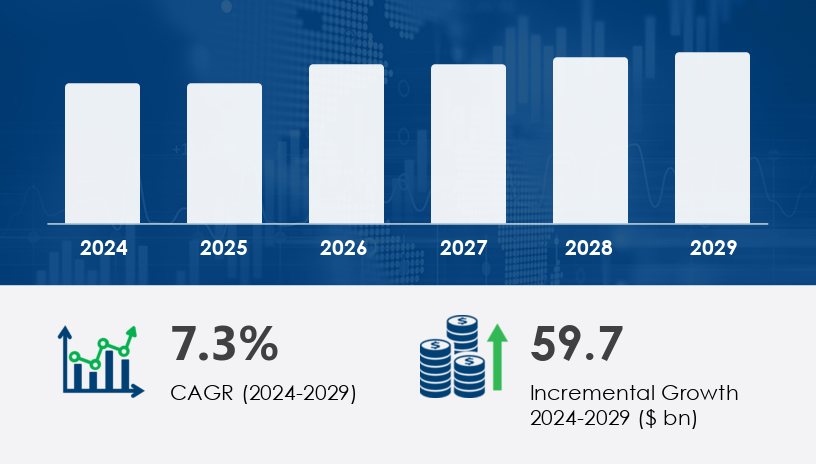

Automotive Tire Market Size 2025-2029

The automotive tire market is projected to grow significantly, with a forecasted increase of USD 59.7 billion, expanding at a CAGR of 7.3% between 2024 and 2029. This growth is largely driven by the increasing sales of passenger vehicles globally, alongside the development of airless and non-pneumatic tires, as well as automotive tire retreading services. These advancements promise enhanced durability and sustainability, vital for the market's expansion. However, challenges related to environmental issues in tire manufacturing processes remain, including concerns over the use of natural rubber, energy consumption, and tire disposal.

For more details about the industry, get the PDF sample report for free

Market Segmentation

The automotive tire market is segmented by distribution channel, vehicle type, and geography.

By Distribution Channel:

- Aftermarket Segment: Expected to witness significant growth, driven by rising demand for tire replacements and upgrades. Seasonal variations and the need for performance tires contribute to this segment's expansion. The increasing adoption of eco-friendly, durable tires in the aftermarket is a notable trend.

- OEM (Original Equipment Manufacturer): Tied closely to the production of new vehicles, this segment continues to grow, especially in high-performance and electric vehicle categories.

By Vehicle Type:

- Passenger Vehicles: Demand is driven by the increasing global sales of sedans, hatchbacks, SUVs, MPVs, and crossovers.

- Commercial Vehicles: Commercial fleets and heavy-duty vehicles are a crucial segment, where durability, fuel efficiency, and cost-effectiveness drive tire purchases.

- Electric Vehicles (EVs): As the EV market grows, tire manufacturers are focusing on developing tires optimized for electric vehicle performance, with specific emphasis on low rolling resistance and extended durability.

By Geography:

- Asia-Pacific (APAC): Contributing to 45% of market growth during the forecast period, APAC is a key region with strong automotive manufacturing bases in China, India, Japan, and South Korea. Growing disposable income, urbanization, and government regulations in countries like China are fueling demand for high-performance tires.

- Countries: China, India, Japan

- Europe: Tire demand in Europe remains steady, with Germany, France, the UK, and Italy being the largest markets, driven by automotive industry strength and high-performance vehicle trends.

- Countries: Germany, France, UK, Italy.

- North America: The U.S. and Canada continue to be significant markets, especially with the increasing adoption of electric vehicles and tire replacement due to aging vehicles.

- South America: Brazil represents the primary market in this region, with automotive production growth in line with the BRIC nations.

- Middle East and Africa: Growing vehicle sales, especially in commercial fleets, are contributing to market expansion in this region.

- Countries: UAE, Saudi Arabia, South Africa

Market Dynamics

Drivers:

- Rising Vehicle Production and Sales: Increasing production of passenger cars, commercial vehicles, and electric vehicles is driving tire demand. In emerging economies like Brazil, Russia, India, and China (BRIC), automotive production growth is substantial, spurring the need for tires in both OEM and aftermarket segments.

- Demand for Fuel Efficiency and Eco-friendly Tires: Fuel-efficient and eco-friendly tires are gaining traction, with tire manufacturers focusing on sustainable production methods and recycled materials to meet the growing consumer preference for green solutions.

- Increasing Average Vehicle Age: In markets like the U.S., the rising average age of vehicles (12.5 years in 2023) contributes to greater demand for tire replacement.

Trends:

- Airless Tires Innovation: The development of airless tires and non-pneumatic alternatives marks a significant trend. These tires, particularly for all-terrain and heavy-duty vehicles, offer improved durability, safety, and performance, albeit they are still in the developmental phase for mass-market passenger vehicles.

- Retreaded Tires: Increasing focus on cost-saving solutions, especially in commercial fleets, with retreaded tires offering a sustainable, budget-friendly alternative to new tires.

- Smart Tire Technology: Tires integrated with embedded sensors for real-time monitoring of tire health (e.g., pressure, temperature, wear) are expected to improve vehicle safety and tire efficiency, with companies like Goodyear leading the charge.

Challenges:

- Environmental Impact of Manufacturing: The tire industry faces challenges related to the environmental footprint of production processes, particularly with the use of natural rubber and high energy consumption. Addressing these concerns through sustainable practices is a key focus area for many tire manufacturers

Get more details by ordering the complete report

Key Companies in the Automotive Tire Market

Some of the key companies of the Automotive Tire Market are as follows:

- Apollo Tyres Ltd.

- Bridgestone Corp.

- CEAT Ltd.

- FURUKAWA Co. Ltd.

- Hankook Tire and Technology Co. Ltd.

- Hefei Wanli Tire Co., Ltd.

- JK Tyre and Industries Ltd.

- Michelin Group

- MRF Ltd.

- Nokian Tyres Plc.

- Pirelli and C S.p.A

- Sailun Group

- Salsons Impex Pvt. Ltd.

- Schaeffler AG

- Shandong Linglong Tyre Co. Ltd.

- Sumitomo Rubber Industries Ltd.

- The Goodyear Tire and Rubber Co.

- Toyo Tire Corp.

- Triangle Tyres

- Zhongce Rubber Group Co. Ltd.

Recent Developments:

- Michelin (December 2024): Launched a new eco-friendly tire line featuring sustainable materials, including bio-sourced and recycled content, reinforcing its commitment to sustainability.

- Bridgestone (November 2024): Formed a partnership with a leading electric vehicle manufacturer to create tires specifically for EVs, focusing on durability and low rolling resistance to enhance EV performance.

- Goodyear (October 2024): Introduced innovative tire technology with embedded sensors to monitor tire health, improving safety and performance.

- Continental (September 2024): Acquired a tire recycling company, enhancing its focus on circular economy practices by promoting tire material reuse and sustainability.