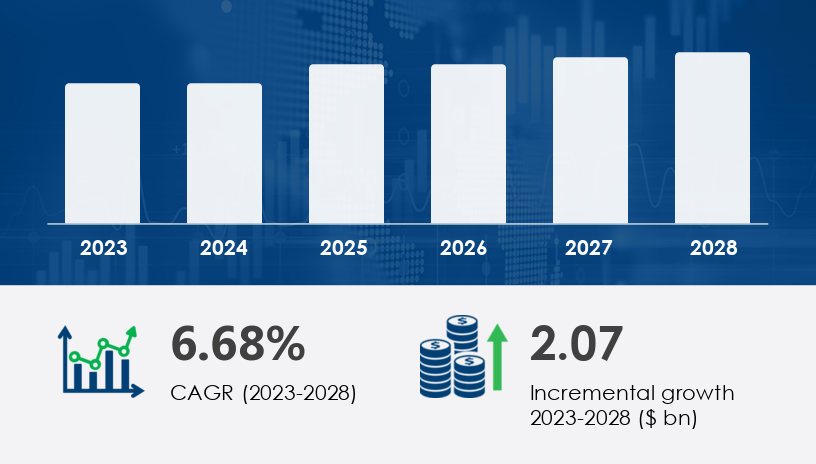

The automotive steering torque sensor market is poised for substantial growth, driven by the increasing adoption of Electric Power Steering (EPS) systems and advancements in autonomous driving technologies. With a projected market size increase of USD 2.07 billion at a CAGR of 6.68% between 2023 and 2028, the demand for high-precision torque sensors is set to intensify across various vehicle segments and geographies. This comprehensive guide delves into the key market segments—application, type, and geography—providing expert analysis and strategic insights for industry stakeholders.

For more details about the industry, get the PDF sample report for free

The automotive steering torque sensor market is experiencing significant growth due to the increasing penetration of Electric Power Steering (EPS) systems in Passenger Vehicles (PVs) and Light Commercial Vehicles (LCVs). The adoption of EPS systems is driving the demand for torque sensors, as they play a crucial role in ensuring optimal steering performance and fuel efficiency. Furthermore, the advent of new and innovative torque sensors is adding to the market's growth. However, the high initial capital investment required for the production and implementation of these sensors poses a challenge to market growth. Overall, the market is expected to witness steady growth in the coming years, driven by the increasing demand for advanced safety features and fuel efficiency in vehicles.

Quick Facts Table

| Segment | Key Drivers | Key Challenges |

|---|---|---|

| Application | Growing demand for PVs and LCVs; adoption of EPS systems | High initial capital investment |

| Type | Advancements in sensor technology; integration with ADAS | Technological complexity |

| Geography | Economic growth in APAC; regulatory support in Europe | Regional disparities in adoption |

Growth Drivers & Challenges: The passenger vehicle segment is the largest in the automotive industry, with its value and volume significantly influencing economic development. The market is significantly driven by the growing demand for passenger vehicles, particularly in developing economies. The Asia-Pacific region is expected to lead the passenger car market due to rapid economic growth and an increasing middle-class population. Over the past decade, there has been a shift from mechanically driven vehicles to advanced, electronically influenced, or electric vehicles, with a focus on safety, security, propulsion, and connectivity features. Fuel efficiency and the increasing adoption of electric vehicles are also key factors driving the market.

Expert Quote: "The integration of EPS systems in passenger vehicles is revolutionizing steering dynamics, necessitating advanced torque sensors for optimal performance."

Mini Case Study: A leading automotive manufacturer in India implemented EPS systems in their latest sedan model, resulting in improved fuel efficiency and enhanced driving comfort. The integration of advanced torque sensors played a pivotal role in achieving these outcomes.

Key Facts: The passenger cars segment was valued at USD 3.41 billion in 2018 and showed a gradual increase during the forecast period.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Growth Drivers & Challenges: Non-contact sensors, such as magnetic sensing and strain gauge bridges, offer advantages like durability, precision, and maintenance-free operations. These sensors are essential for collision avoidance systems, automotive systems, and driver assistance systems. Extreme vibrations, shocks, and temperature variations are common challenges in torque sensor applications.

Expert Quote: "Non-contact sensors are becoming the preferred choice in modern steering systems due to their reliability and performance in demanding conditions."

Mini Case Study: A European OEM adopted non-contact torque sensors in their electric SUV lineup, leading to a 15% improvement in steering response time and a 10% reduction in energy consumption.

Key Facts: Non-contact sensors held the largest market share at 60% in 2023, with a projected growth rate surpassing that of metal contact sensors.

Growth Drivers & Challenges: The Asia Pacific (APAC) region is experiencing rapid economic growth, primarily driven by countries such as China, India, Indonesia, and South Korea. This economic expansion has significantly increased per-capita income and consumer purchasing power, leading to a growth in automobile sales. In response, automotive sensor manufacturers have identified APAC as a key market due to its vast growth potential. Infrastructure and industrial development in the region are also driving demand for commercial vehicles. The automotive industry's focus on electrification, autonomous driving, and advanced driver assistance systems is further boosting the demand for torque sensors in commercial vehicles.

Expert Quote: "APAC's burgeoning automotive market presents unparalleled opportunities for sensor manufacturers, especially in the realm of advanced steering technologies."

Mini Case Study: A Chinese automotive startup integrated advanced steering torque sensors in their electric vehicle models, resulting in a 20% increase in market share within the first year of launch.

Key Facts: APAC is estimated to contribute 70% to the growth of the global market during the forecast period.

The Automotive Steering Torque Sensor Market is evolving rapidly, driven by advancements in Electric Power Steering (EPS) systems, which are increasingly replacing hydraulic alternatives due to better fuel efficiency and enhanced steering precision. Innovations in sensor technology, such as magnetic sensing, strain gauge, and digital torque sensors, are pivotal in improving steering feedback and sensor accuracy. With the rise of electric motors in EV adoption and hybrid vehicles, there is a growing focus on integrating wireless sensors and analog torque sensors for optimized torque measurement. These developments are deeply linked with the broader trend of electrification in vehicles, enhancing both steering systems and overall vehicle performance. Autonomous vehicles and ADAS features, such as lane departure warnings and adaptive cruise control, further necessitate robust steering dynamics and precise torque data for effective precision control.

Opportunities:

Emerging Markets: Countries in Asia-Pacific and Latin America present significant growth potential due to increasing automotive production and demand for advanced steering technologies.

Technological Advancements: Integration of artificial intelligence and machine learning in sensor technologies can enhance sensor accuracy and responsiveness.

Regulatory Support: Government regulations mandating the inclusion of advanced safety features in vehicles are driving the adoption of steering torque sensors.

Risks/Challenges:

High Initial Capital Investment: The cost of developing and implementing advanced steering torque sensors can be prohibitive for some manufacturers.

Technological Complexity: The integration of advanced sensor technologies requires specialized knowledge and can lead to increased production complexity.

Supply Chain Disruptions: Global supply chain challenges, such as semiconductor shortages, can impact the production and availability of steering torque sensors.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

In-depth analysis of the Automotive Steering Torque Sensor Market reveals a strong influence from technological advancements in automotive electronics and control algorithms used in electronic control units (ECUs). The increasing demand for driver assistance technologies has led to tighter safety regulations and higher expectations for vehicle safety. Components such as accelerometers, gyroscopes, and wheel speed sensors play a critical role in supporting steering control and enhancing steering angle measurements. The intersection of brake systems and powertrain efficiency also underscores the need for precise steering innovation. Additionally, suspension testing contributes to optimizing steering dynamics, especially in high-performance vehicles where steering innovation and system responsiveness are paramount. Collectively, these factors are shaping a future where torque sensor integration supports the seamless operation of advanced mobility systems.

Safe and Secure SSL Encrypted