning fresh and shelf-stable milk, alcoholic and non-alcoholic beverages, is entering a new phase — one where functionality meets sustainability.

For more details about the industry, get the PDF sample report for free

The Europe Beverage Packaging Market is characterized by a wide variety of packaging formats, catering to diverse consumer preferences and beverage categories. Key packaging materials such as PET bottles, glass bottles, aluminum cans, and paperboard cartons dominate the market, with a growing emphasis on eco-friendly packaging solutions. With the increasing demand for sustainable packaging, manufacturers are shifting towards recyclable packaging, biodegradable packaging, and lightweight packaging to reduce environmental impact. Notably, the market is witnessing a surge in beverage types such as bottled water, energy drinks, RTD coffee, RTD tea, soft drinks, and alcoholic drinks including beer, wine, and spirits. Packaging innovations like standup pouches, bag-in-box, and Tetra Pak are gaining traction, especially in the juice, milk, and plant-based drinks segments. Moreover, advancements in flexible packaging and rigid packaging offer a variety of options, including single-serve packaging, multi-pack packaging, and packaging equipped with tamper-evident seals, screw caps, and pull-tab cans, making them more user-friendly and safe.

The rise in health-conscious consumers has led to increased demand for enhanced waters, soy drinks, and RTD teas, driving innovation in convenient, single-use, and recyclable formats.

The European Commission mandates recyclable packaging, pushing the transition from fossil-fuel-based PET to virgin plastics and biodegradable alternatives. Companies like Amcor and Tetra Laval are leading the charge with innovations in lightweight, recyclable, and compostable formats.

| Pros | Cons |

|---|---|

| Reduces environmental impact | Higher production cost |

| Aligns with EU regulations | Complexity in recycling streams |

| Enhances brand value | Limited shelf life for some materials |

With rising off-premise consumption and the growth of online beverage sales, packaging must now withstand transport conditions while maintaining product integrity. Expect more rigid pouches, tamper-proof caps, and logistics-optimized cartons.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

The beverage packaging market in Europe is segmented according to type and material.

Cartons are the standout segment, expected to see rapid growth due to their lightweight nature, recyclability, and increasing use in milk and juice packaging.

Bottles remain popular in alcohol and water categories, with glass seeing a renaissance via lightweight recycled glass innovations.

Pouches offer agility and sustainability, ideal for functional beverages and e-commerce formats.

Valued at USD 14.04 billion in 2018, cartons continue to gain traction — especially aseptic variants and gable-top styles for dairy.

Plastic (particularly PET) remains dominant but is under regulatory pressure.

Paper & Paperboard materials gain favor for being biodegradable and lightweight.

Glass is being reinvented by manufacturers like Nakpack, offering lightweight recycled bottles.

Metal (aluminum cans) sustains demand in the carbonated drinks category.

Adaptability to consumer lifestyles — Packaging formats that meet on-the-go consumption and health needs are market winners.

Sustainability isn’t optional — Regulatory frameworks are now legally binding in many EU states.

Innovation in logistics-ready packaging is key as e-commerce channels grow.

Smart packaging solutions like QR codes, RFID, and NFC chips are becoming the norm. These technologies:

Ensure product authenticity

Offer real-time consumer engagement

Provide traceability and compliance data

“Smart packaging creates new touchpoints in the consumer journey,” shares a senior Technavio expert.

Despite their environmental benefits, recycled plastic materials carry high processing and logistics costs. This has been a barrier for many small and mid-sized players.

“Economies of scale are essential. Without them, sustainable packaging remains a luxury, not a standard,” states a senior Technavio expert.

Research analysis reveals that the demand for smart packaging and insulated packaging is rapidly increasing within the European beverage sector. Innovations in packaging materials such as barrier films and beverage closures are becoming essential for preserving product quality and enhancing consumer experience. Moreover, the popularity of non-alcoholic drinks and functional beverages has led to a rise in demand for packaging solutions that maintain product integrity and convenience. Aseptic packaging plays a critical role in extending shelf life for dairy-based and juice products, while vacuum packaging is gaining traction in wine and spirits packaging. The trend toward sustainable packaging is further supported by the increasing focus on recyclable packaging and biodegradable packaging solutions to meet consumer preferences for environmental responsibility. Additionally, beverage packaging companies are prioritizing flexible and lightweight packaging, which not only reduces shipping costs but also supports the growing demand for eco-friendly solutions across the beverage industry in Europe.

Get more details by ordering the complete report

In 2022, a German beverage manufacturer transitioned from traditional PET bottles to fully recycled, logistics-friendly PET containers for its functional drinks line. Within one year:

Transport damages decreased by 23%

Consumer approval ratings rose by 19%

Packaging costs initially rose by 12%, but stabilized as production scaled

This case underscores the ROI potential of eco-innovation when coupled with operational efficiency.

Glass will stage a comeback, but in reinvented forms — thinner, lighter, and fully recyclable.

Carton formats will dominate dairy and plant-based beverage packaging due to environmental and cost considerations.

Plastic will shift — not disappear — evolving into bio-based and circular economy-compatible materials.

Expect more M&A activity as large firms absorb smaller innovators to gain sustainable technology capabilities.

Invest in lightweight, recyclable packaging R&D — particularly in pouches and cartons.

Align with EU sustainability benchmarks — pre-emptively adopt upcoming directives.

Strengthen logistics and e-commerce packaging portfolios — optimize for durability and customer experience.

Explore partnerships with recycling and materials science firms — collaboration is key to cost mitigation.

Adopt smart packaging early — to stand out in a competitive digital economy.

Safe and Secure SSL Encrypted